Two brokers who trialled ANZ’s new pilot project have revealed the scope of the mortgage product that is restricted to Australia’s most lucrative suburbs.

ANZ’s Low Risk LMI Waiver, which can’t be found online and is only available to a few brokers across Australia, offers lending up to 95% without lender’s mortgage insurance (LMI) for customers who meet the policy’s eligibility requirements.

The policy can be used on refinance or purchase applications, for owner-occupied or investment properties with principal and interest (P&I) or interest only (IO) repayments.

Christian Stevens (pictured left) and Ben Sum (pictured right) from Flint Financial, the newly formed brainchild of Stevens and award-winning broker Chris Bates, shared their thoughts after trialling it for six months.

“This is hands down the best policy I have ever seen – incredible. A 95% LVR product with no LMI is a game-changer,” said Stevens.

“Typically, at the top end of the market you would need minimum 20% deposit plus costs to purchase, but this policy has completely changed the game at just 5%.”

What is the ANZ low risk LMI waiver?

Using analytics and credit bureau information, ANZ’s Low Risk LMI Waiver was developed to identify customers who have historically presented as low risk based on a variety of factors.

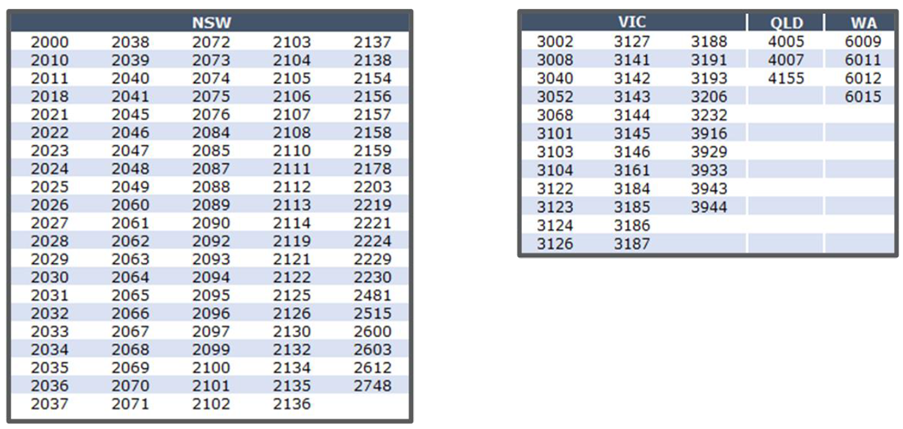

Stevens said the eligible postcodes (145 locations – 200 different suburbs) selected were based on locations which have held or increased their value over a long period of time – some of which include Sydney’s Rose Bay, Melbourne’s Toorak and Canterbury, and City Beach in Perth.

The property offered must be a standard residential security – not a commercial property, SMSF, rural or agribusiness, dual income, boarding houses, NDIS, or other asset types - and it can’t involve applications involving guarantors, companies, or trusts.

ANZ’s high threshold, low deposit policy

Sum, who is Flint’s head of advice, has already put together $100 million worth of proposals for this policy “in the last few weeks alone”.

There are two reasons why Sum believes this to be “the first policy of its kind”.

Firstly, borrowers usually incur a premium on LMI when lending in the >90% LVR band. This effectively lowers the “true LVR” – the deposit you pay in total.

“When you go above 90% LVR, mortgage insurance is typically 3%-4%. So, what that means is that 95% LVR including capitalised mortgage insurance is really a base LVR of about 91% or 92%,” Sum said.

Secondly, rates go up as well.

“Typically, above-90% LVR loans rates are going to be in the seven-plus percent range,” said Sum. “If a client were not to use this policy, we would usually recommend they would buy at a base LVR at 88% where LMI is optimal, and you can still get the below-90% rates.”

However, with this policy, the true LVR is 95%. Customers can save money by not paying the upfront cost of an LMI premium, allowing them to access the market sooner.

Does this policy help the rich get richer?

A key concern with this program is the high minimum loan amount – $2 million. This translates to a required household income of at least $450,000 to qualify, effectively excluding a large portion of potential first-time homebuyers, particularly those in lower or middle-income brackets.

During a national housing crisis, critics argue that products aiming to carve out an exclusive market for the rich exacerbate wealth inequality.

So, does the policy favour the wealthy? No, according to Sum.

“Wealthy people probably wouldn’t need a 95% LVR loan – they already have the equity or cash,” he said. “Truly wealthy people, even with strong incomes, could just ask the bank of Mum and Dad for a deposit… and trust me, that happens a lot.”

“Instead, this policy favours the ambitious and aspiring, especially those without family support who can’t just get a big gift for a deposit. It helps people with strong incomes but limited savings get into the market.”

The ambitious and aspiring: A case study

For example, imagine you are in your mid-30s, your household earns a strong income above $450,000, and you are looking to buy your first property at the $1.5 million mark at 88% LVR – less than the average house price in Sydney.

You are aiming for a 12% deposit plus stamp duty, which is around 5%. So, you need a 17% deposit – about $260,000.

“This is a significant amount of money even for high income earners,” Sum said.

Say you aim to save this over four years saving $65,000 annually. But when you go back with your deposit four years later, that $1.5 million property is now worth $2 million. The market has outgrown your expectations.

“And this is where this policy helps,” said Sum. “People’s income and savings may have grown over that four-year period, but they still might not have that 17% deposit which has also changed over time.”

“This policy makes up for that because you only need that 5% deposit and 5% for stamp duty.”

This is just one example of how this policy can be used. Here are some real-life situations where Flint Financial has helped borrowers with this product:

Limitations to the policy

While the mortgage product has helped in a variety of scenarios, it can have its drawbacks.

To meet the minimum loan amount at 95% LVR, the purchase price needs to be at least $2.11 million to qualify for the $2 million-plus loan.

This could limit options for those seeking properties in the $1-2 million range.

“I've had quite a few chats with clients in the exact scenario – relatively young, on good incomes, and looking to buy their first home. But then they want to buy a property at $1.8 million,” Sum said. “It leads to a tough decision between using more deposit when buying at 88% LVR or using less deposit at a higher price point.”

Secondly, some borrowers might miss out on being eligible because of the policy’s high credit standards.

Young, financially successful clients might be interested in a "low risk" loan product. But despite strong income, their credit score prevents them from qualifying.

Credit scores are data-driven assessments by credit bureaus that predict the likelihood of someone defaulting on a loan (not repaying).

A longer credit history with consistent, responsible credit use typically leads to a higher score.

“Younger people may be doing everything right financially and meet the income requirements but because they only have 5-10 years of credit history, their score might be low,” Sum said.

“Essentially, the system penalises financially responsible young borrowers who need to borrow to get ahead in a competitive market.”

Mortgage product innovation

With banks facing a credit crunch and net interest margins slowly eroding, Australia’s major banks fiercely competed for market share last year. This has since become known as the mortgage wars.

However, with interest rates reaching their highest point in a long time, the landscape has shifted. Banks are now prioritising low-risk vanilla loans.

For banks that still want to compete for business, Sum said they have two choices: innovate or cut rates.

"This product demonstrates that innovation in mortgages can still happen even when banks are being more cautious,” Sum said. “In my opinion, this product innovation is fantastic and serves a variety of clients. Kudos to ANZ.”

What do you think about ANZ’s new mortgage pilot product? Comment below.