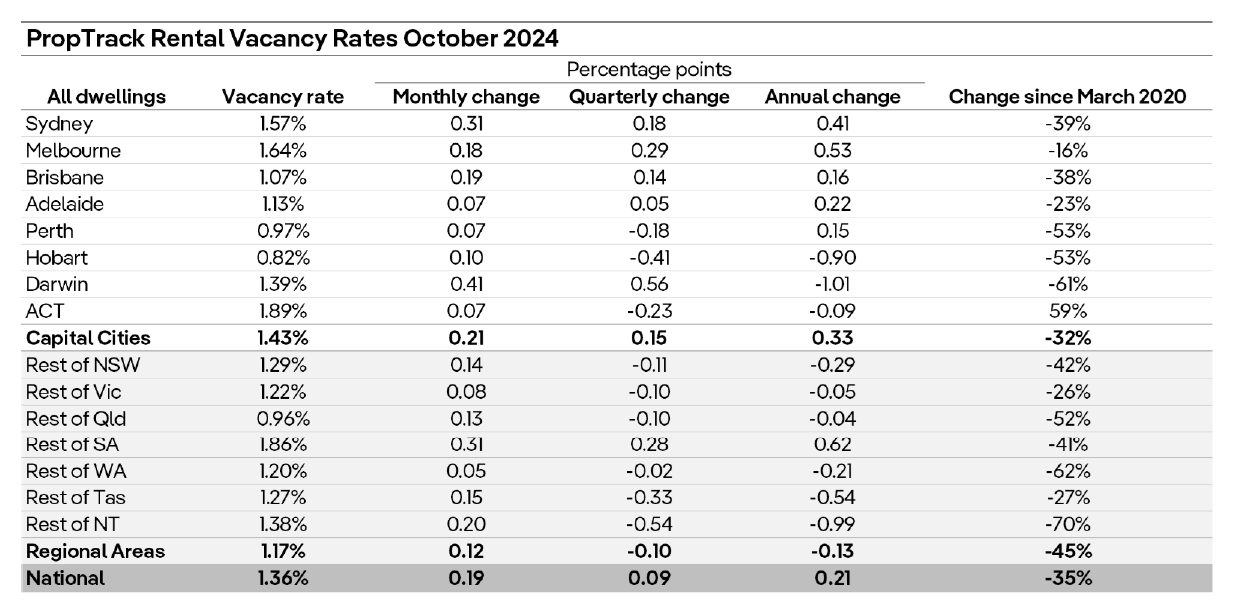

Australia’s national rental vacancy rate climbed to 1.36% in October, its highest level since July 2023, according to a new PropTrack report.

This marked a 0.19 percentage point (ppt) rise, with all capital cities and regional markets experiencing improved rental conditions during the month.

Despite this, Anne Flaherty (pictured above), senior economist at REA Group, noted that rental supply remains far below pre-pandemic levels, with 35% fewer properties available for rent across the nation.

Sydney saw one of the most notable increases in rental vacancies, with its rate jumping 0.31ppt to 1.57%, the second-highest rise nationwide after Darwin, where vacancies surged by 0.41ppt to 1.39%.

Melbourne and Brisbane also experienced significant increases, recording rises of 0.18ppt and 0.19ppt, respectively.

Meanwhile, Adelaide saw only modest improvement, with its vacancy rate sitting at 1.13%, higher than last year’s levels but still tight.

In Perth, increased investor activity has added more rental properties to the market, contributing to a slight improvement in availability. However, the city’s vacancy rate remains among the lowest in the country at 0.97%.

Hobart continues to hold the lowest vacancy rate nationwide, with just 0.82% of rental properties vacant in October, PropTrack reported.

“Rental conditions improved in all capital cities and regional markets over October, with the national vacancy rate now 0.21ppt higher than at the same time last year,” Flaherty said.

While urban areas have seen greater relief, regional markets remain constrained. Over the past year, vacancy rates in capital cities rose 0.33ppt, whereas combined regional areas experienced a 0.13ppt decline.

Flaherty also highlighted the long-term disparity, noting, “Compared to March 2020, there were 45% fewer properties available for rent in Australia’s regional areas compared to a 32% drop in the capital cities.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.