Through the GFC, the rise of fintechs and the coronavirus pandemic, managed funds commercial lender Equity-One has remained steadfast in its mission to provide fast, flexible finance options to brokers and borrowers.

The more things change, the more they stay the same – it’s an old saying but it perfectly sums up Equity-One’s unwavering commitment to keep things simple in an industry that never stands still.Based in Melbourne, the public non-listed financial institution specialises in finance and investment, with a focus on providing fast, competitive finance solutions to commercial borrowers.

Founder and managing director Dean Koutsoumidis says he set up Equity-One in 1998 as a private company before it evolved into a public mortgage fund in 2006. He talked to Australian Broker about the non-bank lender’s history, its vision, the evolving market, and how it handles the various challenges it has faced.

“In the early ’90s, Australia was emerging from the heady boom and later crash of the late ’80s,” Koutsoumidis says. “Australia was in its worst recession since the Depression, and borrowers had a heavy task of trying to untangle themselves from bank loans in an era when interest rates of 17% were the norm.”

“As a much younger mortgage broker, I gravitated to the world of ‘private lending’, as it was known back then, where individuals who had cash to deploy invested in a direct mortgage to a specific borrower, secured by their property.”

Koutsoumidis says this was mainly the domain of law firms, which ran contributory mortgage practices and mostly “they did it for a very long time and did it very, very well”.

“I was fascinated by this style of lending, because it was what we now call ‘peer to peer’, and it was in its purest form. It was very popular in those times as bank and other mainstream lenders were not able to accommodate the entire market, and there was a need for alternative sources of debt.”

Koutsoumidis says he established Equity-One to offer these direct mortgage investments to retail investors. By doing so, it provided commercial borrowers with an alternative source of funds for their commercial property requirements in times when the banks weren’t “dancing”.

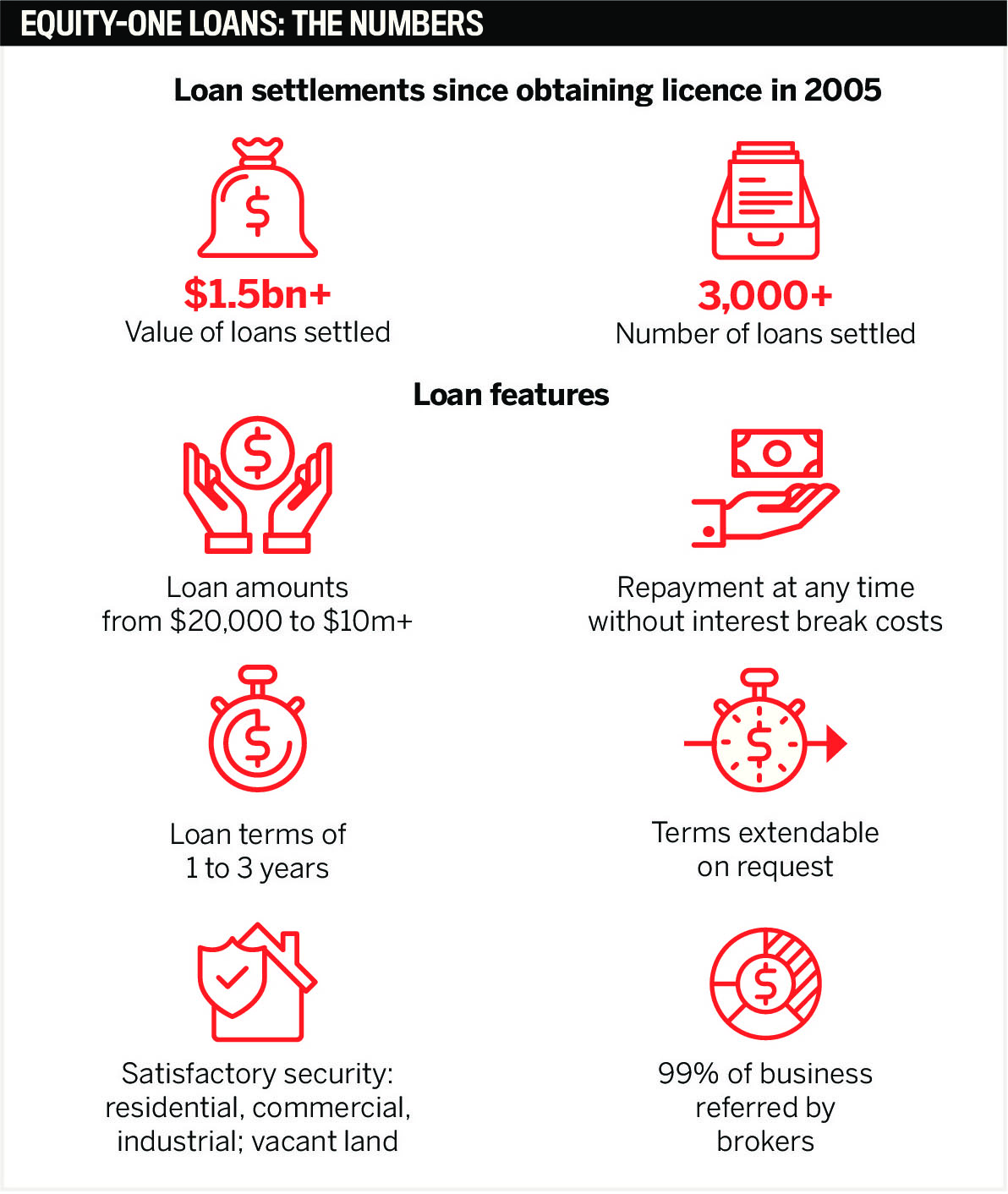

Since obtaining its licence in 2005, Equity-One has settled more than 3,000 loans, with a value of more than $1.5bn. It offers interest-only loans secured by a first mortgage on all manner of properties, including residential, commercial, industrial, vacant land and construction sites, provided it is for non-code business use.

“Borrowers typically come to Equity-One to settle a purchase because their traditional lender has not been able to deliver,” says Koutsoumidis.

“In that sense, we are the ‘second phone call’, but we don’t have an issue with that. That’s our relevance in the marketplace. We also help developers with cash put on residual stock, and refinancing.”

Loans are fixed interest with terms of one to two years, but they can be repaid at any time with no break or exit fees.

“This is a real plus for borrowers that need a non-bank option but may be able to get their ducks in a row faster than expected.”

Equity-One lends to registered Australian companies, trusts with corporate trustees, and self-managed superannuation funds, but not to individuals or partnerships for consumer purposes.

Koutsoumidis says Equity-One’s catchcry is “deliberately simple”, something the firm has stood by during economic upheaval and industry changes.

“It is interesting that we have been through the property crash of the ’90s, the GFC of 2007, and the dreaded COVID-inflicted year of 2020, yet the products in demand remain essentially the same.”

In all these years, the key outcomes that borrowers seek have not changed.

“Borrowers still have the same needs, that is, commercial mortgages that are cost-effective, flexible and fast. In this regard nothing has changed. Our relevance in the marketplace is just as strong now as it was in the ’90s.”

However, the delivery of financial products has changed and borrowers’ expectations have sped up, says Koutsoumidis. “I mean, we don’t exactly send loans approvals through the fax machines any more. What even is a facsimile?

“Borrowers are savvy, knowledgeable, and have high expectations. Pricing is not only the key point, but service levels and seamless processes are essential.

“This is a good thing because it separates lenders who want to step up to the best practices from those that do not value it.”

Despite the far-reaching effects of the pandemic on the Australian economy, Equity-One has remained immune to any negative impacts.

“We have been one of the fortunate lenders throughout 2020, largely because there are certain segments which we have not entered, ” says Koutsoumidis.

“Construction, whilst in high demand and a very large area of non-bank lending growth, is an area we have kept away from. This suits us fine as our investors are more passive, and this is reflected in our style of lending.”

Other non-bank lenders have taken up more of the construction lending space, which is a good result given “the majors have taken the foot off the gas pedal in these areas.”

He says there have been some surprises too.

“In a market that is left to its own devices without government intervention, one would have expected interest rates from non-bank funds in 2020 to have increased,” Koutsoumidis says.

“As we all now know, the opposite occurred. A contracted market coupled with cashed-up ready-to-lend entities meant that competition for the right opportunities was a challenge. This meant rates dropped and dropped by significant margins.”

He says it will be interesting to see how this space evolves in 2021, particularly as the government’s COVID-related relief provisions are rolled back.

“Time will tell. For Equity-One, it is business as usual. We simply want to continue providing commercial loans to borrowers and our broker network by the cheapest, fastest, most seamless methods possible.”

Meanwhile, Equity-One has invested in technology to provide a better service to its investors and is planning to do the same with its loan products in the future.

“Technology is at its best when it makes things simple, and fast. Developing technology to be just that isn’t as simple as it sounds,” Koutsoumidis says.

The company has progressed further in its technology upgrades with investors, providing all correspondence, statements and reports through individual, secured portals.

The company has progressed further in its technology upgrades with investors, providing all correspondence, statements and reports through individual, secured portals.

“Investors of all ages have taken up this technology very quickly, and it has now become the norm. We also invested in electronic signatures on investor documents two years ago, which also was wonderfully received,” Koutsoumidis says.

“We look forward to enhancing these platforms to borrowers shortly, as fast, real-time communication is critical to brokers who want to deliver excellent service to their clients. We want to be a part of that journey with them and to add value where we can.”

Koutsoumidis says that apart from some limited advertising, all of Equity-One’s business, from borrowers, brokers and investors, comes from word of mouth.

“We continue staying in touch with our client base and delivering on what we promise, deal by deal by deal, one step at a time. It worked in the time of fax machines, and, you know what? It still does.”

In terms of Equity-One’s broker relationships, Koutsoumidis says “the key for us is focusing on being relevant to them”.

“It is not only about pricing. It is interesting that even in the rapidly evolving digital world, people still need human engagement more than ever before.

“To this end, we focus on ‘being there’ for our brokers when they want to pick up the phone. Our view is that it is not only the current transaction that is our focus, but the ones in the future from the broker, too.

“We try to invest in the relationship at every touchpoint, and if we do not deliver, we would like to know. It’s all about people.”

Equity-One’s trustworthy reputation and its long-term endurance in the commercial loan industry continues despite the rise of fintech lenders and neobanks, “which will continue to make headways in the Australian market”.

“Many of them will raise the bar and offer innovative solutions for borrowers, but others will not.

“Xinja Bank was a recent example of the failure to launch. Our focus, tech-driven or not, will still be to provide non-bank funding for commercial borrowers. We expect to broaden our products too, but more on that a little later.”

Koutsoumidis says Equity-One is in its third decade of business and is delighted to still be a key part of the Australian lending and investment landscape.

“Equity-One is all about its people and stakeholders. Whether you are a borrower, investor, adviser, team member or consultant, it takes every single human that is involved to make us who we are as an organisation. For this, we are very proud and grateful, and we plan to be doing it for the next four decades and beyond.”