An Islamic home finance provider has ventured into offering self-managed-super-fund (SMSF) products as it looks to develop more diverse options for the growing demographic of Muslim buyers.

Afiyah, an Australia-based Islamic finance startup which specialises in home, business, and car financial solutions, offers loans in accordance with Islamic principles. However, Afiyah’s SMSF product is what makes it unique.

“Our unique product offering is the SMSF product, which draws a varied clientele, including skilled migrants and investors seeking ethical investment opportunities,” said Aamir Shaik (pictured above), lending manager and director at Afiyah.

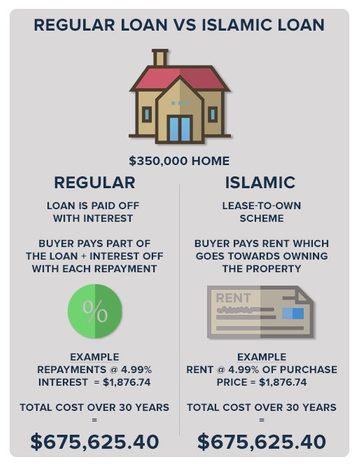

“Each agreement features a rental charge component, upholding Islamic lease-to-own principles. Our financing options are sourced from wholesale funders who provide access to Islamic funding. This funding is structured in compliance with Sharia principles.”

Despite Australia’s rich Islamic history, many Muslim Australians have historically faced difficulties in securing financing that complies with their religious ban on Riba (interest).

“Islamic finance is based on the principles of just, transparency, and risk-sharing. Interest-based transactions are completely prohibited and, instead, financing is provided through profit and loss-sharing agreements,” said Shaik.

“But with limited Islamic financing options previously available, numerous families continued to rent, while others felt compelled to opt for conventional home loans.”

However, as Islamic financing becomes more accessible, Shaik said Australia is witnessing a significant shift.

“More families are now exploring these options, leading to an increase in informed discussions and decisions,” he said.

Recently, in Sydney, Shaik said two colleagues discovered Afiyah’s Islamic SMSF offering.

“After consulting their accountant and financial advisers, they realised this option aligned well with both their financial objectives and religious values,” Shaik said.

This led them to invest in property, a step they previously hadn’t considered viable.

“Their experience demonstrates the practical benefits of Islamic financial products in offering investment paths that meet both financial and religious criteria,” Shaik said.

“This case reflects the increasing importance of such products in the market, addressing the needs of those seeking appropriate investment opportunities.”

The demand for Islamic finance is growing domestically and internationally.

The global Islamic economy has come from a US$1.62 trillion consumer spending market, as estimated in 2012, to US$2.29 trillion in 2022, according to a UAE government report.

This has been driven by a young and fast-growing global population that extends beyond the core 1.9 billion Muslim consumers to include a wider global ethical consumer market, the research found.

It’s a similar story in Australia too, according to Shaik.

The demand for Australian Islamic finance has increased in line with the growing Muslim population, now at 3.2% according to the latest census – around 820,000 people.

“There’s a notable shift among groups, such as well-informed skilled migrants eager to get into the market and those moving from conventional to Sharia-compliant options as Islamic rates become more competitive,” Shaik said.

Shaik said interest in house and land packages has been “particularly strong” in the expanding outskirts of cities like Melbourne and Sydney, reflecting a nationwide trend and broadening demand for Islamic financing solutions.

“A significant chunk, 82%, are under 45, emphasising the need for a solid digital presence. In places like Broadmeadows, Muslims constitute around 32% of the population,” Shaik said.

“They’re typically earning decently, with many focused on family life and homeownership.”

Also known as Islamic finance, Sharia-compliant finance is a financial system that operates in accordance with Islamic law, or Sharia.

Sharia law prohibits charging or paying interest (riba), engaging in speculative or risky transactions (Gharar), and investing in businesses that are considered haram (forbidden), such as those involved in alcohol, gambling, or pork products.

Instead, Sharia-compliant finance uses principles such as profit and loss sharing (Mudarabah), leasing (Ijara), and joint venture partnerships (Musharakah) to structure financial transactions.

“It has become increasingly popular among Muslims who want to invest their money in a way that aligns with their religious beliefs,” Shaik said.

“The aim of Sharia-compliant finance is to promote ethical and socially responsible investment while providing financial services that are accessible to everyone.”

Far from restrictive, Islamic finance has several financing options. For example, imagine you want to buy a house:

Musharakah: You and your friend (the lender) both chip in for the down payment and become co-owners of the house. You share costs like mortgage payments and repairs, and any increase in the house value benefits both of you equally.

Musharakah is often used for business and home loans.

Ijarah: Your generous aunt (the lender) buys the house and then leases it to you with the option to buy at the end of the lease. You pay monthly rent like you would for any apartment, and, at the end, you have the right to purchase the house outright if you wish.

Ijarah is typically used as the structure for home loans and SMSF products.

Murabahah: Your lender buys the house at the market price and adds a contractor’s fee on top. You then pay them back in instalments, like monthly rent-to-own payments, until the house is officially yours.

Murabahah is typically used as a structure for car financing loans.

Mudarabah: You’re a skilled fixer-upper, and your investor sees that potential. They provide the cash for the house, and you use your skills to renovate it. Any profit from a future sale is shared according to your agreed-upon ratio, but if the renovation costs more than expected, your investor bears the additional expense.

Mudarabah is often used for business financing.

While still in its infancy, the Australian financial services sector has slowly warmed to the Islamic finance market.

Apart from Afiyah, the main Australian financial institutions currently offering Sharia-compliant products or assistance are Ijarah Finance, Hejaz Financial Services, Amanah Islamic Finance, MCCA Islamic Finance and Investments, and Islamic Cooperative Finance Australia Limited (ICFAL).

Australia’s first Islamic bank, Islamic Bank Australia, is also set to join the landscape soon. With its full licence expected in 2024, it will further broaden access to Sharia-compliant financial solutions, including home finance.

Having already signed up over 1,000 brokers in its network and teaming up with aggregator Finsure, Hejaz Financial Services had also planned on achieving bank status.

Instead, the provider announced last year it would invest in the Islamic Bank Australia project.

While Afiyah already does SMSF, cashflow, business, car and home loans, Shaik said the startup plans to further diversify its offering into investments and risk management.

For mortgage brokers servicing Muslim clients seeking Sharia-compliant options, Shaik said it’s crucial to understand the nuances of products like rent-to-own arrangements.

“Educating clients about how these products differ from conventional loans is vital. Clients are often eager to learn and appreciate brokers who can provide a variety of Sharia-compliant choices and articulate their benefits,” Shaik said.

“This informed approach not only shows respect for their beliefs but also ensures clients make decisions that align with their financial and religious values, effectively tapping into this growing market segment.”

What do you think of Afiyah’s Islamic finance offering? Comment below.