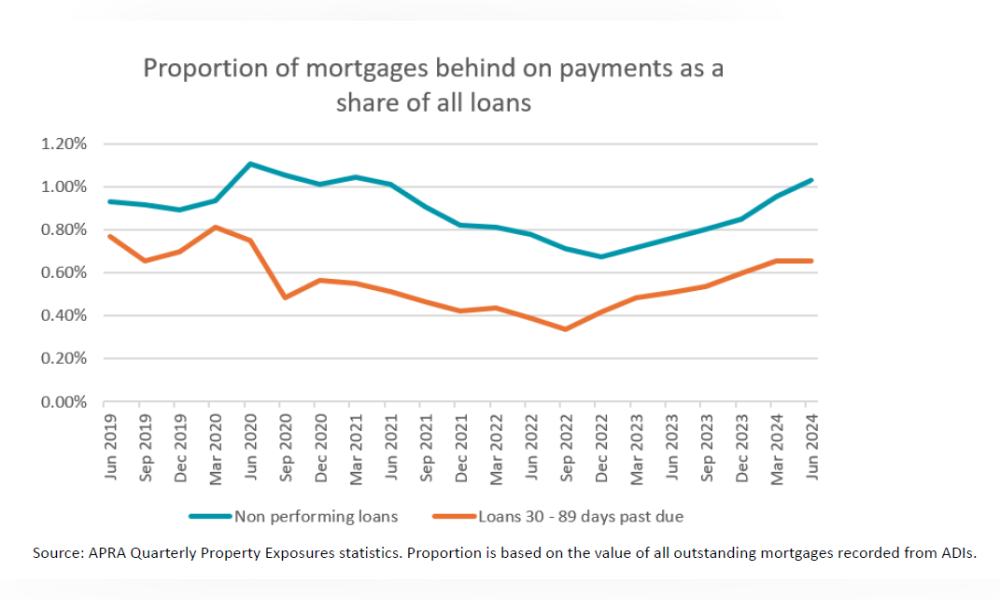

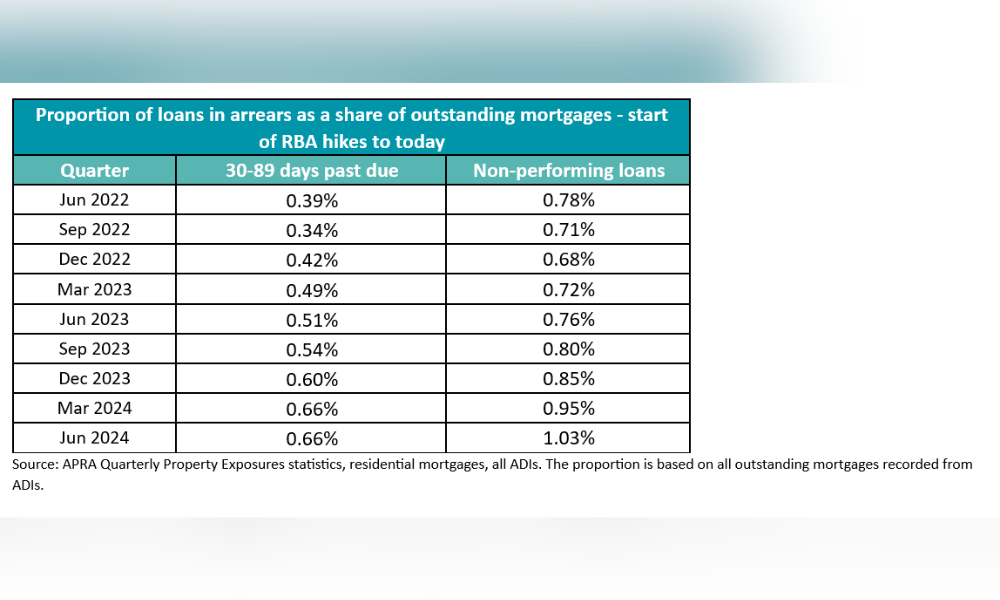

Mortgage arrears in Australia have risen for the sixth consecutive quarter, with non-performing home loans now valued at $23.37 billion, according to APRA’s latest data.

This figure represents 1.03% of all mortgages, a steady increase from pre-COVID levels.

“It’s concerning but by no means surprising to see the total value of mortgages in arrears continuing to climb,” said Canstar data insights director Sally Tindall (pictured above).

Owner-occupiers are over-represented in the arrears data, with non-performing owner-occupier loans making up 1.07% of total owner-occupier loans, compared to 0.86% for investor loans.

Tindall noted that owner-occupiers face more difficulty than investors in navigating arrears, as they can’t rely on rental income or easily sell their home without significant disruption.

Offset account balances saw a sharp $6.14 billion drop in the June quarter, marking the first quarterly decline in a year.

However, Tindall expects the balances to rebound in the September quarter, as Australians deposit savings from tax cuts and energy bill relief into their offset accounts.

“Australians might have raided their offset accounts, but we expect the amount to bounce back,” Tindall said.

Low deposit loans, with an LVR of 80% or more, have become more popular, making up 31.9% of all loans settled in the June quarter, up from 28.7% in the previous year. However, this is still well below the peak of 42% in late 2020, when record-low rates made borrowing easier.

Refinancers locked in mortgage prison due to failing the standard stress test are benefiting from exceptions made by banks.

A total of $7.55 billion in new mortgages were processed under these exceptions in the June quarter, a significant 82% increase from last year.

“It’s fantastic to see borrowers breaking free of mortgage prison and moving to lenders offering lower rates,” Tindall said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.