While Australia may be out of its pandemic funk, its effects on business sentiment still linger as it entwines with the current cost-of-living and inflationary pressures.

However, some states are worse off than others, according to a senior advisor of an SME fintech.

Rodney Fleiszig (pictured above), business partner at SME financial solutions company Fifo Capital, was “deeply concerned” about the sentiment in his home state of Victoria.

“Although there are other factors at play, 262 days of lockdowns over two consecutive years have contributed to a loss of confidence amongst business,” Fleiszig said.

“Victoria doesn’t have the natural resources of Western Australia and Queensland to emerge from this. The state government will have to step in to help reverse this trend so employment can remain stable.”

Generally, Australian consumers are in a pessimistic mindset entering the Christmas holiday period – a fact that has obvious repercussions to Australian businesses.

The NAB business conditions survey released Tuesday showed that business conditions are still tracking well compared to the start of the year, indicating a “surprising resilience” across the economy, according to NAB economist Alan Oster.

However, the bank’s Small Business Sentiment Index was still in negative territory for the third consecutive month.

Among consumers, pessimists still outweigh the optimists, according to the Westpac-Melbourne Institute Consumer Sentiment index, which rose to 82 in October in an indicator where a score above 100 indicates optimism.

But perhaps what best illustrates Fleszig’s concern is the latest data from ScotPac’s SME Growth Index.

In an op-ed in The Australian, ScotPac CEO Jon Sutton explained that despite the current pressures, 57% of small businesses predicted positive revenue growth over the next six months.

However, in what he described as a “two-speed economy” 32% of SMEs forecasted their revenue to fall in the next six months – the largest divergence in the Index’s history.

The clear difference lay between states with Queensland and Western Australia particularly bullish in the months ahead, with 92% and 84% respectively predicting revenue growth.

However, Victoria is at the other extreme with 69% of SMEs forecasting a decline in revenue to March 2024 and a dismal 17% expecting growth across the state.

Fleiszig said this is partly because in states like WA and Qld, where there is a mining industry, there are a lot of well-paying jobs.

“This helps SMEs because people have more disposable income to spend,” he said. “However, it’s also because the Victorian government hasn’t done enough to stimulate its economy after the pandemic.”

Fleiszig has a particularly unique view on this matter, being a BDM for a business called RenewOak, which rejuvenates old oak barrels, as well as providing financial solutions for SMEs through Fifo Capital.

While the South Australian business was impacted by geopolitical pressures with China, as was the rest of the wine industry, Fleiszig has seen a recovery in the state compared to Victoria.

“The South Australian government has even been proactively lobbying for Victorian businesses to come over, so there may be some opportunities for SMEs in Victoria to relocate, which is terrible news for the Victorian economy.”

While the alarm bells aren’t ringing yet, the data suggests the pressure on businesses is clearly going to get worse.

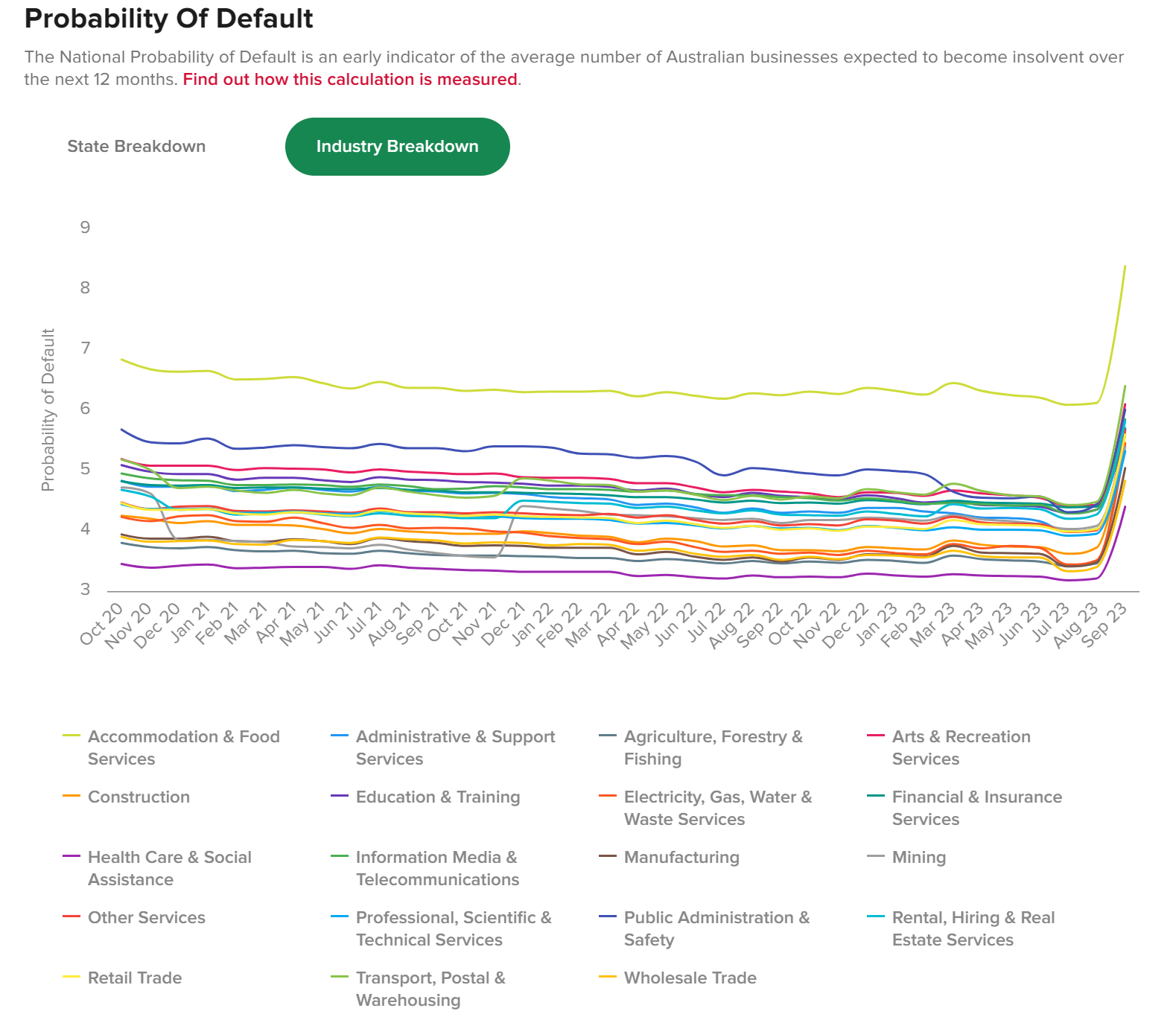

Creditor Watch’s National Probability of Default index (in the graph below), which measures the average number of Australian businesses expected to become insolvent over the next 12 months, shows a worryingly sharp uptick across the board.

Although Victoria is not indicating any more pain compared to other states, Fleiszig worries that if small businesses are pessimistic, they won’t invest and grow.

“They'll employ less people or they might or they may decide to move shut down. Overall, it's not good for the economy because if you haven't got businesses that are willing to invest, they're paying less taxes,” Fleiszig said.

“The government needs the revenue for the services, and for the community.”

For his part, Fleiszig said his team at Fifo Capital are doing what they can.

“We get a lot of inquiries from SMEs, and we're pretty prompt with our activity. We try to get an initial offer out within one to two days and sort out their funding arrangements as quickly as possible.”

However, he said with SMEs employing 97% of all businesses in the country, it was important for the government to stimulate the economy through measures that support small businesses.

“If the government continues to put further and further regulation on businesses, it will be a disincentive to invest, which will result in not as many jobs being created.”