The official cash rate has remained steady for the fourth month in a row after the Reserve Bank’s October board meeting on Tuesday, but mortgage rates continued to move, with several lenders making changes to their variable and fixed rates between Sept. 25 and Oct. 3.

Within that period, Bank Australia (0.05%), Bank of China (0.1%), and Orange Credit Union (0.15%) lifted their variable rates while Auswide Bank (-0.08%), Greater Bank (-0.08%), Newcastle Permanent (-0.22%), Resi (0.11%), Yellow brick Road (0.11%) slashed theirs. Fixed rates increased at NAB (0.08%), while cuts have been made at Bank First (-0.24%), Credit Union SA (-0.2%), Greater Bank (-0.18), and Newcastle Permanent (-0.18%).

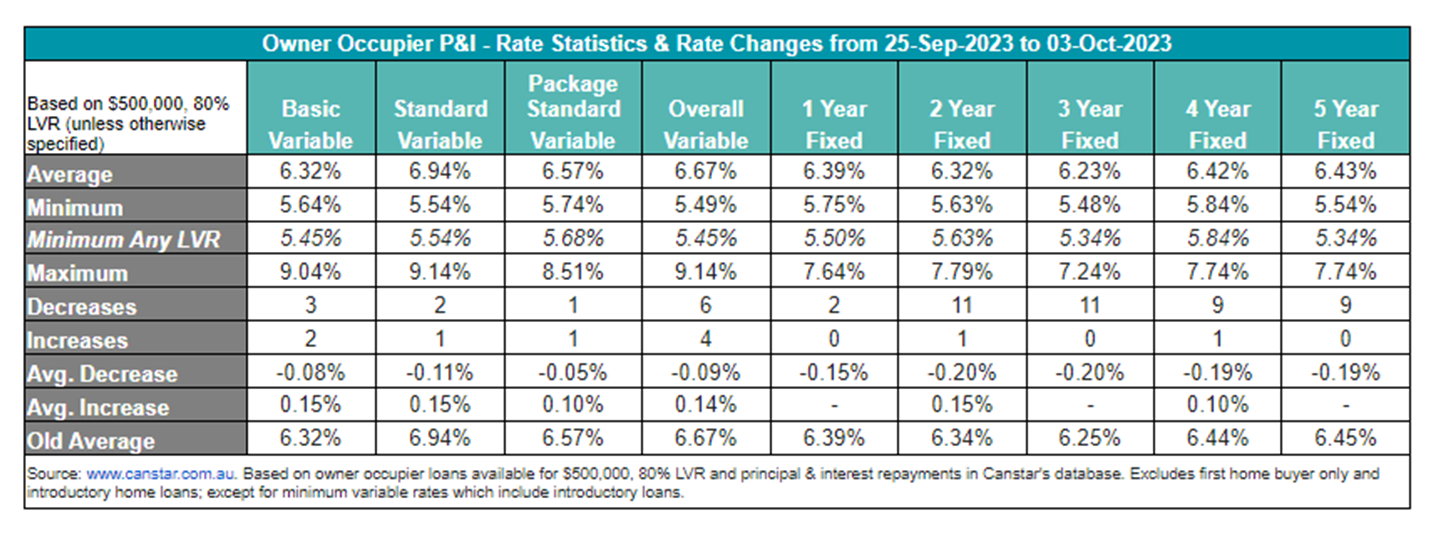

Below is the owner-occupied P&I rate movement summary for the Sept 25 to Oct. 3 period.

“Findings show that 48% (43 of 90) of variable rate lenders on Canstar.com.au have increased variable rates since the July cash rate decision by an average of 0.15%,” said Effie Zahos (pictured above), Canstar’s editor-at-large and money expert. “Fixed rates also saw considerable increases during this time with 81% (65 of 80) of fixed-rate lenders increasing fixed rates by an average of 0.27%.”

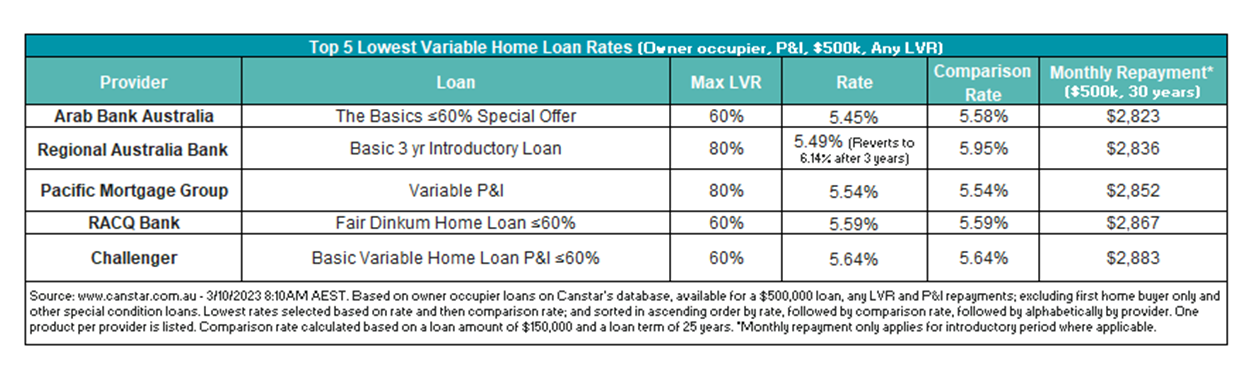

Zahos said this makes it more important than ever for borrowers to make sure they are getting the best rate possible. The good news is that there are still 120 rates below 5.75% on Canstar's database.”

See table below for the lowest owner-occupier home loan rates.

Canstar also revealed that 11 lenders continued to offer cashback deals.

“Canstar crunched the numbers and found that quick gains can be made by collecting cashback offers, even when compared to having the lowest-rate home loan on the market,” Zahos said.

“HSBC, for example, is offering up to $3,288 cashback when you refinance. On a $500,000 home loan, the total interest cost over one year would be $29,032 – $1,500 more than the $27,532 you’d pay with the cheapest loan on the market from Pacific Mortgage Group if you have at least 20% equity in your loan.

“That difference of $1,500 would be more than offset by the cashback although the homeowner would need to reassess their affairs after the first year.”

Commenting on RBA’s latest decision, Zahos said the central bank will likely hold a tightening bias and will no doubt keep its eye on the quarterly inflation figures, which will be out on Oct. 25, as well as employment figures to be released on Oct. 19.

“There remains a risk of a rate hike in November or December,” she said. “Homeowners need to be prepared for the fact that we may not see any rate cuts for quite some time, so they may continue to feel hip-pocket pain,” Zahos said.

“On a positive note, a pause in the cash rate may attract more buyers into the market,” she said. “Knowing that we are near the top of the rate-hike cycle may offer some certainty to those who can afford to jump in.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.