By

In response to evolving market conditions and a recent dip in wholesale funding costs, Westpac Bank has announced a substantial cut to its fixed mortgage rates, marking a strategic shift among Australia's major lenders.

Effective from Aug. 21, Westpac's reductions span from 0.50 to 0.80 percentage points across various fixed-term home loans. This move positions Westpac as the most competitive among the big four banks, offering the lowest rates for one- to five-year fixed terms for borrowers who maintain at least a 30% equity in their property.

These adjustments follow the National Australia Bank’s (NAB) revision of its three-year fixed rate in July. Westpac's new rates are particularly significant given the broader context of the banking industry's competitive dynamics and their impact on the financial stability of homeowners.

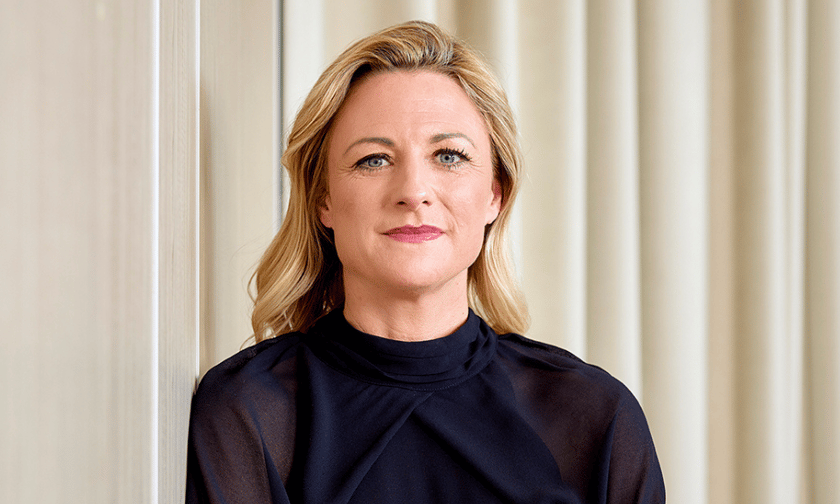

"Westpac has slashed its fixed rate mortgages by up to 0.80 percentage points, making its one- to five-year fixed rates the most competitive out of the big four banks. These cuts from Westpac are designed to entice borrowers who are sick of the rollercoaster ride a variable mortgage rate can take their finances on,” Canstar data insights director Sally Tindall (pictured) said.

“Westpac, like NAB, is likely to be responding to an easing in the cost of wholesale funding, but also the security that comes from locking customers in for a fixed term.”

Despite the appeal of lower rates, fixed-rate mortgages have seen a low uptake, with the Australian Bureau of Statistics (ABS) reporting that just 2.6% of new and refinanced loans in June chose a fixed rate, a sharp decline from past years.

However, Tindall predicts a shift might be on the horizon: "It’s highly likely we’ll see more fixed rate cuts in the months ahead as we inch closer to a potential cash rate cut. Whether borrowers take the bait remains uncertain."

Westpac's strategic rate reductions place it ahead of its peers, including the Commonwealth Bank of Australia, ANZ, and NAB, as banks increasingly look to attract customers with fixed-rate products.