By

FAST CEO Brendan Wright explains the leadership strategy helping brokers to achieve sustainable success

From Richard Branson to Warren Buffett, there is no shortage of people sharing their wisdom regarding business leadership. However, while inspiring, their one-size-fits-all approach doesn’t always translate to the world of broking.

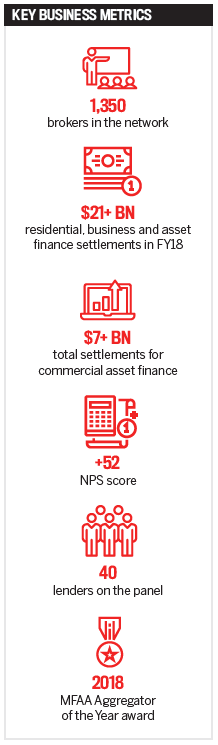

Filling the void for its 1,350-strong broker network, NAB-owned aggregator FAST is promoting a new leadership strategy with the objective of supporting brokers in creating successful and sustainable businesses. Implementing the plan, the aggregator’s CEO, Brendan Wright, has charted a path through to 2019 and beyond that defines the key leadership skills demanded by the changing industry landscape.

Observing a “complex and ambiguous” operational environment, Wright’s three pillars of leadership were devised in the wake of such developments as ASIC’s broker remuneration review, the Combined Industry Forum (CIF) and, of course, the royal commission.

“As we flow through into 2019 there are three key foundations to our strategy: purpose-led transformation, adapting through diversity, and differentiating through culture,” says Wright.

The first step to enduring success is a defined purpose, according to Wright. As business owners, brokers must identify their purpose and then bring it to life in order to remain successful in the face of whatever regulatory or economic developments may occur.

“Gender diversity makes sense because we all know that men and women think and do things differently, and that creates opportunity. But this is also about leveraging the diversity of experience, capability, background, ethnicity and other factors, to drive positive business outcomes for brokers and positive outcomes for their customers,” Wright explains.

Citing the CIF as a “perfect case” of how this can be achieved for the common good, Wright maintains that adapting through diversity is about bringing together a range of perspectives that work towards the same goal.

He says, “If you think about the CIF, you have aggregators small, medium and large; banks and lenders small medium and large; you have five industry bodies; the consumer advocate – and they are all coming together to ensure the industry takes a proactive approach to identifying what it’s going to do.

“The CIF is a classic example right now of the value of diversity and how you can adapt in ambiguous and complex times,” he continues, highlighting that it isn’t just brokers but customers too, who face this increasing complexity.

“The foundations are there for broker business owners to show quality of leadership and get on the front foot in terms of helping their clients to move through the complex scenarios that exist now when obtaining finance,” Wright says.

While the three pillars hold equal importance, the implications of diversity arguably reach the furthest. In this context, Wright emphasises that diversity is a partnership rather than a collection of opinions and experiences, which means business owners don’t have to come up with all the answers on their own.

“Leveraging diversity, from your stakeholders and employees to the customers that you serve, you can create an environment in which you are receptive to diverse thinking and backgrounds that propose answers you may not have thought of. Rather than thinking, ‘I have to come up with all the answers’, this is where the significant value in adapting to diversity comes in,” he says.

The third pillar, differentiating through culture, focuses on the good customer outcomes that should be front and centre of any business.

Explaining how the pillars were devised, Wright says, “Quite simply, when evolving and creating a strategy that differentiates any business in a marketplace, it’s important to have two or three key pillars to that strategy.

“At FAST we decided these three are the most relevant: they provide an opportunity to differentiate in a competitive market for sustainable business success, and achieve good customer outcomes for the client and brokers.”

Know and show

Know and show

To implement the pillars, Wright advocates a ‘know and show’ approach, whereby the broker appropriately records, and then uses, the information from their client interactions.

As a concept, know and show was first introduced at the sixth annual FAST Business Excellence Conference, held in August, and it is rooted in the importance of a broker not only knowing their customers but also being able to demonstrate that knowledge.

Wright’s message was echoed at the conference by NAB’s GM for performance and operations, Nicole Devine, who spoke along with executive GM of NAB broker partnerships Anthony Waldron, futurist Steve Sammartino and Stephen Scheeler, former Facebook CEO for Australia and New Zealand.

Addressing the conference, Devine said, “Most brokers would say they have a customer-centric culture, but how do you show it and how often do you think about it? This is where compliance frameworks and asking the right questions to fully understand a client’s situation come into play.”

For Wright there are two ways brokers can achieve this: by changing how and why they communicate with clients and using aggregator platforms, such as FAST’s Podium, as business operating platforms on which to build a richer profile of each client.

“This might sound simple, but it’s critical to be inquisitive, ask open questions, ensure you really help the client flesh out what they are trying to achieve and what their current circumstances are, and then record it in the aggregation platform,” he says.

His advice ties in with the extended role data now plays in client relationships – instead of simply creating an extensive log of a client’s details, specifically using data as a springboard from which to tailor their experience.

It also ties in with how a broker can show the ongoing service they provide to their client.

Supporting this, a series of investments are being made in Podium. The platform will be updated with new features and expanded functionalities specifically designed to help brokers engage and connect with their customers.

The strategy will create a tool that Wright describes as being “highly agile”, with future-proofed capabilities to integrate with new APIs and apps as they enter the market.

“These developments have already started and will continue to build momentum through early 2019 to September and October,” Wright says.

There is no uncertainty that further changes will occur across the industry and, in light of the distance CBA has created between itself and its integrated verticals, the future could see more ownership – and leadership – shake-ups for the bank-owned aggregators.

In addition, open banking and comprehensive credit reporting are being ushered in as data takes new precedence across the finance industry. However, as Wright highlights, the developments only bring more opportunities for brokers.

“In 2018 we have seen more and more consumers and business owners going to brokers to get their financial services needs met, and that will continue to be the case. The exciting opportunity is that the industry and brokers have a clear road map around how to deliver their service, so it’s exciting times,” he says. AB