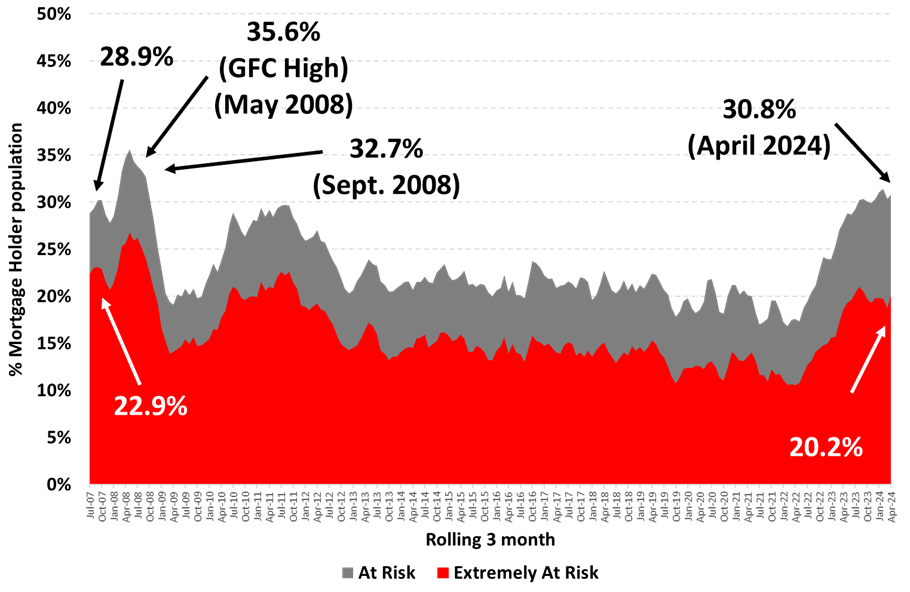

New research from Roy Morgan showed that 30.8% of mortgage holders, approximately 1,560,000 people, were considered “at risk” of mortgage stress in April, a 0.5% increase from March.

This rise still falls below the peak levels seen earlier in the year.

“The pause in rate increases for the last six months since November 2023 has reduced the pressure on mortgage holders,” said Michele Levine (pictured above), CEO of Roy Morgan. Rising household incomes have helped mitigate mortgage stress.

Meanwhile, the number of mortgage holders considered “extremely at risk” has reached 994,000 (20.2% of mortgage holders), significantly above the 10-year long-term average of 14.4%, Roy Morgan reported.

See LinkedIn post here.

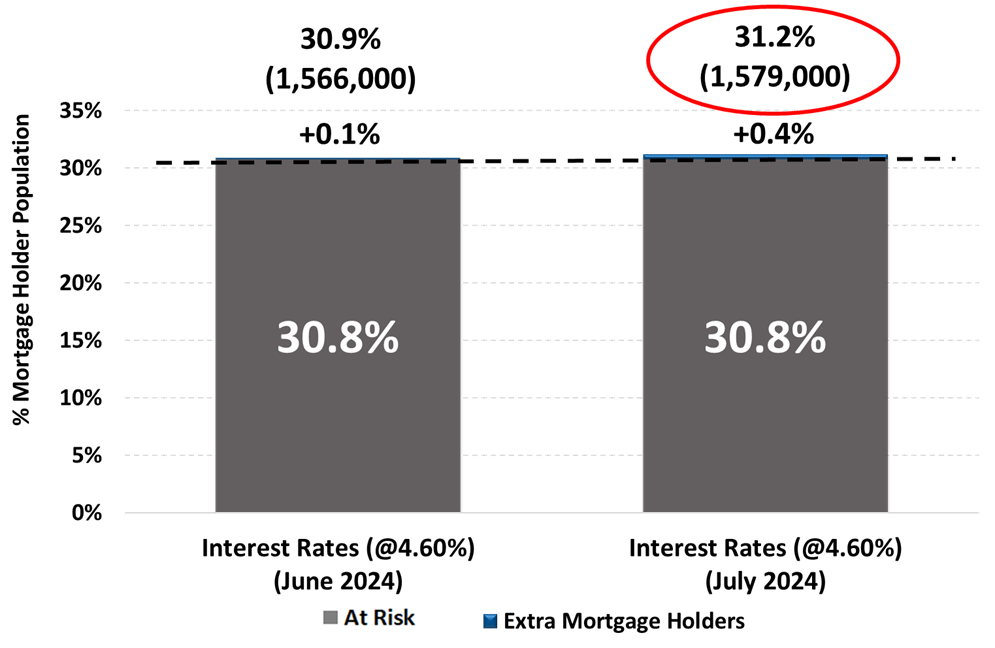

If the RBA raises interest rates by 0.25% in June, Roy Morgan forecasts an increase to 1.58 million mortgage holders considered “at risk.”

“Mortgage stress is influenced significantly by household income, directly related to employment,” Levine said.

The employment market has been exceptionally strong over the past year, with Roy Morgan's latest estimates showing 418,000 new jobs created. This has underpinned rising household incomes, helping to moderate increases in mortgage stress since mid-2023.

The April figures showed an increase of 753,000 mortgage holders considered “at risk” since the RBA began raising interest rates in May 2022. This period includes 13 rate hikes, totalling an increase of 4.25 percentage points to 4.35%.

Despite recent increases, the current level of mortgage stress is well below the record high of 35.6% during the Global Financial Crisis. The ongoing challenges reflect a complex interplay of interest rates, inflation, and employment factors.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.