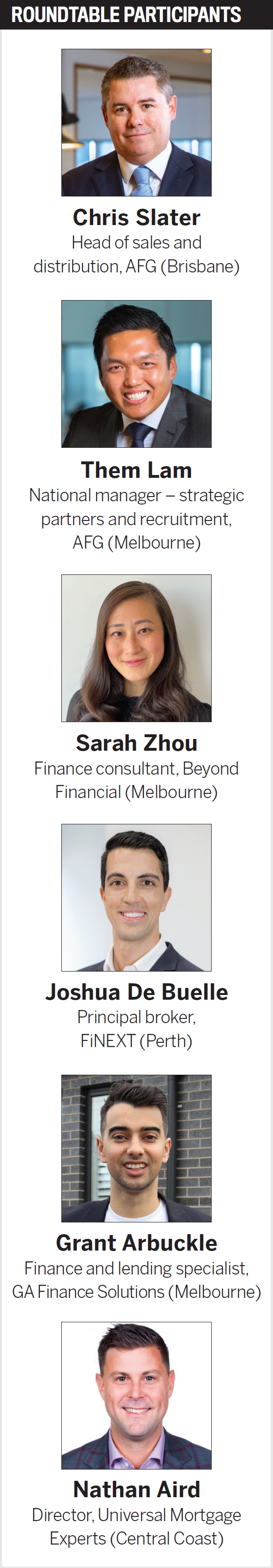

Setting up your own brokerage can be a daunting challenge, but AFG brokers know they have the backing of a supportive network. AFG has released a new e-book guide for brokers on starting a business. Here, four brokers who feature in the e-book discuss their career journeys with AFG’s Chris Slater and Them Lam.

Q: What was the trigger that made you want to start your own mortgage broking business?

Joshua De Buelle, FiNEXT: I went to one of AFG’s conferences. Back then I was an employee of another firm, and I remember standing around talking to all the other guys that were there, and they were all business owners. I was talking to my wife, and I said: you know the one thing I don’t have that all these guys have is that they own their own business; they’ve got control over their business, their direction, their trailbook as well. That was back in 2016, and I just came away from that going no, I want this.

So I started having discussions with the people I was in business with then. It took about two years to go through the process of buying them out and taking over the business and rebranding. That would have been the trigger – respectfully, a lot of those in the room would have been twice my age, and I said if I want to be there one day, I’ve got to start that journey now.

Nathan Aird, Universal Mortgage Experts: It’s definitely control, wanting to be able to do my own thing. I was subcontracting within a business. The business wasn’t running in the direction I wanted it to run. I had this image, I had this brand, I knew what I wanted. I was the one working on the brand for the business, with no support from the business owner. I was just getting no traction with what I wanted, so you’ve just got to rip the band-aid off and go out on your own. That was my trigger.

Sarah Zhou, Beyond Financial: I was working as a broker for an accounting firm, building a book. Twelve months ago, I told them that I was planning a family and I didn’t feel the business supported me at all. They wouldn’t pay any mat leave; they wouldn’t pay me any trails for the book that I’d written. They said, if you’re off, that’s it, no money, no support. So that was the biggest trigger to go ‘I want to build something for myself ’; and also, coming back from mat leave, there was no support there. It’s really hard to balance childcare or who’s looking after the baby – do I have to end up doing nine-to-five hours? So it was six months of planning – to go, alright, the only other option financially is to start my own business, forgo what I’ve built the last couple of years. It’s building something that’s for me, but also I can work the hours that I want to work. I plug in the hours when the baby’s asleep for two or four hours a day, and then at night I can do all the admin stuff. It’s a lot more flexible to suit my lifestyle.

Grant Arbuckle, GA Finance Solutions: I didn’t have any finance backing behind me; I had my degree, diploma and my cert. I came from hospitality in corporate. I enjoyed what I was doing, but I got to a point where helping corporates hit their KPIs wasn’t what I wanted any more; I wanted to start helping people more widely. At this point, I didn’t really know what mortgage brokers essentially do, so I did as much research as I could before starting as an employee with a mortgage broking company. When I started, I didn’t like how they did things, so I lasted there about six weeks before I flipped it on its head and said, ‘I’m going to do this my way’. I’m going to give this a crack in the best way that I can, to bring in what I know around corporate client management and processes. One of the biggest triggers for me is doing things differently, in ways that I want, all of which ensures greater satisfaction when achieving the end result.

Them Lam, AFG: That’s the common theme – being the master of your own destiny and choosing a career path for yourself that suits your lifestyle. Whilst it’s a difficult job being a mortgage broker and a business owner, it’s very rewarding for the right type of person. It’s not for everyone.

Chris Slater, AFG: I’ve just always admired how brave our entrepreneurs are. Josh is basically working for someone else and says, I’ve got to create my own destiny. Sarah’s story is very similar; they’re very brave stories. That’s what I love about brokers the most; I just love how brave they are to get out right at the start and go and do that. Sarah’s story’s the one that we’ve been trying to get out into the marketplace – there’s good opportunities for females that want a role in a business that can fit in with their lifestyle and give them different challenges at all different stages.

Q: How did you build out your business plan?

Q: How did you build out your business plan?

Sarah Zhou: When I started working two years ago with the accounting firm, I wrote a business plan for them. I wrote a 10-page business plan which included where all your leads come from, what each month would look like in terms of numbers and costs and cash flow projections. When I decided to do my own business, I adapted that. I was quite realistic about it all – how many hours can I contribute to the business versus a balanced lifestyle and looking after the baby. Not setting too high an expectation for the first couple of years and understanding that it is a gradual build, because if you have a huge goal and you’re not meeting it, it does become a stress. Entrepreneurs are all very hard on themselves about meeting targets and goals. I prepared a huge list of where the leads are going to come from; how do I feed my business, what are the avenues, what are all the networks – clearly written out and planned in a timely manner. There are some days when the whole world seems like earthquakes, pandemics and protests, and you think, did I even make these calls this week? But I think if there’s an overall picture of where you’re heading and there’s progress, then that’s OK.

Nathan Aird: My plan probably wasn’t as well thought out as some of these people’s here. I like the baby theme – I had a seven-month-old when I set up my own business as well. It was also the back end of the GFC, and I was broke, and I knew that I could do better than what we were doing. So, when I took the plunge to set up my first office on the Central Coast, we were literally busted up. My wife wasn't working, we’d had our first baby, and I had a ton of debt. I just backed myself – it wasn’t with a plan. Most of the things I’ve done have just been through hard work. I just knew I could do it, so I did it.

Grant Arbuckle: One of the biggest things I had to focus on was cash flow. I didn't have a detailed business plan. The big thing I knew was that cash flow was going to be my make or break. So in my first 18 months I would regularly change my business plan to adapt to where the business was going. As we continue to scale, processes are the most important aspect of our business, so nail the processes and everything else starts to come into play. Whether I was doing a million [in lending] a month or five million a month, making sure that I had the same process and principles in place would ensure the remainder of my goals would start to come to fruition.

Joshua De Buelle: When I started as a broker, I had no plan. I was only 22. I saw a mate doing it, and I thought, this looks great, I’ll give it a crack. I’m good with people, good with numbers. Starting my own business, I had to be very detailed. I went to AFG to fund the purchase of the trailbook, and they wanted me to give them a 16-page blueprint business plan, white paper, spreadsheet, the works. They said, we’re going to give you a million dollars plus, so we need to see what you’re going to do with it. I was a broker for 10 years before I took that leap. Cash flow wasn’t a major issue; I was able to buy my book, but I also had a load of debt that was about to start. I just backed myself – I knew all I’d got to do was continue what I’d been doing for the last few years, because I had been doing well. What AFG forced me to do with that business plan was actually document it. Every day I got up, and I said, just follow the plan and go and do it. It then becomes a habit.

Them Lam: It’s so important to have that discipline. Every business is unique, but there’s common problems to solve – the customer, the process, profitability and cash flow. When we’re talking to our broker groups, to be able to share that knowledge collaboratively as an industry, we grow. It’s pleasing to see.

Q: How important are support networks to your business success? What does that network look like?

Joshua De Buelle: Within my business plan, AFG wanted to know who was in my network – did I have a financial adviser, did I have an accountant, did I have business partners, mentors. I was honest; I said, look, I don’t know it all, but I’ve got the right people around me that can help. I’m always a big believer in never trying to figure everything out yourself, because there are people out there who’ve been there, done it before better than me. You’ve got to have the people doing the right jobs, and I think if you don’t have that either within your business or externally, it’s a lot harder road. The mistakes that we’re going to make everyone’s made before – you can learn from that, so being honest and sharing your vulnerabilities with people allows other people to share what they’ve gone through.

Chris Slater: I think you guys do that for your customers. They’re coming to you because they want someone to give them confidence that what they’re about to do, others have done, and you can help them do it. You’re surrounding yourself with other brokers or mentors that have been there, and they can give you confidence that you can do that too. That’s what you do for your clients every day – you give people confidence, and they give you confidence that you can achieve what you want to achieve.

Nathan Aird: The people I’ve met in this industry – the brokers, the staff and the support that I’ve got through my journey – have been phenomenal. I wouldn’t have taken a lot of the chances I have or backed myself without knowing that I spent time with those that have done it before me, made the same mistakes, had the same triumphs and were willing to share. People talk about competition in our industry; I don’t see it. The most successful people that I’ve ever met or been involved with at AFG, the most successful share, and that’s what I love: share what you do, your process, your triumphs, your challenges. That’s my network – other brokers. From there it’s family. My wife’s a big supporter; it’s amazing what she does to pump me up and challenge me.

Grant Arbuckle: When I started broking I just picked an aggregator, and at about the four-to-six-month mark I thought, this isn’t going to work for me. So I knew I had to work out where I was going, and I read of the prospects of being an AFG broker. To AFG’s credit and the people that I met, I probably wouldn’t be where I am now without their support. Yet further to AFG is mentor support. I have mentors that are both in industry and out of industry. I personally believe there’s merit in having people that don’t understand exactly what your industry does but understand how a business should run. Quite directly, I’m seeking a new mentor now who can take me to the next stage in my business career. As I tell my team now, you’re only as good as those who are around you.

Chris Slater: We had Ariarne Titmus and [coach] Dean Boxall on our webinar – the trust between them, that he could actually tell her all the stuff that people wouldn’t want to hear. Being able to have a mentor to able to say, ‘hey Chris, mate, you need to change the way you’re thinking; your thinking’s not right’, and for you able to hear that and change it. What makes successful people successful is that they’re very open to a mentor giving them some hard truths.

Sarah Zhou: There’s a lot of times when running your own business you just go, I know what to do, and this is how I need to get there, but it’s quite assuring when you know you can ask for help. There’s times when I go, this is a really tricky situation, what do I do – and ask for that help. I’ve got my partner who’s not in the finance industry, and sometimes I chat through situations, and he says, what about this, and I go, I’ve never thought of that. My support network is friends, family, work colleagues from the 10 years I worked in banks. Just be open and honest about when you need help, and give that back when they need a hand.

Q: How do you balance your roles as a broker and business owner? How have you made that transition?

Nathan Aird: I’ve always looked at myself as a broker, not a business owner, but as you build your team you realise you become a business owner. The biggest challenge was letting go, because I’m far too OC, far too controlling, and generally try to do everything, but you can’t – it’s impossible. The transition to running a team of people was letting go, letting those that are employed for a certain segment of my business do their job. Building trust within a team of people, moulding them to keep to my high standards – it’s still a challenge. I’ve now got a team of four people that are doing an amazing job, but at the same time I’ve still got to grow them in their positions.

Joshua De Buelle: I consider myself a broker first. We’ve got a team of 10 now. I always think of a footy club or a team. Call me the captain, but most captains are out there playing in the field. Transitioning to being the coach off the field and overviewing the game is something I started eight months ago. At the beginning of the year I employed a young guy, Jake, who I trained up to get his diploma. I’ve brought him in as my succession plan. The plan is to train him up as a shadow broker, and then eventually he’s going to take over my database and the day-to-day of being a broker. Then we’ll get another guy starting next year. I’m very obsessive, so the only way to let go of things is just literally to do it, but having the trust and the processes comes first. We’ve got three support staff and another five brokers. My plan at the end of next year will be to completely take my hands off the wheel from the day-to-day broking. My kids are now four and one and a half, so my next decade is about being a dad.

Sarah Zhou: I love broking, talking to customers and helping them achieve their goals. I’ve only just started my business seven months ago, so I can’t really see myself stopping that part at all yet. From the business owner side, there was just so much more to have to know – the paperwork side, the admin side. I haven’t done it for too long, but it balances out the broking stuff. To go, right, I’ve worked on you, the customer, helped you with your goals; now I need to focus on my tasks and on helping me. It’s all new and fresh at the moment, which is nice.

Grant Arbuckle: I’ve got a couple of team members, and I’m always looking to grow. I’m certainly a broker first and foremost and am always aspiring to become a successful business owner. My biggest challenge is putting the right people in the right roles to help us all move forward. As I’m well and truly in the early stages of building my business, I still see myself as a day-to-day broker with the added arms of being a business owner fulfilling tasks such as cash flows and budgets. For my first employee, I was a bit cheeky. I took the risk out of recruiting, and I made an offer to my previous office coordinator from when I was in the corporate world, because I trusted her – she knew how I worked back to front. At this time, I couldn’t keep up with admin. My skill set is being on the phone. I know my place, and I’m comfortable with that. Frankly, I’m 60 years old in my technology skills, so that’s why I pay for systems and hire staff better than me to fill these gaps. Our second team member I brought on was to better support and continue with our promise of being customer focused. Both of my two team members were outside of industry.

Nathan Aird: Every single employee I’ve ever employed has come through a training company. I’ve always hired trainees straight out of school, and they always stay. Ryan, my wingman, has been with me since he was 18. I knew I needed to grow an administration team to do what I needed to do. I always train them to be mini-me’s. I’ve never hired a broker.

Chris Slater: I’ve spent the last decade hiring people, and I find you get a much better result if you know them. Trying to pick a candidate out of 15 résumés that got emailed to you is very, very difficult versus knowing someone, trusting someone and picking the right characteristics. If you’ve never hired people before, you have to learn it. We try to share our experience, which is to talk through your process, why you’re hiring, who you’re hiring, what characteristics you’re looking for. What’s in it for them?

Them Lam: The employee value proposition is so important. They spend a third of their lives with you. To attract the right talent into your business is about building that culture that makes people want to come and work with you side by side.

Q: What processes and systems have been most important to your business success when starting out?

Joshua De Buelle: Administration is not my skill set. Just having your team line up correct. It flows within the five of us – I implement the strategy, and then we’ve got an analyst who does all the research, all the processing and qualification of the client. I’ve got Jake who goes out and does all the appointments, and we’ve got a pre-settlement officer and a post-settlement officer that processes the file. Breaking that up to the five different stages just allowed us to do a lot more volume with a lot less work, because you had each specialist doing what they were really good at. The process is identifying what people want to do, getting them to do it well, and being vulnerable enough to understand when you’re not good at it and letting someone else take that over for you.

Sarah Zhou: It’s about time frames. Being a new business, to go out there and to tell my network, hey, you should work with me. Why? My selling point to my referrers and my network is my time frames. I absolutely will get back to you with a response within 12 hours. That’s my promise. I will lodge your application within a certain time. So that they have the confidence if they refer a client, and also when a client comes to me, they know exactly what to expect. It’s an assurance to my referrers, to my clients, that they can rely on that. As a business starting up, for me that’s important. It’s something to distinguish myself as a new business. Every one of my referrers has other brokers on their panels, so this is where I can go, this is what I’ll stick to, this is the process I’m going to work to, and I’m bringing you on board with it, and that’s why you should work with me.

Nathan Aird: I’ve got people that are responsible for certain segments of my business – they know what their job is, and they have a certain part of the process that they take care of, and I know that too. So I find myself to be a traffic director with the information that comes to me first, and whose job it is to do that. Every person has their job they were employed and trained for. What works so well for our 300 customers every year is that every person gets the exact same service, because the same person does the same job and they do it very well because that’s what they were trained to do.

Grant Arbuckle: There’s probably two prongs. There are the business processes which I think we’ve all nailed – staffing and allocating who does what; and our client processes, which we are always adapting. Certainly in my first year, before I had any staff or frankly knew what I was doing, the biggest thing was IT. What creates a positive impact for my clients – systems like bankstatements.com or DocuSign. Just about everything we do is digital, and we know that these systems impact the client’s experience positively. It all means we can get things out quickly and effectively, because we’ve got the systems in place to do so.