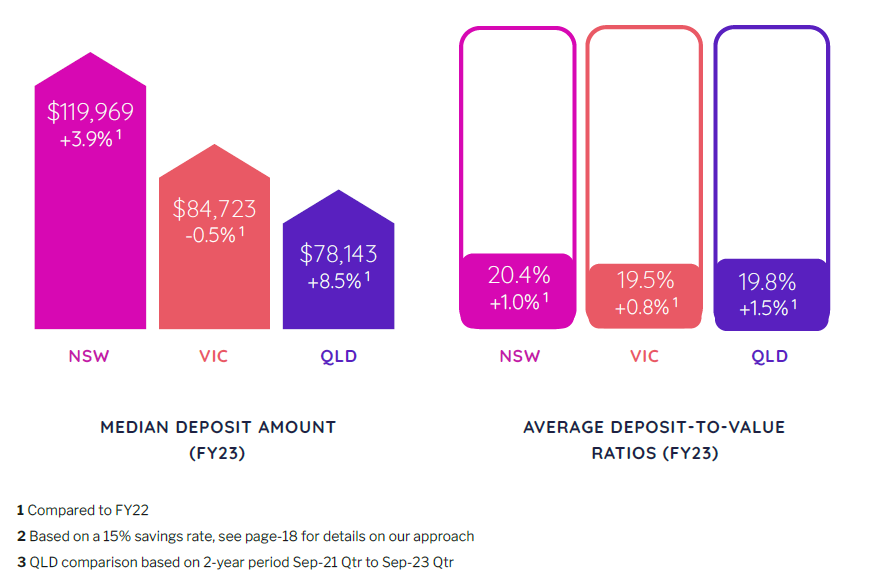

Median deposits in New South Wales surged in FY23, reaching just under $120K, a 3.9% increase from FY22, outpacing Victoria ($84,723, -0.5%), and Queensland ($78,143, +8.5%), according to a new PEXA report.

The PEXA Buyer Deposits Report for November, which explored the deposits used by home buyers in Australia’s three largest states, also showed that average deposit-to-value ratios (DVRs) rose to around 20% across the eastern states as lenders tightened credit standards.

In NSW, buyers contributed 20.4% of the property value as a deposit (+1% on FY22), while VIC and QLD recorded DVRs of 19.5% (+0.8%) and 19.8% (+1.5%), respectively.

“As property prices have increased across the country, the deposits required by buyers have risen proportionally. This has impacted housing affordability, particularly for certain cohorts of buyers, such as first-home buyers,” said Mike Gill (pictured above), PEXA head of research.

Gill said PEXA defined deposits as “all the funds contributed by buyers to settle their property purchase, including any initial cash deposits provided at time of sale, as well as any other cash funds added prior to settlement.”

PEXA estimated that NSW buyers will take nearly eight years to save the median deposit, an 83.2% rise in the past three years. Victoria and Queensland buyers are estimated to take just over five years and just under five years, respectively, with time to save increasing by 64.2% and 36.9% in the past three and two years.

More than half of home buyers in the eastern states required lenders mortgage insurance (LMI) to purchase a residential property in the 2023 financial year, with average LVR around 80% for news loans, PEXA reported.

Average LVRs for new loans across the eastern states hovered around 80% in FY23, with specific figures varying slightly: 79.6% in NSW, 80.5% in Victoria, and 80.2% in Queensland. All states witnessed a decline in average LVRs since FY22, with Queensland experiencing the biggest drop at 1.5%.

Major banks averaged higher LVRs than non-major lenders, recording 81.2% in NSW, 81.9% in VIC, and 81.9% in QLD in FY23. Despite a year-on-year decline ranging from 1.2% to 1.6%, major banks’ LVRs remained higher than non-majors, which ranged between 76.2% and 77.6%.

Victoria had the highest percentage of new borrowers requiring LMI in FY23 at 56.5%. The higher average LVRs of major banks led to a greater proportion of their customers requiring LMI, particularly in VIC, where 63.9% of major bank customers had an LVR higher than 80%.

Visit the PEXA website to read the full report.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.