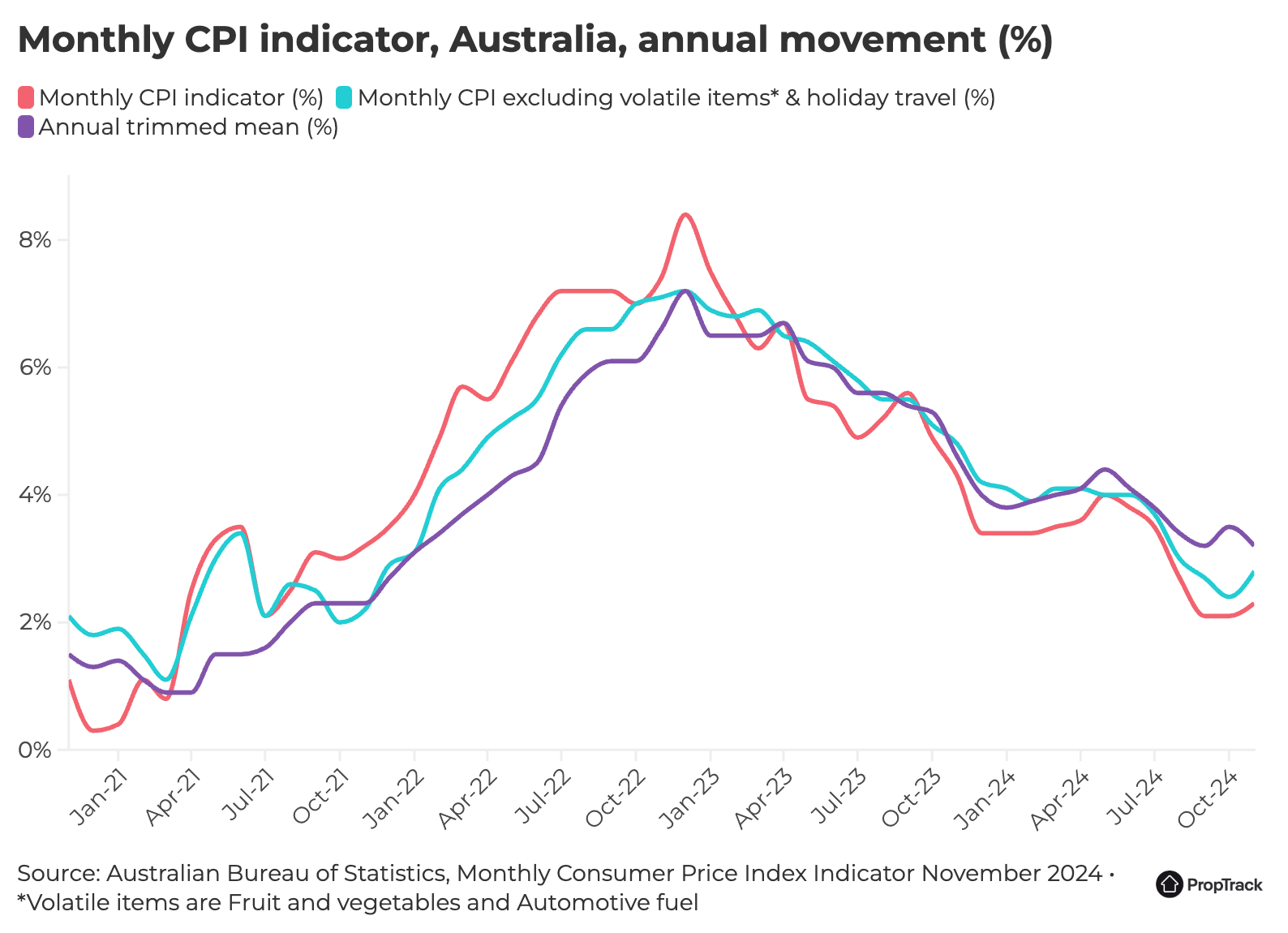

Karen Dellow (pictured above), a senior audience data analyst at REA Group, highlighted that the consumer price index (CPI) increased by 2.3% over the past year, aligning with RBA’s target of 2-3% and raising hopes for a likely interest rate cut to 4.10% at RBA’s February meeting, with financial markets estimating a 78% probability.

According to the PropTrack analysis, a potential rate cut would significantly benefit homeowners with variable loans by reducing monthly payments and increasing disposable income.

This financial relief could be a boon for the real estate market, as it would enhance borrowing capacity for prospective home buyers, potentially stimulating further activity in the housing sector, Dellow said.

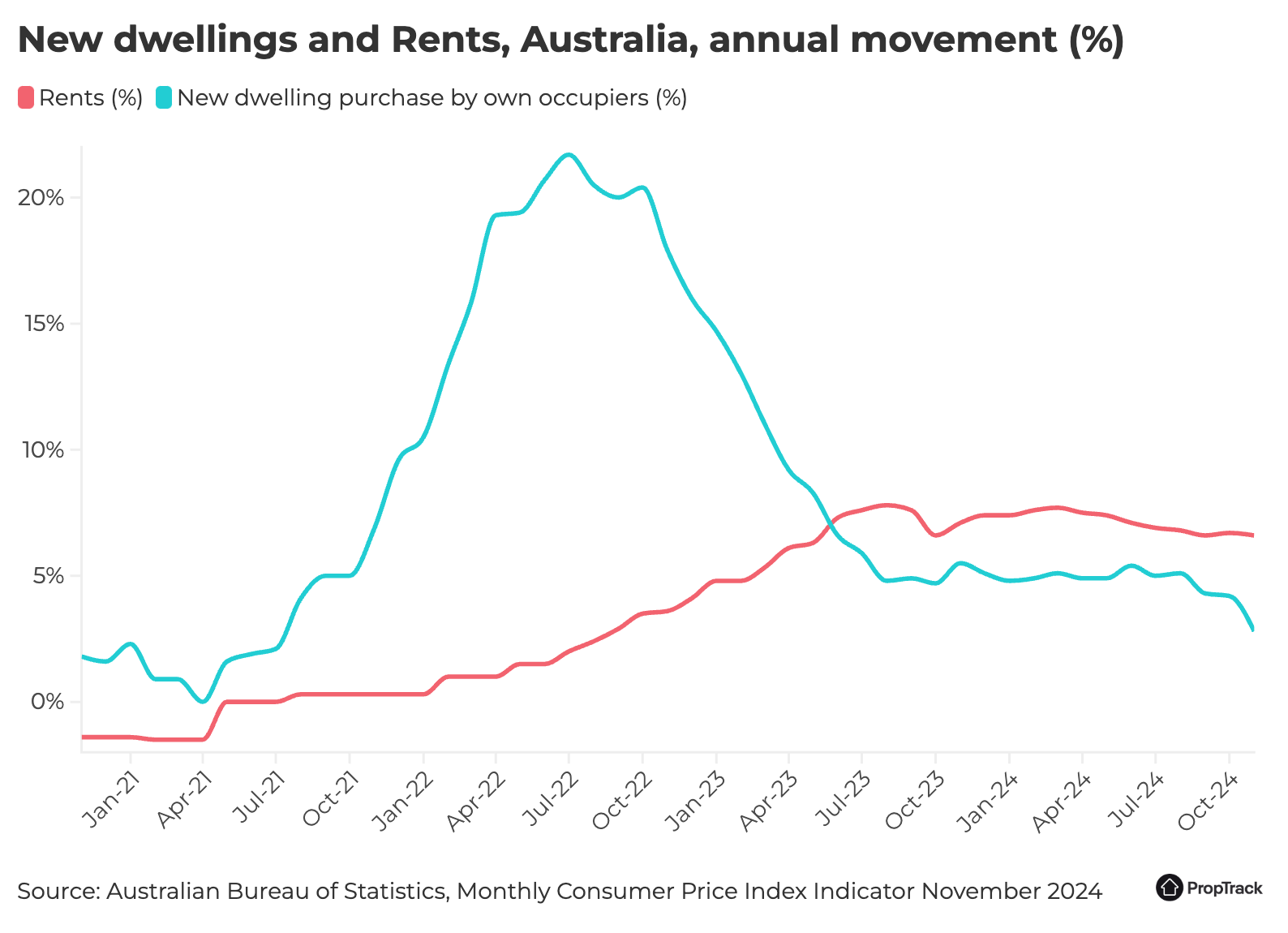

The CPI report indicated a slowdown in the rise of housing costs, including rents and the price of new dwellings, which have only increased by 2.8% annually – the slowest growth rate since July 2021.

This deceleration is partly due to builders cutting prices and offering deals to attract buyers amidst a backdrop of slowing construction cost increases and a stabilisation in the supply chain.

Rental growth has also decelerated, with an annual increase of 6.6% as of September. Despite tight vacancy rates in capital cities, a slight uptick in availability has helped moderate rent increases.

Government assistance adjustments have also played a role in stabilising the rental market.

Despite the favourable inflation report, rising living costs, including groceries and utility bills, coupled with high interest rates, continue to pressure household budgets.

This financial strain has led to changes in consumer behaviour within the real estate market, with potential buyers and renters adjusting their expectations and often opting for less expensive property options or delaying transactions, Dellow said.

RBA is set to closely monitor the next set of quarterly CPI figures due in three weeks, which will play a crucial role in determining the timing and extent of interest rate cuts.

If the January 29th report shows inflation remaining within the target range, it could trigger a rate reduction as early as February, providing further relief to homeowners and potentially invigorating the property market, PropTrack said.

The recent CPI data not only fits within RBA’s target but also marks four consecutive months of stable inflation, suggesting a strengthening economy and raising hopes for easing monetary policy.

With the potential for rate cuts on the horizon, 2025 may see increased activity in the housing market as financial pressures on households begin to ease.