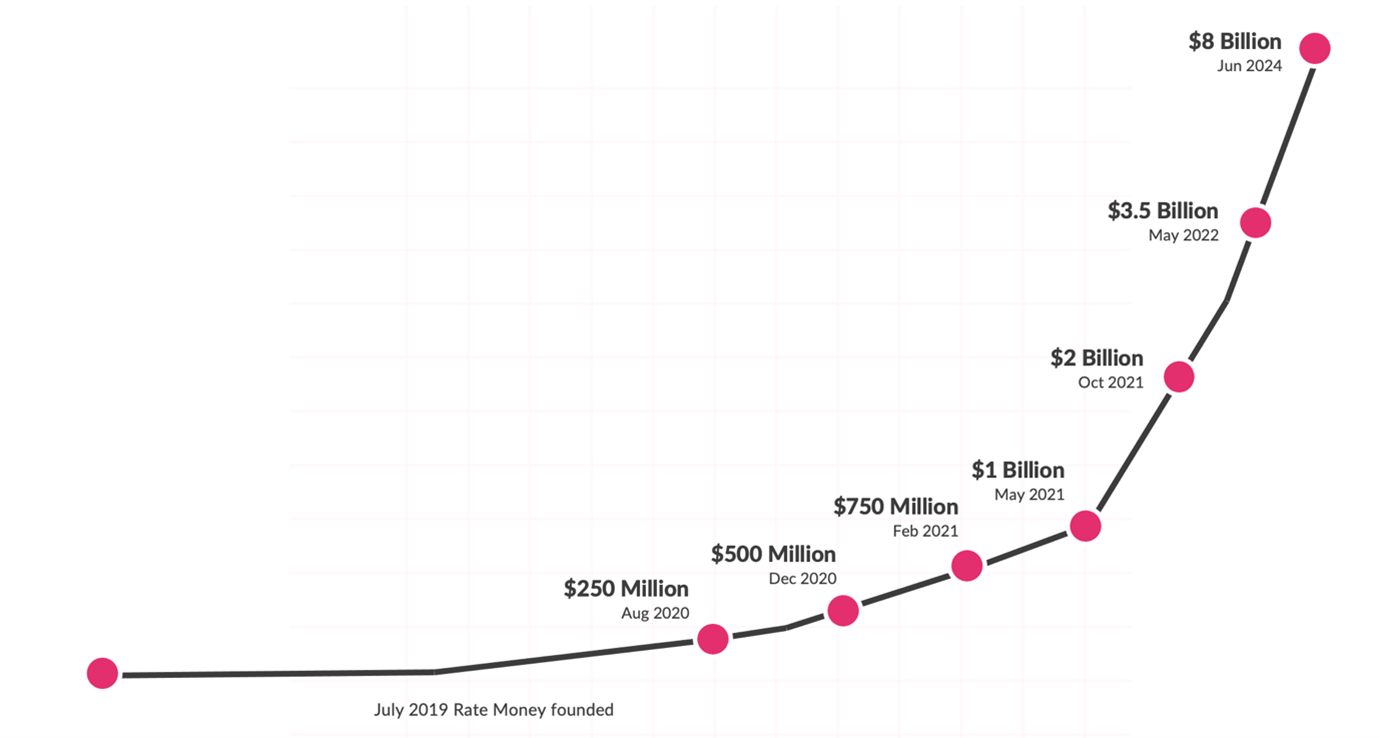

Self-employed home loan specialist Rate Money has reached a significant milestone of $8 billion in loans written since its inception in 2019.

The company highlighted its rapid growth, with $4.5 billion of that sum achieved in the past two years alone.

Rate Money, CEO, Ryan Gair (pictured above) said he was thrilled to have reached the milestone in such a short period of time.

‘We have successfully developed and executed on a plan to reshape the mortgage industry for the benefit of Australia’s 2 million-strong self-employed heroes,” said Gair.

In August 2021, the company passed the symbolic $1 billion mark for settled loan. By November 2022, the number had grown to $4 billion before adding another $1 billion just seven months later.

Gair attributed the company's success to its focus on disrupting the traditional mortgage industry for the benefit of self-employed Australians.

Rate Money removes fees like Lenders Mortgage Insurance (LMI), risk fees, application fees, and valuation fees for more than 8,000 customers.

The company also claimed to be the first to eliminate clawbacks without risk fees, replacing them with transparent commissions for loan writers. Gair said he saw this as a sign of the company's dedication to fair business practices.

"They say imitation is the sincerest form of flattery and we are proud to have influenced the rest of the industry as they try to mimic the same clawback reductions and remove the same risk fees from their products for Australia’s hard-working, uniquely ambitious small business owners who big bank lenders have historically neglected,” Gair said.

“We’re proud to be spearheading this change and remain dedicated to serving our customers while driving transformation.”

Rate Money also credits its investment in technology for its success. A custom-built CRM and automated workflow systems have reportedly reduced turnaround times and error rates.

"Over the past 18 months, we experienced an increase in monthly call volumes of more than 200% to our contact centre from our growing customer base and maintained a Grade of Service in the high-90s,” Gair said.

This was achieved by introducing automation to support our experienced customer support officers."

Recent product innovations also contributed to the milestone.

In October 2023, Rate Money introduced a tax return product for self-employed customers, simplifying the loan process by requiring just one tax return instead of the usual two years' worth.

Thanks to exclusive funding arrangements with two partners, this product enables a faster transition from low/alt-doc loans to full-doc loans.

The company also launched the Elevate Easy Doc Construction Loan—an alt-doc construction product for self-employed Australians looking to finance construction projects.

Gair said the company built its value proposition around comprehensive support, tailored solutions, and ongoing innovation, “ensuring every decision we make is in the best interest of our customers, brokers, and franchisees”.

“Our commitment to navigating the complex challenges of self-employment and proactively monitoring market trends has allowed us to provide exceptional value to our customers,” Gair said

“We look forward to continuing our work of transforming the mortgage industry for the better and helping self-employed Australians succeed as we do.”

What do you think about Rate Money’s latest milestone? Comment below.