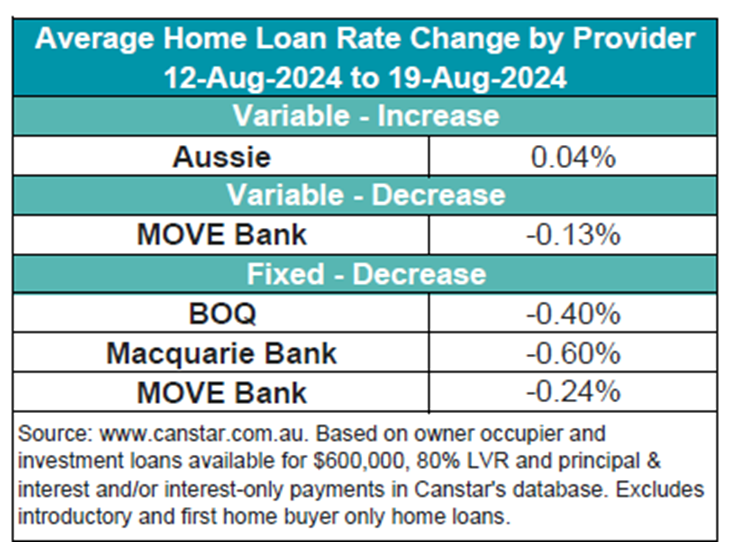

This week saw limited movement in the mortgage market, with only a few lenders adjusting rates, Canstar reported.

Aussie increased two owner-occupier and investor variable rates by an average of 0.04%, while MOVE Bank cut six variable rates by an average of 0.13%. Additionally, three lenders slashed 88 owner-occupier and fixed rates by an average of 0.45%.

The lowest variable rate, at 5.75%, is offered by Arab Bank Australia.

Canstar’s database now shows 19 rates below this threshold, a slight increase in recent weeks. Among the lenders offering competitive rates are Australia Mutual Bank, Bank Australia, BOQ, and Horizon Bank.

“There were minimal rate changes across the mortgage market this week as lenders continued to employ the same ‘wait-and-see’ approach the RBA has held since November of last year,” said Sally Tindall (pictured above), Canstar’s data insights director.

While fixed rates are often the lowest advertised, Tindall noted that they’re not drawing much interest.

“They are unlikely to be getting many nibbles... despite Governor Bullock’s insistence rate cuts are off the table in the ‘near term,’” she said.

Tindall encouraged mortgage holders to take matters into their own hands. For mortgage brokers, this highlights an opportunity to assist clients in exploring refinancing options and negotiating better rates.

“Negotiating with your current lender is an easy option, and one that’s well worth undertaking... After all, a phone call or two isn’t exactly a big commitment,” Tindall said.

She also emphasised the benefits of refinancing, with 29 lenders offering variable rates under 6%, the lowest being 5.75% from Arab Bank.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.