Recent findings from a Deluxe Holiday Homes study have put Melbourne in the spotlight, revealing a significant increase in rental rates accompanied by a drop in property prices.

This trend underscored a growing preference for renting over purchasing in Melbourne, distinguishing it from global patterns.

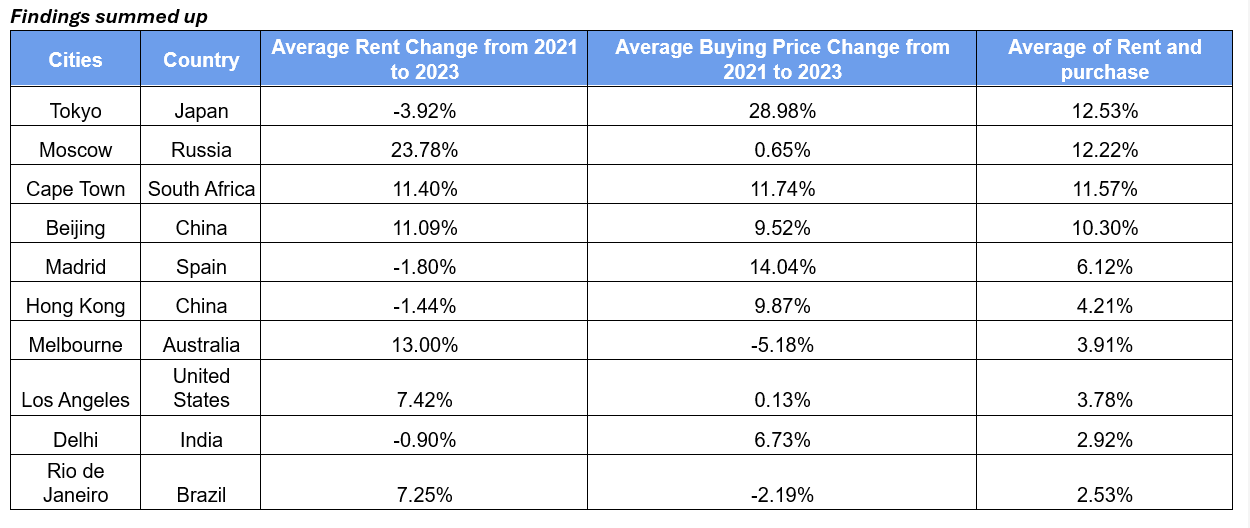

The study assessed changes in real estate prices across the top 10 cities globally, focusing on the percentage change between 2021 and 2023. It aimed to identify investment potentials and economic growth indicators within these urban markets.

Leading the rankings, Tokyo experienced the most volatile market, with property prices soaring by up to 28.98% while rent prices fell by -3.92%. This duality marks Tokyo as one of the most turbulent real estate markets studied.

Coming in second, Moscow's real estate market saw a significant divergence with a 23.78% rise in rents but only a slight 0.65% increase in property prices, indicating a robust rental market growth despite stagnant property sales.

Cities like Cape Town and Beijing also showed strong growth in both sectors, whereas Madrid and Hong Kong presented mixed results, with shifts in preference between renting and buying.

Ranking seventh, Melbourne’s market dynamics are particularly noteworthy.

Rents in Melbourne surged by 13.00%, a reflection of heightened demand for rental properties.

Conversely, property prices fell by 5.18%, suggesting a shift away from home buying, possibly due to economic uncertainties and rising interest rates.

This pattern in Melbourne points to potential opportunities for investors, particularly in the rental sector, while caution may be advisable in the homebuying market due to declining property values.

The study’s insights indicated that Melbourne’s real estate market may continue to favour rental investments if current trends persist.

Meanwhile, globally, cities exhibit diverse growth patterns, from booming rental markets in Moscow to balanced expansions in Cape Town and Beijing, each presenting unique opportunities and challenges for investors.

Follow this link for the full Deluxe Holiday Homes research.