NAB’s chief economist Alan Oster (pictured above) predicts that the Reserve Bank of Australia (RBA) will start cutting interest rates in February as inflation continues to ease and wage growth stabilises.

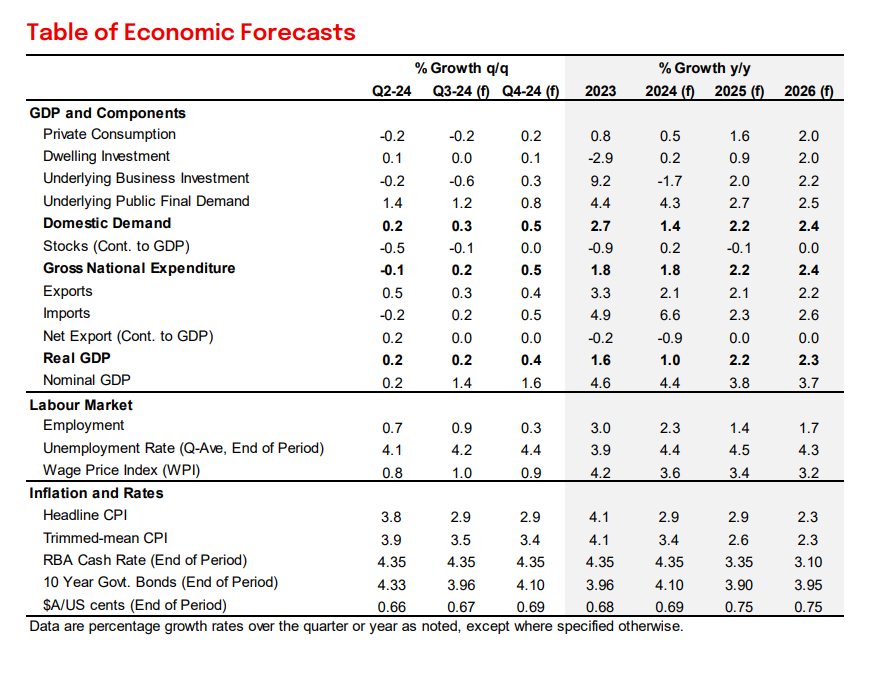

NAB anticipates the first reduction will be 25 basis points, initiating a gradual shift toward a cash rate of 3% by early 2026.

Oster explained that recent inflation and labour market data point toward a more balanced economy, opening the door for rate cuts.

“We expect the RBA’s next move will be down, with the first rate cut likely in February,” he said. “The inflation backdrop is cooling, and the risks are shifting toward easing real income pressures for households.”

Australia’s inflation rate fell to 2.7% year-on-year in August, with subsidies on electricity costs easing pressure on consumer prices.

Oster forecasts that inflation will gradually decline toward the middle of RBA’s 2-3% target band by 2025. He noted that core inflation is expected to stabilise at around 3.4% by the end of 2024.

“Our outlook suggests inflation will be on a downward path, allowing RBA to pivot toward an easing cycle,” Oster said.

RBA’s policy shift will also reflect slower wage growth and improving household incomes, it was suggested.

Wage increases, which peaked earlier in 2024, are expected to stabilise between 3-3.5%, giving the RBA room to cut rates without reigniting inflation.

Oster anticipates that tax cuts and energy subsidies will also support consumption, further reducing inflationary pressures.

Although NAB expects the RBA to begin cutting rates in early 2025, the bank is unlikely to move aggressively.

Oster stressed that the RBA will prioritise a “soft landing” for the economy, balancing inflation control with employment gains.

“RBA’s focus is on managing inflation sustainably while maintaining recent gains in the labour market,” Oster said. The NAB economist added that global factors, such as China’s economic slowdown, could also influence the pace of rate cuts.

NAB’s forecast aligns with its expectation of steady economic growth and a gradual recovery in consumer spending by mid-2025.

“This approach implies a later and slower pace of cuts than in other advanced economies, reflecting the RBA’s more measured starting point,” Oster said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.