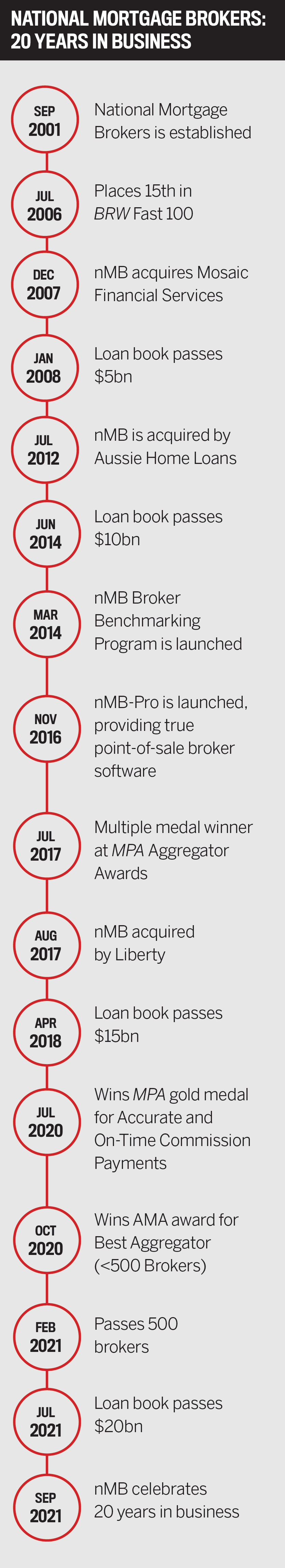

National Mortgage Brokers launched in September 2001, little did managing director Gerald Foley know it would lead to the thriving and respected company that today has 500 brokers on its books.

“In a way, nMB came about through circumstances beyond our control,” says Foley.

“I had started working for the Johnson Taylor Potter stockbroking firm in 2000 to set up a mortgage arm as part of JTP building a multiservice financial group.

Kon Avramidis and Sal Cinque, who I’d worked with previously, soon came across to JTP as we established this new business.”

After about a year, Foley says, the trio had started to build its national broker team when JTP was acquired by then Bell Securities, forming what today is Bell Potter.

“Bell Potter was not interested in continuing the broader financial strategy, so we were faced with heading off in our separate directions or putting in place a management buyout.

“We chose the latter, with the support of two other backers, John Bignell and Rob Emmett, and relaunched as National Mortgage Brokers on 1 September 2001 and moved the model to wholesale aggregation.”

nMB, which won the Australian Mortgage Awards Aggregator of the Year (Under 500 Brokers) award in 2020, has grown steadily over the years with a singular focus – to help brokers grow their businesses.

The company has offices in Melbourne and Sydney and has invested significantly in developing opportunities for its broker network, including lead generation, diversification and training, backed by nMB’s proprietary technology platform.

“Our ability to build and maintain long-term broker relationships has been a highlight,” says Foley.

“Our ability to build and maintain long-term broker relationships has been a highlight,” says Foley.

“I’m also proud that we’ve been able to have change at an ownership level but still maintain our own identity and independence, at the same time giving our brokers greater corporate backing.”

“Having the balance sheet strength of a company that has built its business with the broker market as a focus means that we can continue our growth and support brokers every day with a trusted and proven partner.”

Foley says over time nMB has evolved its broker engagement around the 5 Ps – Planning, Partners, People, Premises and Process.

“Focusing on these covers all aspects of building a great broker business. At each stage we can provide guidance and tools to work with our brokers in these areas.

“We’re all about the broker-to-broker business journey,” Foley says. “Over the years we have focused on working with our brokers as they grow their businesses, providing support and guidance as required. It’s not a one-size-fits-all approach; every business is different and has its own needs.”

Technology and assisting brokers to achieve faster loan turnaround times are also important aspects of nMB’s value proposition.

“Tech is naturally an important part of a broker’s arsenal. Since we started nMB we have built and developed our tech platforms, tapping into market solutions where appropriate. We’re looking forward to a new platform being rolled out during 2022.”

Foley says turnaround times are a regular discussion point in nMB’s supplier engagements.

“I understand that at times some lenders will hit speed humps; however, these often seem to drag on too long. Any disparity between broker and bank direct also needs to be addressed where it occurs.

“We made several changes when BID was implemented to make sure our brokers could manage customer expectations around loan processing times.

“The first was to bring forward questions along the lines of ‘how soon do you need an answer on this loan?’

“Borrowers will usually be prepared to wait for a refinance, especially when there is a cashback involved. Where a lender’s current processing times don’t align with the borrower’s expectation, those lenders will be removed from the selection process.”

Foley says nMB has also moved away from the industry norm of service level agreements, or SLAs.

“We now refer to ‘loan processing times’ – or LPTs – and convert to calendar days, on the basis that a contract of sale is

also based on calendar days, not business [days], so it made sense to align the expectation.”

Despite the difficulties created by the coronavirus pandemic, nMB reached the milestone of 500 brokers in February.

“FY21 was a challenging year on so many levels. The move to meeting online rather than in person was a big change. What we found very quickly, not dissimilar to brokers and their customers, was that meeting online often created far more opportunities and accessibility.

“We introduced over 140 new brokers into our business, through a combination of new businesses and existing brokers growing their teams.”

Loan settlement growth has also been impressive in FY21.

“We closed settlements 35% up year-on-year. There were several factors driving this across owner-occupiers and investors, including upsizers/downsizers, tree/sea changers; first home buyer incentives; refi nance opportunities; and, it seems, many FOMO buyers.”

Foley says the aggregator’s plans for the next 12 months are to keep building its broker numbers through new business partnerships and working with existing brokers to build their teams.

Alex Martin, a director of Melbourne specialist mortgage broking and fi nance consultancy business Premium Lending Group (PLG), has the proud distinction of being nMB’s first broker and is still part of its broker network today.

Alex Martin, a director of Melbourne specialist mortgage broking and fi nance consultancy business Premium Lending Group (PLG), has the proud distinction of being nMB’s first broker and is still part of its broker network today.

“I had worked in banking for many years, including a stint at Westpac Commercial in the ’90s when I met Kon Avramidis, one of the founders of nMB,” says Martin.

“When Kon started out at Johnson Taylor Potter in 2000 and was looking to grow a team of mortgage brokers, it presented a great opportunity to work with him again and within a stockbroking company.”

After Avramidis, Cinque and Foley set up nMB, Martin says “it presented as a great time for me to move into my own broking business”.

“Asset Plus Finance was launched the same day as nMB, and I was very happy to be their first appointed broker.”

In 2014, after a four-year contract providing broking services to The Pharmacy Guild, Martin says he was looking at what the next stage of his business might look like.

“A lot had changed since I started in 2001, and I felt the need to be part of something a little bigger than being just me.”

PLG, founded in 2006 by Michael Umbers, Peter Catramados and Tim Donohue, was aggregating with nMB, and the aggregator suggested Martin have a chat with Umbers as PLG was looking at growth opportunities.

“I knew Mick well through our nMB connection, so we had a discussion. It just fell into place that we could merge our businesses to provide greater capacity to help more clients and share resources and experience.”

Martin says it’s great to have been part of the nMB story since day one.

“The support has always been there, and I have met so many good people along the way. We’ve shared so many important events, including weddings, new family members and, sadly, funerals.”

So, what sets nMB apart in the industry?

“What stands out the most is the commitment to helping us grow and develop our business,” says Martin.

“The support is always there, with all the team available to help out. Our partnership manager, office team.

“If we have questions around loan scenarios, marketing, commission queries or compliance, the team will always take a call and assist. Having that support network is highly valued by us and allows our company to concentrate on continuing business.”

nMB’s communication with brokers is also first-class, says Martin. “Each day we receive a summary of the day’s supplier changes and updates. This makes it easier for me to have one reference point to all the changes that take place through a day or week. As key market events occur, nMB keep us up to speed with any change that impacts on us.” The aggregator is a trusted advocate for brokers in the mortgage fi nance industry.

“nMB and Gerald Foley have been heavily involved in this industry for as long as I can remember,” Martin says. “With the speed of regulatory change, it’s hard for brokers to be across it all. It’s reassuring to know that nMB is reviewing and advising us of the changes we need to consider in managing our ACL [allowance for credit losses] and changing obligations.”

While PLG operates under its own brand and organises its own marketing, nMB provides the brokerage with access to its CRM, content, and third-party relationships that it can use.

“Being part of the nMB Broker Benchmarking Program has been a good way to identify where we can increase our marketing activities and opportunities through analysing our activity levels, loan portfolio and lead sources and identify areas for improvement for our business.”

“Being part of the nMB Broker Benchmarking Program has been a good way to identify where we can increase our marketing activities and opportunities through analysing our activity levels, loan portfolio and lead sources and identify areas for improvement for our business.”

Martin says although all the brokers within nMB run their own businesses, there is a great sense of camaraderie.

“We all enjoy catching up for the PD events – and the afters – and other events on a regular basis. Many of us get together outside of nMB events as well for lunches, and we regularly check in and support each other when needed.

“This support crosses over from business needs to life events where we can help a colleague through a business-related matter or just through a tough time.”

Although it hasn’t been a live event for the past two years due to COVID-19, nMB’s annual national broker conference is a highlight.

“There is an automatic connection with the other nMB brokers from all over the country and a great sense of team.

“PLG has also been recognised in the nMB first 11 for several years now. This is a great opportunity to catch up with a smaller group of high-performing business owners to learn and share best practice.”

Martin encourages new-to-industry brokers to partner with nMB as their aggregator.

“nMB is the right aggregator partner for new and experienced brokers. They have a great, supportive culture and are always able to assist through the various stages of building your business,” he says.

“At the start of your broker journey, the benefi ts of long-term partnerships may not be high on your list of priorities. Trust me, if you’re going to make a success in this industry, this experience and support provided by nMB is invaluable.

“Ultimately it’s up to you to have a red hot go; it’s not easy, but the benefi ts and rewards can be fantastic. Good partnerships and friendships are such an important part of this.”