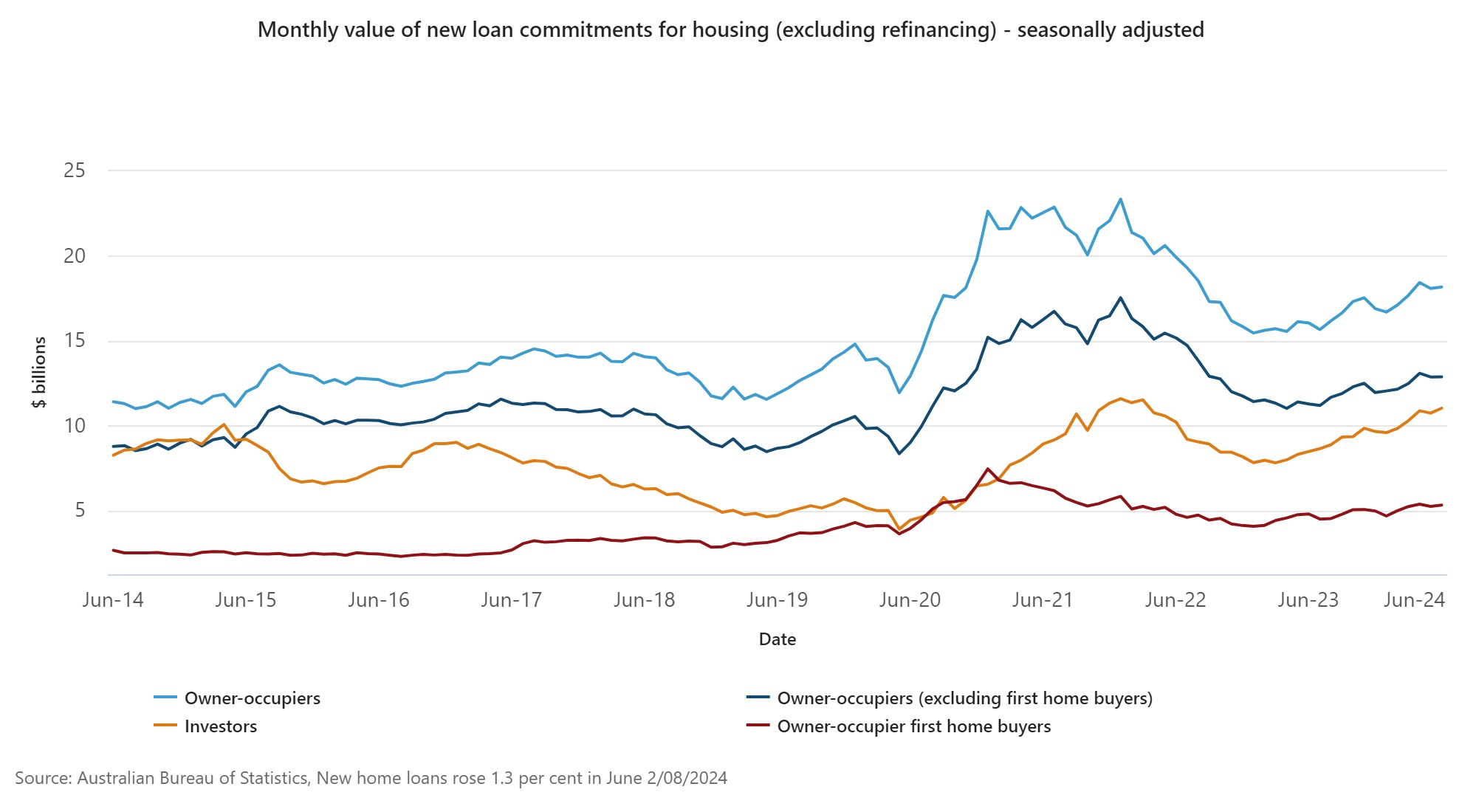

Investors are piling their money into residential property despite higher interest rates, with the annual growth in the value of new investor home loans rising 30.2% in June from a year earlier, according to the Australian Bureau of Statistics.

This increased investor demand has largely outpaced owner-occupiers, including first-home buyers who are being priced out of the market, according to Simon Arraj (pictured above), founder and director of private credit investment manager Vado Private.

ABS data released on Friday revealed that the value of new owner-occupier loans only grew by 0.5% to $18.2 billion in June, while the value of new investor loans jumped 2.7 % to $11 billion during the month.

Over the year, owner-occupier loan values rose 13.2%, well behind investor loans.

However, it’s the rate of first-home buyer loans that are most concerning, rising 0.7% in June and 3.4% compared to a year ago.

On the ground, Arraj has found investor demand for housing to be “very strong” despite the high-rate environment.

“While the cash rate has increased 425 basis points since early 2022, investors are still investing heavily in bricks and mortar,” Arraj said. “Notwithstanding this, house prices could consolidate from their record levels, as the Australian economy slows, and higher rates feed through the economy.”

“This raises the importance of diversifying investments out of property, which is fully priced, into higher yielding assets.”

While growth in the value of new investor loans was seen across all states and territories over the past 12 months, it was driven by New South Wales (up 27.3% or $901m), Queensland (up 34.5% or $587m) and Western Australia (up 56.7% or $428m).

By comparison, growth was relatively slower in Victoria (up 9.4% $199m) and South Australia (up 38.3%n or $175m).

New South Wales is also leading the nation in terms of loan sizes.

Over the past 12 months, NSW continued to have the highest average loan sizes for both owner-occupiers and investors.

In June, it rose to $780,000 for owner-occupiers and $818,000 for investors, compared to $636,600 across Australia, $604,300 in Victoria, Queensland’s $599,300, $545,800 in SA, $566,700 in WA and $467,500 in Tasmania.

Reflecting Australians’ love affair with property, recent data from the Australian Bureau of Statistics reveals that household net wealth was a record $16.2 trillion in the March 2024 quarter, boosted by a record level of property assets of $11.0 trillion.

As a proportion of household wealth, residential property comprises 67.9%, up from 61.7% in December 2020. The key driver of household wealth gains in recent years has been rising property prices.

With such a large proportion of wealth invested in property, Arraj said investors should consider diversifying into other asset classes which can deliver a higher income.

“Unlike yields on residential property, which generally fall below 5%, the yield on private credit investments can sit at around 10% p.a, more than double the average yields on one or three year bank term deposits, and well above the yield on Australian investment grade corporate bonds, as measured by the S&P Australia Investment Grade Corporate Bond Index, which was 6.8% over the year to July 31 2024,” he said.

Broadly speaking, Arraj said an allocation to private credit can potentially enhance risk-adjusted returns, as well as boost diversification and provide a consistent income stream.

“That is why it’s so important for retirees and other retail investors to better understand the resilient returns offered by private credit,” he said.

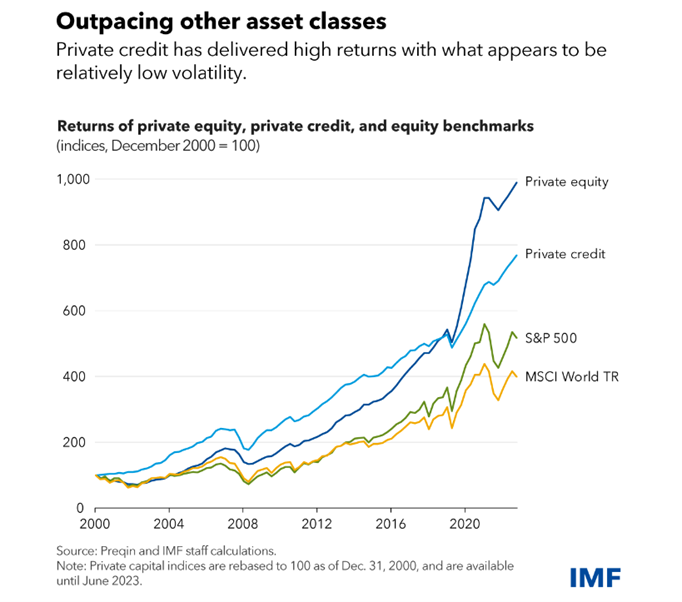

According to 2024 research from the IMF, The Rise and Risks of Private Credit in its Global Financial Stability Report, since the Global Financial Crisis (GFC), direct lending (the most common type of private credit globally), has provided higher returns and lower volatility compared to both leveraged loans and high-yield corporate bonds.

The chart below displays the relatively higher returns of private credit compared to equities since 2000.

“With significant exposure and weighting to Australian property, shares and cash, SMSFs, and other investors would arguably benefit from greater allocations to private credit investments,” Arraj said.

“The key for investors is to conduct due diligence and scope a specialist investment manager that can deliver attractive risk-adjusted returns from private credit, over time.”