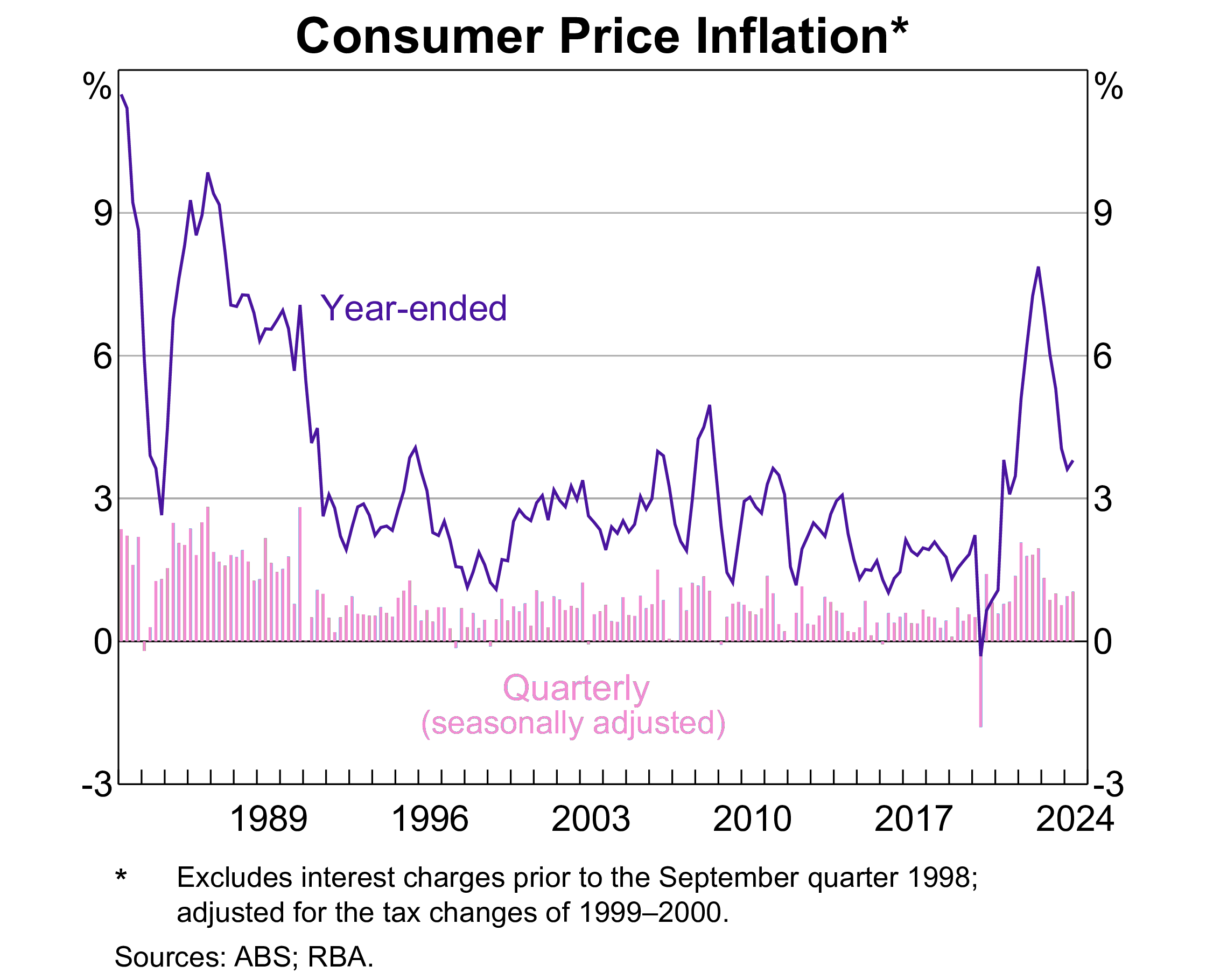

Australia’s central bank decided not to follow its US counterpart in cutting rates with inflation still above the 2-3% target band.

However, anticipation is building for a rate cut this side of Christmas as several key economic indicators point towards a struggling economy.

Anthony Waldron (pictured far left), CEO of Mortgage Choice, who anticipated the hold, said the latest data made the case for the Reserve Bank to pause the cash rate.

“ABS data showed that inflation is trending down, and the seasonally adjusted unemployment rate rose slightly in July,” said Waldron.

“Data also points to interest rates affecting the economy as intended, with the ABS Australian National Accounts showing that outside of the pandemic, the economy recorded the slowest annual financial year economic growth since FY92.”

While the result was expected, what this RBA meeting will be remembered for is its unfortunate timing.

In a potential sliding doors moment, commentators will be left to speculate on what effect tomorrow’s CPI data may have had on the RBA’s decision-making.

In an interview with Sky News’ Andrew Clennell, treasurer Jim Chalmers said he expected the CPI numbers will be down “in the low threes or the high twos” – potentially within the target band.

If this happens it will be the first time headline inflation will have dropped below 3% since August 2021 in the ABS monthly dataset.

However, Chalmers did note that tomorrow’s monthly inflation data would hold less weight than the quarterly CPI figures.

For reference, the monthly CPI indicator rose 3.5% in the 12 months to July while it rose 3.8% the last quarterly data in June. The September quarterly CPI data is released on October 30.

Waldron said the RBA’s best tool to drive inflation towards its target range is the cash rate.

“While inflation is trending in the right direction, it’s still not low enough for the RBA to consider cutting the cash rate yet.”

Source: RBA

Source: RBA

While the central bank’s collective mindset is to walk the narrow path towards putting inflation back in a comfortable range, some experts have questioned whether the 2-3% target band has become an arbitrary and limiting goal.

In the Finder RBA Cash Rate Survey, some panellists think the target range should be expanded to a larger range or dismantled altogether. These panellists believe the current range does not allow the RBA enough flexibility to lessen the impacts on certain parts of the economy.

Leanne Pilkington from Laing+Simmons said, "Steadfastly observing a narrow range constrains the RBA’s freedom to more deeply consider other variables and their impacts, or potential impacts, on different parts of the economy."

However, the majority of panellists (86%, 30/35) agree that the current inflation target of 2-3% should be kept in place.

Shane Oliver (pictured centre left) from AMP said the 2-3% inflation target has served Australia well over the last 30 years.

“There have been lots of calls to lower or raise it over the years (usually when inflation is below or above target) but doing so will just reduce the RBA’s inflation fighting credibility by changing the goal posts,” Oliver said.

“In particular, raising or removing it will likely see higher inflation locked in which will lead to permanently higher interest rates, greater economic volatility and higher unemployment.”

Positive economic sentiment remains low

Although integral to the RBA’s decision-making, inflation is but one of many economic indicators the central bank looks at.

While GDP avoided falling into negative growth this month, the Australian economy still remains flat.

Business confidence took a dip in August, according to NAB, whose chief economist Alan Oster expects the unemployment rate to reach 4.5% by the end of the year.

The ANZ-Roy Morgan Consumer Confidence Index shows similar pessimism, with consumer confidence having remained below 85 for a record 85 consecutive weeks.

Finder's Economic Sentiment Tracker - which gauges experts' confidence in five key indicators over the upcoming six months (housing affordability, employment, wage growth, cost of living and household debt) – also showed a similar story.

After dropping to a record low of 7% in August, average positive economic sentiment has barely improved – sitting at just 8% in September.

Both housing affordability and household debt continue to be a problem, with 60% of experts expressing a negative outlook to both metrics.

The sentiment towards employment has the highest negative score, with 73% of experts expressing concern.

While the economic data provides enough fodder for economists and commentators to mull over and debate, the official cash rate has a practical effect on the budgets of millions of Australians.

A recent report by the Real Estate Institute of Australia (REIA) revealed that 48% of income is going towards home loans.

In New South Wales, the burden is even heavier, with families spending 57.9% of their earnings on mortgage payments.

Graham Cooke (pictured centre right), head of consumer research at Finder, said given the sharp and rapid rise in mortgage repayments, millions of Aussies are under significant financial stress.

“A whopping 40% of homeowners say they are struggling to pay their home loan in September, according to Finder’s Consumer Sentiment Tracker,” Cooke said.

Households saved just 0.9% of their income over the past year, according to data from The Australian Bureau of Statistics (ABS) - the lowest rate of annual saving since 2006-07.

The average Australian has $39,407 in cash savings in September, according to Finder’s Consumer Sentiment Tracker.

|

|

Men |

Women |

National average |

|

Average cash savings |

$48,546 |

$30,629 |

$39,407 |

|

Percentage with less than $1,000 |

32% |

48% |

40% |

|

|

|

||

Source: Finder’s Consumer Sentiment Tracker of 3,082 respondents, July - September 2024

However, the nation’s big savers are clearly pulling up the national average, with 40% of Aussies having less than $1,000 in their savings account.

The majority of experts (67%, 18/27) who weighed in say these low household savings rates will lead to an increase in household personal debt over the next 12 months.

Graham Cooke said budgets are being squeezed by rising costs.

“Less in savings means people are more likely to have to rely on credit cards, loans, and buy-now-pay-later products to get by. These products can be great if used properly, however they can quickly get out of hand if relied on for everyday expenses.

While the cash rate is on hold, Canstar’s Belinda Williamson (pictured far right) said there was another deluge of fixed rate cuts this week with 16 lenders slicing 165 rates on the back of a continued drop in the cost of wholesale funding.

As a result, almost 90% of lenders’ lowest rates are fixed ones, of those offering both fixed and variable rates.

"Does that make it a good time to fix? The answer is unlikely, particularly when you consider that the gap between the lowest fixed and the lowest variable is just 0.26 percentage points,” Williamson said.

Mortgage Choice home loan submission data showed a similar story in that borrowers are continuing to opt for variable rate home loans during this extended period of relatively high interest rates.

“In August, just 3% of loans had a fixed component, and that trend is continuing so far in September,” said Waldron.

While Canstar believes the RBA isn’t set to cut rates in the next four months, Williamson said there’s a much higher chance it will in the next six to 12 months.

Canstar ran the numbers on whether a borrower would pay less interest opting for one of the lowest fixed rates versus one of the lowest variable rates during the fixed rate term, and only on the 1-year rate did fixing have a chance of coming out on top, and “even then it was a close call”.

"Term deposit rates also continue to drop like flies. A total of 10 banks cut at least one term deposit rate in the last week, while just two banks increased rates,” said Williamson.

The drop in banking term deposit rates has also led to an increase in private credit term deposits, which are usually higher.

"The cuts for term deposits and fixed mortgage rates are in response to a drop in the cost of wholesale funding but also the increasing likelihood of cash rate cuts within these fixed rate terms,” Williamson said.

"We expect both of these rates will continue to fall as we edge closer to a cash rate cut next year.”

While Canstar forecasts the impending rate cut to not happen until 2025, others aren’t so sure.

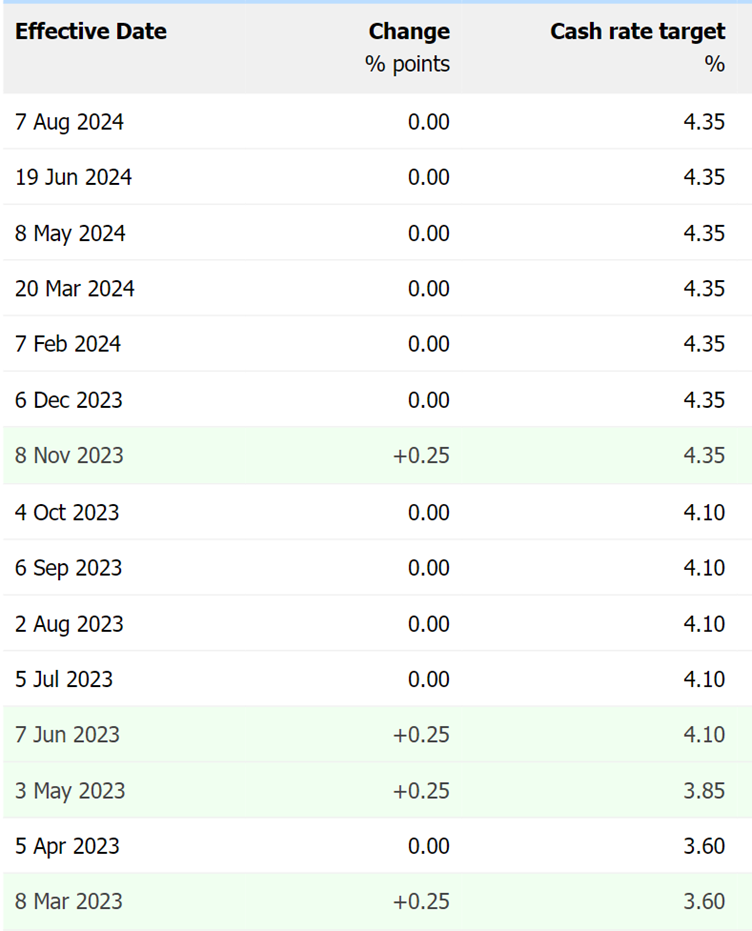

Exactly when this period of pauses will end is still a matter of contention, with some economic teams from major banks, including CBA and Westpac, predicting a rate cut on November 5.

The RBA last raised the cash rate to 4.35% on November 2023, and with many homeowners holding out for relief, some expect the RBA to make a proactive and popular decision before the holiday season.

Cooke said a rate cut is looking “much more likely this side of Christmas”, following the US Federal Reserve slashing American interest rates by 50 basis points.

However, not all agree.

David Robertson from Bendigo Bank said monetary policy is firmly on hold although the RBA should be in a position to start cutting official rates in early to mid-2025.

“Other central banks are now steadily reducing rates, but our cycle appears to be around six to nine months later."

Source: RBA

Source: RBA

With a rate cut on the horizon, Cooke is still urging consumers that “you don’t need to wait for the RBA to move the cash rate to see if you can find a better deal”.

“Finder has a number of variable home loan offers that start with a “5” – if yours does not, it could be time to switch."

Waldron said,” If you’re hoping to buy in Spring, and don’t yet have a pre-approval, I’d encourage you to meet with a mortgage broker to get a pre-approval sorted and ensure you’re in a position to make an offer as soon as you’ve found the right property to purchase.”

“For borrowers who haven’t reviewed their loan so far in 2024, now is a great time to meet with a broker to check that your loan still meets your needs. Mortgage brokers can help you understand if your home loan interest rate is still competitive, and if the structure and features of your loan work for you.”