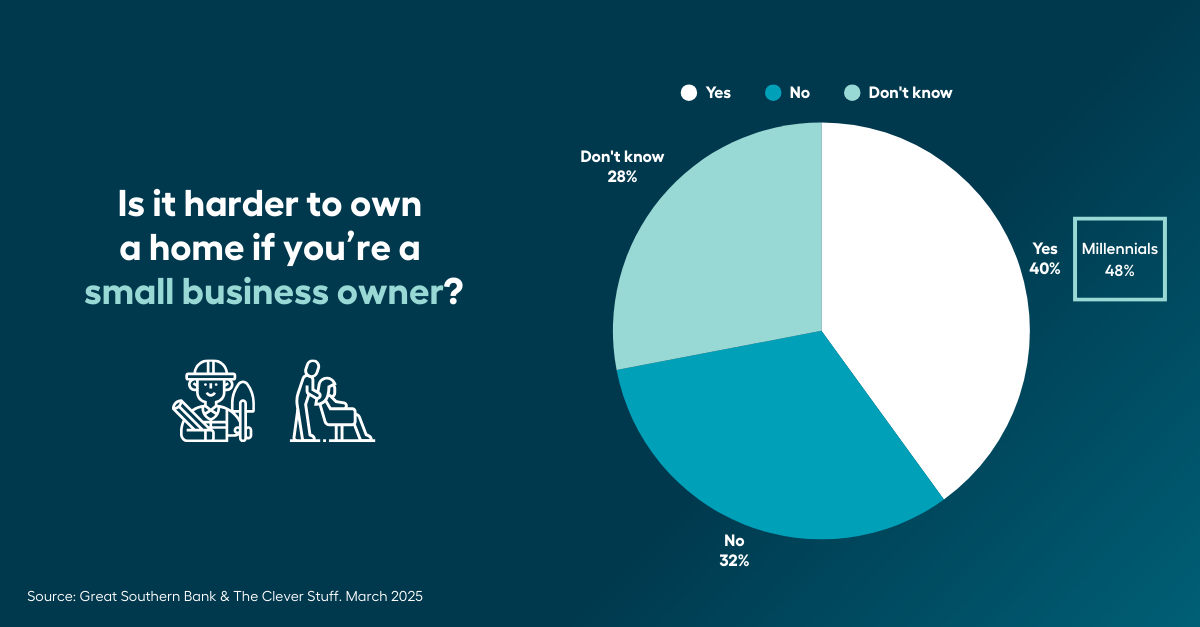

Recent findings from Great Southern Bank’s Smaller Small Business Research highlighted that securing a home loan is particularly challenging for small business owners, with 40% indicating that being self-employed makes homeownership more difficult.

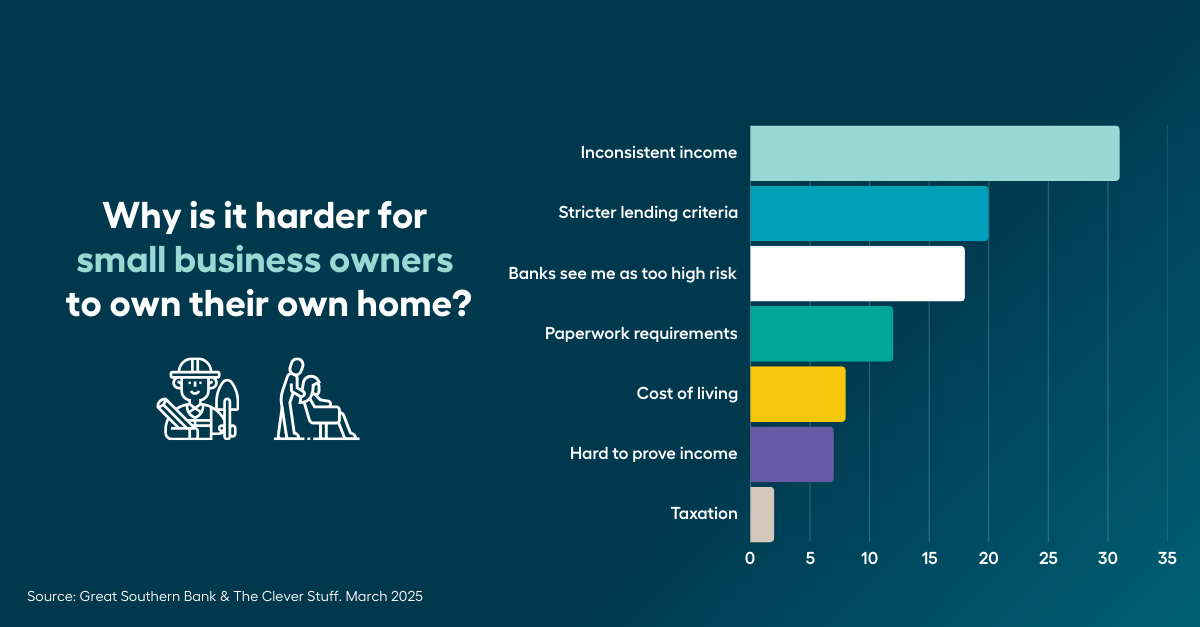

The main hurdles include the instability of income, stringent lending criteria, and the complex process of gathering the necessary documentation.

This difficulty is underscored by recent Grattan Institute research, showing that rising house prices have lengthened deposit-saving times from six to over 12 years, resulting in homeownership among young Australians falling from 57% in 2001 to 50% in 2021, particularly affecting the poorest 40%.

The struggle is particularly pronounced among millennial entrepreneurs, where nearly half of the small business owners aged between 27 and 42 report facing significant challenges in securing a mortgage.

This demographic finds the inconsistency in income and being labeled as “high risk” by lenders as substantial barriers.

Jacole Davies (pictured), a mortgage broker specialising in helping self-employed clients, shared insights into what lenders are looking for.

“Lenders want consistency in income, and that can be tough for business owners whose earnings fluctuate,” Davies said.

She advised small business owners to demonstrate consistent income over the last two years as a critical step towards improving their chances of securing a home loan.

Great Southern Bank has responded to these challenges by enhancing its lending policies, simplifying the process for sole traders to get home loan approvals.

For mortgage brokers advising self-employed clients on securing home loans, here are some tips to navigate the process more effectively.

Encourage clients to pay themselves a steady, market-rate salary to establish financial stability. This consistency is crucial in demonstrating to lenders their ability to maintain regular loan repayments.

Advise clients to reduce their personal debt levels before applying for a mortgage. A lower debt-to-income ratio increases their attractiveness to lenders and can lead to more favourable loan terms.

Stress the importance of maintaining organised and comprehensive financial records. Ensure clients have ready access to two years of tax returns and business activity statements, as these are often required by lenders to verify income and business viability.

Teach clients about addbacks—expenses that can be added back to their income for loan serviceability assessments. Common examples include depreciation, non-recurring expenses, and certain types of business-related expenditures.

Understanding what can be added back can significantly affect how lenders view their income and borrowing capacity.

To support small enterprises further, Great Southern Bank recently introduced the Business+ app, a tool designed to streamline banking and financial management for small businesses.

This platform integrates functionalities like automated invoicing and payment reminders, and syncs with accounting software like MYOB and Xero, making it easier for business owners to track and prove their financial status.