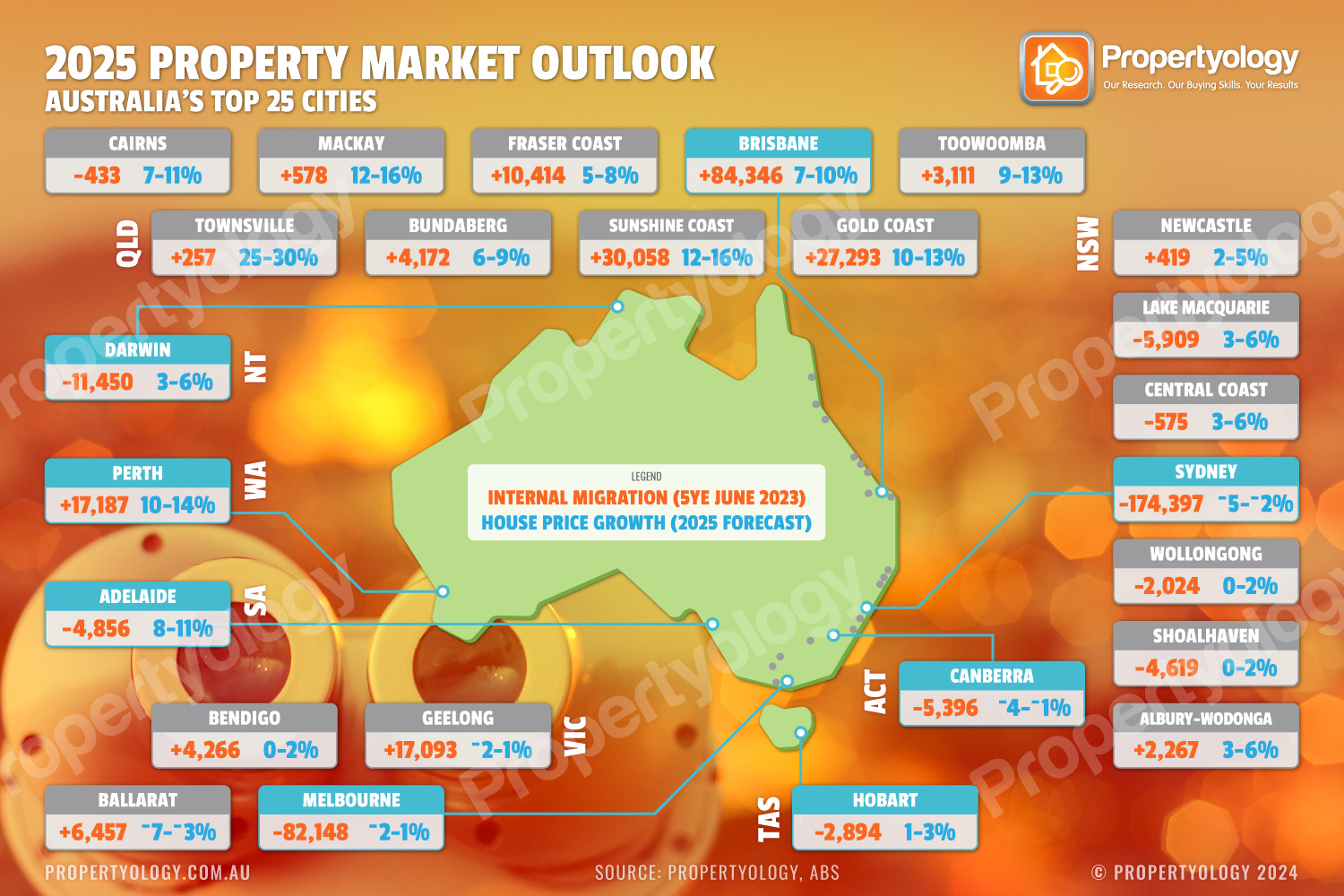

Propertyology's latest research indicated that 11 of the top 25 Australian cities by population size are poised for a real estate boom in 2025.

The standout performer is expected to be Townsville, currently the 14th largest city, which may see an impressive surge in property values.

In contrast, Sydney and Melbourne, Australia’s two largest cities, are projected to experience a slight downturn in the property market.

This prediction is part of a broader analysis covering Australia's primary urban areas, each with populations exceeding 100,000.

“2025 looks promising for 20 out of the 25 major Australian cities,” said Simon Pressley (pictured above), head of research at Propertyology.

This optimism comes despite a 25% drop in housing supply from a decade ago, juxtaposed with a significant population increase of 4 million.

Pressley highlighted the enduring demand for housing, backed by a robust job market expansion, as a positive indicator for the property market.

Sunshine Coast and capital cities shine

The Sunshine Coast is forecasted to be the second-best performing market, with expected growth rates between 12% and 16%.

“The area has benefited immensely from internal migration, more than any other region over the past five years,” Pressley said.

Additionally, Adelaide, Brisbane, and Perth are likely to achieve double-digit growth.

Townsville, with a current population of 205,000 and a median house price of $520,000, is predicted to experience a remarkable growth of 25-30% in 2025.

This city has been recognised for its economic improvements and was recently named Australia's Port of the Year for 2024.

The past year saw more than 117,000 households purchasing their first homes, a 9% increase from the previous year.

Predictions for 2025 suggest that if interest rates drop, first-home buyers could approach the 150,000 mark. Moreover, Generation Y investors from high-cost cities like Sydney are expected to be particularly active in the property market.

“Gen X-ers are entering an investment sweet spot,” Pressley said.

Many in this demographic have significant home equity and are looking towards property investment as they approach retirement. This trend is likely to lead to a surge in property investments across borders.

The property markets in Western Australia, Queensland, and South Australia are predicted to continue their strong performance.

Meanwhile, conditions in Tasmania and the Northern Territory are expected to improve gradually.

New South Wales will see mixed results, with some regions like Newcastle and the Central Coast poised for moderate growth, whereas Sydney may face a 5% decline, Propertyology reported.

Victoria is described by Propertyology as “Australia’s problem child,” with state government debt projected to hit $228 billion by 2028.

Pressley criticised the lack of private sector investment in Victoria, compounded by a hefty public sector debt burden, which could impact the state's economic stability and infrastructure development for years.

The 2025 property market in Australia presents a landscape of varied growth and challenges, with certain cities poised for significant booms while others may face stagnation. Investors and homebuyers alike should heed these forecasts as they plan their real estate strategies for the coming year.

For more property market insights, visit Propertyology’s website.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.