A new survey has found that around 29% of Australians own property with a mortgage while 30% own their homes outright. The remainder were rental tenants.

The recently released

MLC Quarterly Australian Wealth Behaviour Survey polled more than 2,000 respondents to look at investor intentions and behaviours.

In enquiring about the average family home, researchers found that 55% of Australians aged over 50 owned their homes outright while just over 20% had a mortgage.

Australians between 30 and 49 years were more likely to be paying off a home loan with 43% holding a mortgage. Only 15% owned their home outright.

These figures were even more skewed for those between 18 and 29 years old. In this age bracket, fewer than 5% owned their homes fully while19% had a mortgage. The remainder rented (for a fee or free).

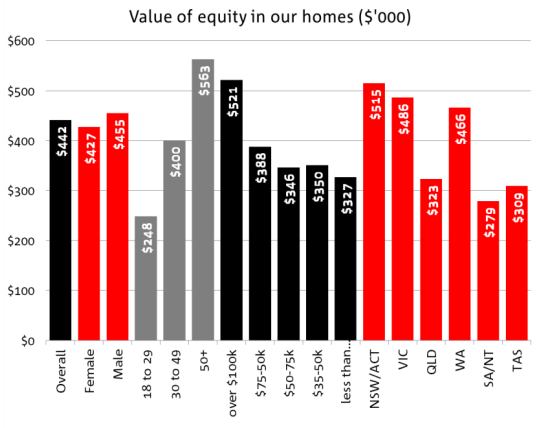

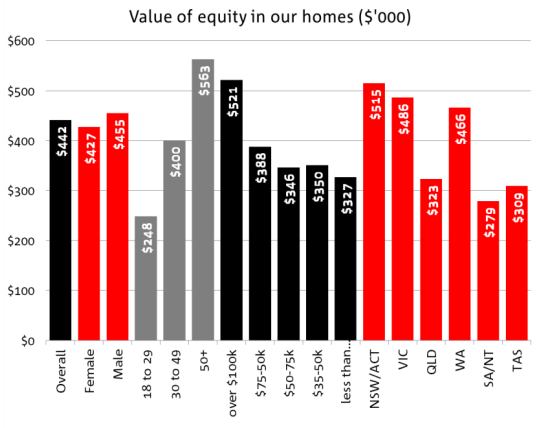

On average, Australians had around $442,000 worth of equity in their family homes. Again, this was heavily skewed for older Australians in the following manner (with the average equity for each age bracket found in parentheses):

- Over 50 years old ($563,000)

- 30 to 49 years old ($400,000)

- 18 to 29 years old ($248,000)

Those living in NSW and Victoria had the highest average home equity while those in Western Australia came in third place. The full breakdown of average home equity among those surveyed can be found below:

Related stories:

89% of Australians pushing to fast-track mortgage

Why more Australians stay put in their first home

Negative equity risk for nearly 7% of Australian mortgage holders

Related stories:

89% of Australians pushing to fast-track mortgage

Why more Australians stay put in their first home

Negative equity risk for nearly 7% of Australian mortgage holders