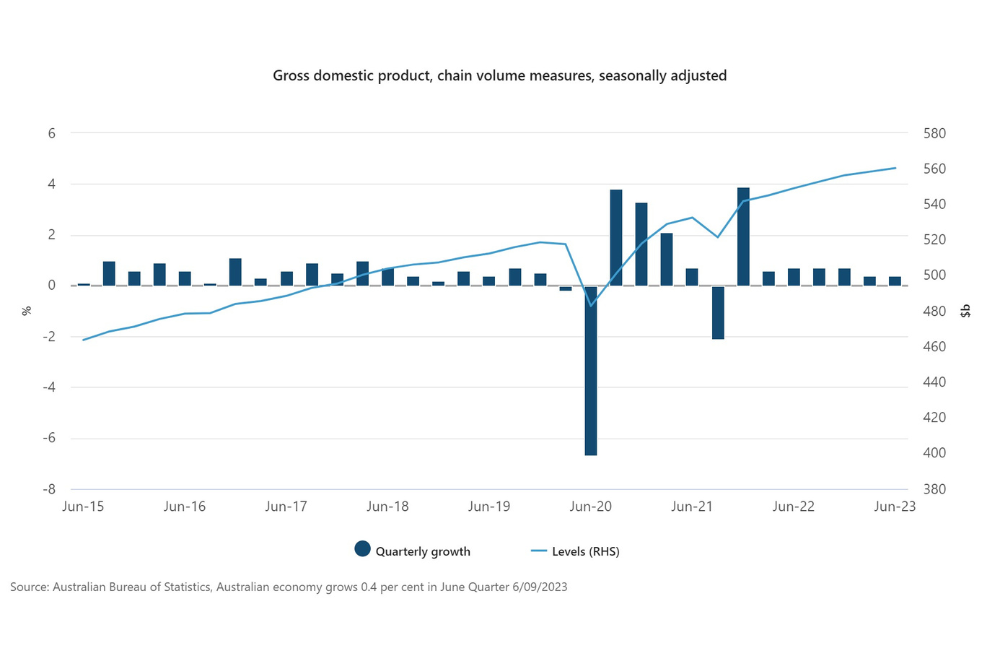

The Australian economy expanded by 0.4% in the three months to June and by 3.4% over the 2022-23 financial year, according to figures released by the Australian Bureau of Statistics (ABS).

Katherine Keenan, ABS head of national accounts, said this was the seventh straight rise in quarterly GDP, and annual growth remained above trend, reflecting the absence of significant COVID-19 disruptions, such as lock downs, in 2022-23.

“Capital investment and exports of services were the main drivers of GDP growth this quarter,” Keenan said.

While Australia's overall GDP has continued to grow and avoided recession so far, its GDP per capita - a measure that calculates a country's economic output per person - fell 0.3% compouding the same drop experienced the previous quarter.

By this measure, which is calculated by dividing GDP by Australia's population, Australia has entered a recession after a second consecutive quarter of negative growth.

Household spending also remained slowed further in the June quarter rising 0.1% and contributing 0.1 percentage points to GDP growth.

This can largely be attributed to the ongoing cost-of-living crisis despite inflation showing signs it has peaked.

“Spending on essential goods and services were the main contributors to the rise in household spending, while many discretionary categories detracted. The exception was spending on vehicles which rose 5.8% as supply bottlenecks eased during the quarter,” Keenan said.

Overall, the Reserve Bank responded to the latest economic indicators by pausing the official cash rate on Tuesday.

The household saving to income ratio fell for the seventh consecutive quarter to 3.2%, its lowest level since June quarter 2008.

“The fall in the household saving ratio was driven by higher interest payable on dwellings, income tax payable and increased spending by households due to the rising cost of living pressures," Keenan said.

Total income received by households rose 1.8% driven by interest received and compensation of employees.

Nominal GDP fell by 1.2% in the June quarter but grew by 9.7% over the 2022-23 financial year.

The GDP implicit price deflator fell 1.5% in the June quarter. This was driven by a fall in the terms of trade (-7.9%), as export prices fell (-8.2%) more than import prices (-0.3%).

The decline in export prices was driven by energy related commodities, as coal and other mineral fuels prices both fell. This was the largest quarterly fall in export prices since June quarter 2009. The fall in import prices was led by oil-based products.

The large decline in commodity prices caused mining profits to fall 11.2%. This drove an overall fall in gross operating surplus of 4.5%.

Domestic price growth remained steady at 1.2%, driven by rises in household rents and food as well as capital goods, which rose due to the depreciation of the Australian dollar.