By

Thousands of formerly prime borrowers now fall into the specialist lending bracket. However, specialist clients do not require specialist skills

Recent months have seen a rapid withdrawal of major banks from multiple segments of the lending market, leading to huge numbers of formerly prime borrowers being reclassified as specialist.

The trend has implications for borrowers and brokers; the former find themselves rejected for finance they could have easily obtained a year ago, and the latter have to pick up the pieces when expectations cannot be met.

Anecdotal data from Canstar confirms the trend has been emerging since 2015 when investors first fell out of favour with the mainstream banks. As a result, brokers continue to be challenged to find alternative funding sources for their customers.

Helping to close the funding gap, specialist lending is increasingly sought as a solution for those who don’t fit the banks’ vanilla borrower profiles, and represents a growing market segment on multiple fronts. For lenders, growth is driven by sharp rises in self-employed and multiple-income borrowers, as well as those who no longer fit the major banks’ narrowing criteria. For brokers, it is driven by the need to find competitive solutions for every client.

Specialist lending encompasses those deals that don’t meet mainstream bank criteria – a broad and growing category. It can also include complex prime, shared ownership, buy-to-let, secured loans and other products.

The reclassification of prime borrowers means that specialist lending now comes with far fewer risks than previously and brokers have a significant opportunity in the segment to embrace new, specialist clients.

“Some brokers still consider specialist lending as a challenge simply because they may hold a belief that specialist lending equates to higher risk. This is not always the case, particularly in the current environment,” says La Trobe Financial chief lending officer Cory Bannister.

“Another misconception is that specialist lending must relate to some form of credit impairment. This is not the case either. Specialist lenders cater for niches within the mortgage market where a sector of consumers is left underserved by market gaps. For example, the major lenders withdrawing products like interest-only loans or SMSFs, changing policies, and regulatory assessment directives, to name a few, across different asset and borrower types, cause these market niches to either grow or shrink at different points in the economic cycle. Some restrictions may even be unrelated to credit issues or the quality of the borrower,” Bannister says.

Since its establishment in 1952, La Trobe Financial’s focus has been to serve customers who are underserved by major lenders. Today, the non-bank offers full-doc and lite-doc products for residential and commercial clients, along with development finance and other products, offered at competitive rates.

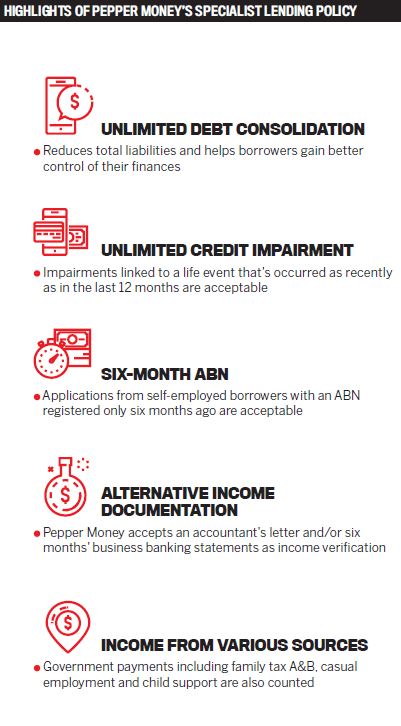

Pepper Money has invested heavily over the years in demystifying and simplifying alternative lending for brokers and consumers through a range of broker tools, a dedicated scenarios team, a local BDM presence, and a retail brand presence for consumers. The reasons are clear: the lender’s own research reveals that 70% of brokers expect to write more non-conforming loans in the coming year, while 66% predict a decline in the number of prime loans written.

“Alternative lenders exist to provide solutions that meet the needs of clients who fall outside of traditional lending criteria,” says Aaron Milburn, director of sales and distribution at Pepper Money.

“Many brokers incorrectly believe that positioning an alternative loan with a client is challenging.”

In fact, the broker’s loan assessment remains the same; the borrower information required, whether for a traditional lender or alternative lender, is predominantly standard across the industry. What is different is the broker’s conversation with the client.

“A broker has to familiarise themselves with a product that they don’t know, which can be time-consuming. Similarly, managing the customer’s expectations can be difficult. The customer may expect to obtain a loan from a household brand name at an interest rate similar to what they’ve seen advertised,” Milburn says.

There are many ways a broker can boost their confidence when dealing with specialist clients, from building familiarity around application processes to tapping in-house support from the lenders themselves.

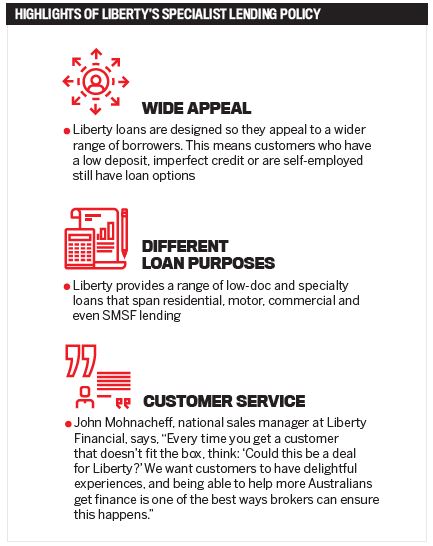

“It is a common misconception that specialist lending is more complicated – especially among brokers who may not have written a custom loan before,” says Liberty Financial national sales manager John Mohnacheff.

“The difference isn’t in the assessment or writing of the loan, but rather coming up with the right solution for each customer’s individual circumstances, and we see this as an opportunity. For more than 20 years we’ve been able to offer borrowers lending solutions that don’t fit traditional loan requirements. Over these two decades, we have honed the process to make it as simple as possible for our brokers and customers.”

Specifically, this approach encompasses personalisation of the customer’s loan experience, backed with extensive product education for the broker through Liberty’s BDM network and calendar of PD days.

As a result, Liberty has loaned $25bn to 270,000 customers since 1997, and today the lender’s suite of solutions includes home, car, business and personal loans for those who don’t tick the traditional boxes.

“Essentially, there is not much difference between how you approach offering a custom loan versus a traditional loan,” Mohnacheff says. “The same information is required in terms of assessing the borrower’s needs, objectives and financial situation, and then verifying that information. The key difference is that this is a more personalised approach. Rather than making the customer’s circumstances fit the loan product, we can tweak the loan product to match the customer.”

At La Trobe Financial, products, policies and processes are engineered with the broker experience in mind; for example, all products are available to all brokers without requiring separate accreditation, and application forms are standardised for all products, including residential, commercial, SMSF, and construction and development products.

Further, the lender employs more than 38 BDMs and 86 credit underwriters, the largest underwriting team of any non-bank.

“Our underwriters are on every loan submission. We piloted this back in 1994 and have been consistently recognised for this service. Brokers tell us they feel listened to and supported through the entire process, giving them the confidence to continue in the specialist space,” Bannister says.

Lenders also offer tools that can be utilised. In July, Pepper Money introduced its Customer Conversion Toolkit featuring the Pepper Product Selector (PPS), a market-first indicative-offer tool that takes the guesswork out of finding the most appropriate Pepper product for clients with difficult scenarios, in as little as two minutes.

“Borrowers should never be in a position where they don’t understand their finance options, regardless of their circumstances,” says Milburn. “Our PPS gives brokers the confidence to offer their client a genuine viable alternative solution, instead of saying no.”

From left to right: Cory Bannister, chief lending officer, La Trobe Financial; Aaron Milburn, director of sales and distribution, Pepper Money; and John Mohnacheff, national sales manager, Liberty

Managing expectations

The majority of specialist applicants have received a rejection from a major bank, while others go directly to a specialist lender based on previous experience and advice. Managing client expectations throughout this time can be a delicate and challenging process, especially if the client has just received their first rejection.

On the part of the broker, a combination of strategic direction and empathy can go a long way in their customer’s eyes, and presenting a borrower’s full picture to their would-be lender from the start also helps.

Mohnacheff says, “As with any broking service, brokers should understand the customer’s situation and what the customer wants to achieve, and present those details to the lender as best they can.

“A specialist loan is still assessed based on the creditworthiness of the applicant, just like any other loan application. There may be different verification requirements depending on the customer’s circumstances, but we communicate those clearly and up front, which means the process is much the same as for any other customer.”

“When a client doesn’t fit traditional lending criteria, a broker must help the customer accept the reality of their situation,” Milburn says.

“This can often be a highly emotional time, and the challenge is to get the client to acknowledge the reasons why they are not eligible for a traditional loan. Creating a positive environment in order for them to accept the circumstances, understand there is an alternative option and move forward is important.”

Pepper Money’s most common client profiles fall into two categories: self-employed applicants with regular financial needs, and those who have experienced a disruptive life event, such as divorce, illness or redundancy, which has impacted their credit servicing.

According to Milburn, both types of client have the potential to become their broker’s biggest advocate, and understanding the client’s profile and circumstances is crucial to successfully handling their expectations.

“With guidance and support from their broker on the alternative options available, these clients tend to remain loyal and readily refer potential clients,” Milburn adds.

Clients also appreciate having the full facts to hand from the start of the application process. Sharing five steps to follow with applicants, Bannister advises brokers to listen while keeping an open mind, and ask for “the whole truth and nothing but the truth”.

Further, he advises conducting “reasonableness tests” on stated income and expenses; educating clients on their current and future options; and speaking to a specialist lender early in the process.

“With some exceptions for aged-care loans or reverse mortgages, brokers will soon realise there is no material difference between selling a mainstream or vanilla loan and selling a specialist loan,” Bannister says.

“The key is to understand the borrower’s situation and to be able to communicate that clearly to the lender. The more information we have up front, the quicker and easier we can provide a solution.”