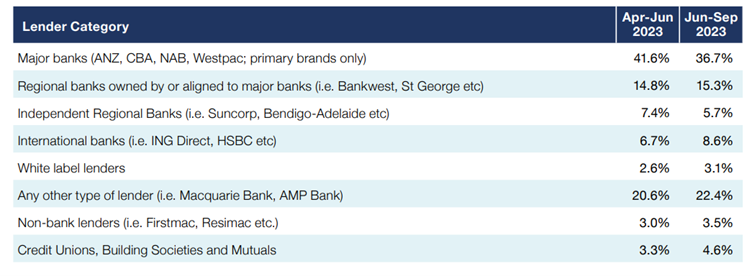

Mortgage brokers are abandoning Australia's big four banks in favour of a broader range of lenders, according to the latest MFAA Industry Intelligence Survey (IIS), with only 36.7% of broker-originated loans coming through the major banks.

The findings mark the first time the market share of the major banks fell below 40% for the period since the measure has been tracked by the survey.

Featuring data for the April 30 – September 30 2023 period, the report provides insights on the mortgage and finance broking industry including the size of the mortgage broker population, the value of loans settled and lender segment market share.

MFAA CEO Anja Pannek (pictured above) said that despite the period covered in the report being one marked by continued high refinancing levels and borrower concern about interest rates, mortgage broker activity remained strong.

“Our industry is growing, with more mortgage brokers than ever before, and positive shifts recorded across a number of aspects of the industry during the period covered in the report,” she said.

“The choice and competition mortgage brokers have brought to the home lending market to the benefit of consumers shines through in this data.”

The midway period in 2023 marked a frenetic time in the market for mortgage brokers.

The major banks had begun to pull back from the mortgage wars – a period that saw increased cashback offers, razor thin margins, and channel conflict.

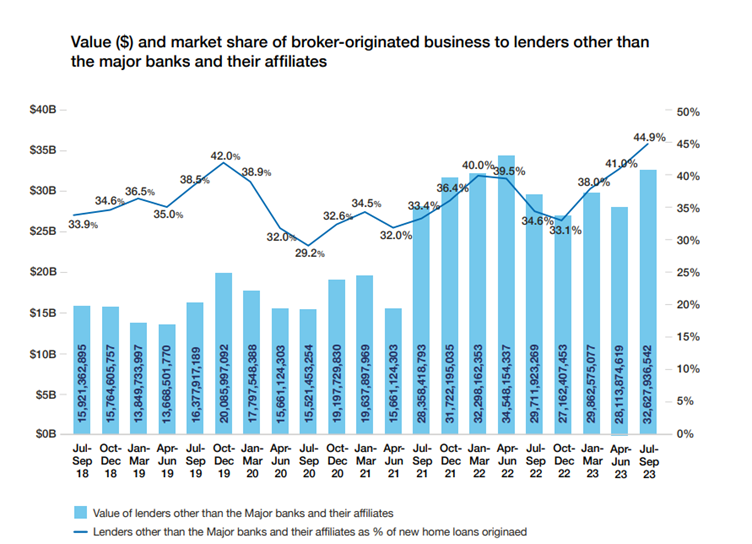

Through these tactics, the major banks and their affiliates began to clawback market share in 2022, writing over two-thirds (66.9%) of the new home loans originated in the final quarter of the year.

But as credit got tighter and net interest margins eroded, brokers increasingly sought out loans through a wider range of lenders.

With home loans increasingly coming through the broker channel, the major banks began to lose their market share.

Commonwealth Bank’s home loan books even went on an unprecedented three-month decrease during this period.

By the July-September quarter of 2023, only 55.1% of loans were written through major banks and their affiliates.

Pannek said the result indicates that borrowers are more confident to go through lenders outside the big four to secure a loan that meets their needs.

"There are over 100 lenders in the market today, and it is because of brokers that Australian homebuyers have access to a wide range of lenders. It is also clear that this choice is a valued and important part of the market."

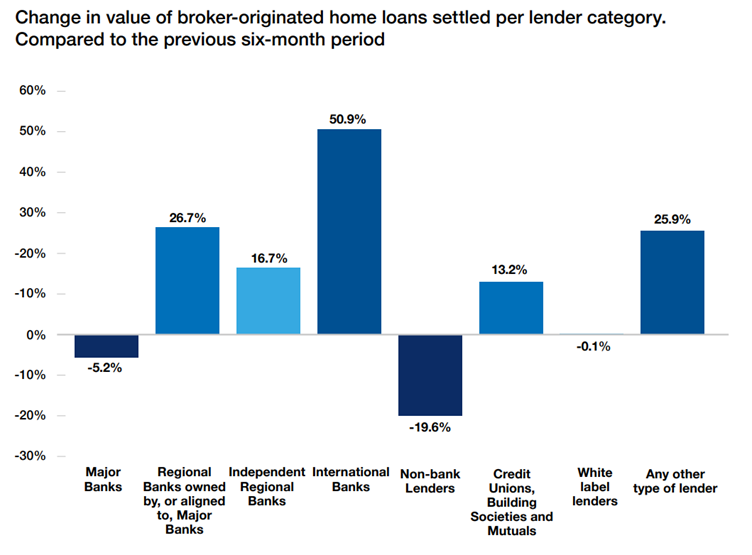

While the major banks experienced decline, other segments experienced growth.

Regional banks aligned to the majors increased their market share by 0.5 percentage points over the same period from 14.8% to 15.3%.

Lending with other types of lenders grew 1.8% points, international banks grew 1.9 percentage points and the credit unions, building societies and mutuals segment grew 1.3 percentage points.

Interestingly, non-banks lenders recorded the greatest decline at -19.6%, followed by the major banks at -5.2%. White label loans also recorded a slight fall of -0.1%.

The international banks, regionals owned by the majors and other types of lender segments all recorded double-digit gains of 50.9%, 26.7%, and 25.9% respectively.

Settlement values for mortgage broker originated home loans surpassed $300 billion for a 12-month period for the second time, at $350.63 billion to September 2023.

The mortgage broker population grew 3.3% year-on-year to 19,872. Seven out of ten home loans were written by brokers during the six-month period with the September 2023 quarter recording a 71.5% market share.

However, the conversion rate of home loan applications to settlements has seen a decline, indicating that serviceability challenges are taking a toll on prospective homebuyers seeking finance.

“While overall home loan applications are up across most of the country, we hear consistently from our members that serviceability has been a challenge for their clients as they adjust to current interest rate levels," Pannek explained.

Conversion rates recorded a second consecutive six-month period of decline, experiencing a 9.2 percentage point dip year-on-year and falling below 80% for the first time since 2021.

"The downward shift in conversion rates highlights this it's harder to get deals through, with much more work required on the part of mortgage brokers to find the right solution for their clients,” Pannek said.

The report also covers the extent of commercial lending facilitated by mortgage brokers.

While the number of mortgage brokers who also settled commercial loans during the period declined, the value of those loans reached a record high at $17.29 billion.

The IIS report draws on data supplied by the industry’s leading aggregator brands to provide mortgage broker, industry performance and demographic data.

The IIS was first published in 2015; this is the 17th edition.