Mortgage holders are postponing making big life decisions due to tough economic conditions brought on by the cost-of-living crisis and rising interest rates, according to a recent survey commissioned by Mortgage Choice.

Conducted by Honeycomb Research, the survey of 1,000 people showed 76% of mortgage holders and 78% of prospective buyers have postponed a big life decision due to the current economic climate.

Australians aged 55 years and older are currently more likely to delay their retirement, and millennials are more are likely to delay starting or expanding their family.

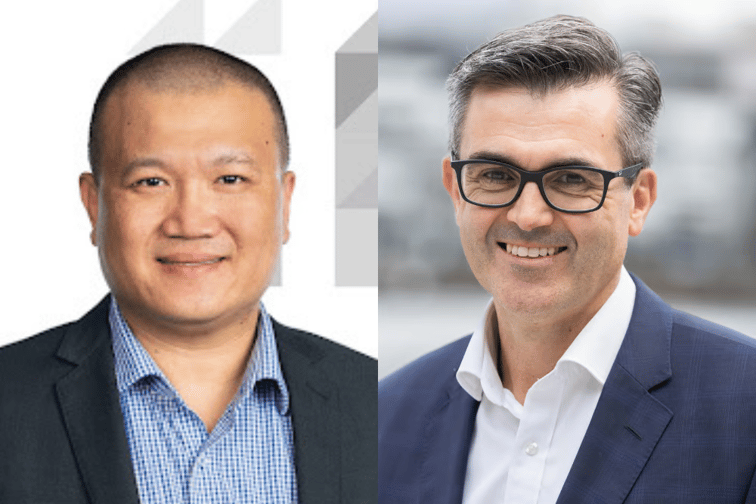

Haison Tran (pictured above left), a Mortgage Choice broker at Indooroopilly in Queensland, said the current market provided the perfect opportunity to educate clients about loans and the mortgage cycle while “giving the options”.

“Coming off a low fixed rate will impact their situation but it’s all about working with these clients to see how it will affect them – and not just financially as there is always more to the story,” Tran said.

Overall, the study indicated that both homeowners and home seekers have delayed big decisions, but often differ on what that decision was.

For example, half of mortgage holders said they had postponed saving money compared to 40% of prospective buyers while mortgage holders (31%) were more likely than prospective property buyers (21%) to postpone buying a car.

However, more prospective property buyers (42% compared to 28%) had postponed buying a new home or investment property and 11% of home seekers had also postponed starting a family.

Interest rates have also affected the plans of older Australians too, with 19% of those aged 55+ having postponed their retirement plans.

Mortgage Choice CEO Anthony Waldron (pictured above right) said 12 interest rate increases since May 2022 and the rising cost of living had put pressure on people’s hip pockets.

“These findings are worrying, but unfortunately not surprising,” said Waldron. “We know that Australians' borrowing power has reduced by as much as 30% since the RBA first started raising the cash rate in May 2022.”

“Every day our brokers are meeting with worried borrowers – in particular those facing the end of their fixed term rates and potential increases of more than $1,000 per month in their mortgage repayments.”

Tran said while some of his clients were “lucky enough” to be rolling off fixed rates in another one or two years, he was already looking at their cash flow now.

“Just because a decision makes financial sense doesn’t mean that it fits within their lifestyle at that point in time. As brokers, we need to look at things from a wider lens and discuss all the options on the table,” he said.

“I think it more important to listen to their plans and work out what they can do from a cash flow and lifestyle perspective rather than looking at interest rates by itself.”

Waldron said mortgage brokers could help plan their clients’ next life stage and show how their home loan could work around these changes in the economy.

“As the cost of living rises, it’s easy to feel like you don’t have options, but a broker can model different loan scenarios so you can make informed choices,” said Waldron.

Has the economic environment impacted your life decisions? Comment below.