Marcus Price, CEO of PEXA, is spearheading the property industry’s transition from paper to digital settlements, a move that has challenged practitioners and lenders to adapt. He talks about being at the frontier of digital disruption and how brokers are going to fit into PEXA’s widening ecosystem

Throughout Marcus Price’s career, technology and change have been recurring themes, from starting three of his own technology companies to working at

NAB.

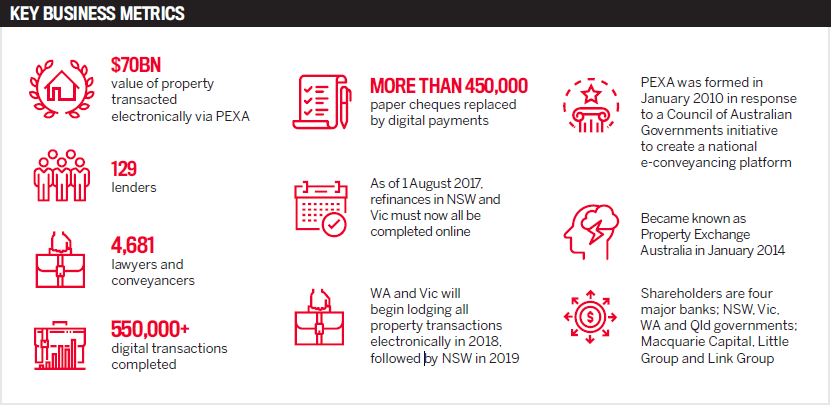

Those experiences, as well as his psychology degree and personal study of history, have served him well as the CEO of Property Exchange Australia (PEXA), where he is leading the $7.2trn residential property market and those who work in it into entirely new territory, digitising the settlement process to do away with lost cheques, postal problems and stressful in-person settlements.

Modernising property settlements isn’t just about implementing new technology and hoping everyone jumps aboard. It’s about building people’s trust in the unknown and reshaping how they think and approach the settlement process.

“E-conveyancing was not a technology problem; it was a people and business problem. There’s nothing particularly earth-shattering about the technology we’re using here; it’s pretty straightforward stuff,” he says. “It’s about changing behaviours and changing processes, so I think a science degree in psychology was entirely the appropriate qualification,” he says.

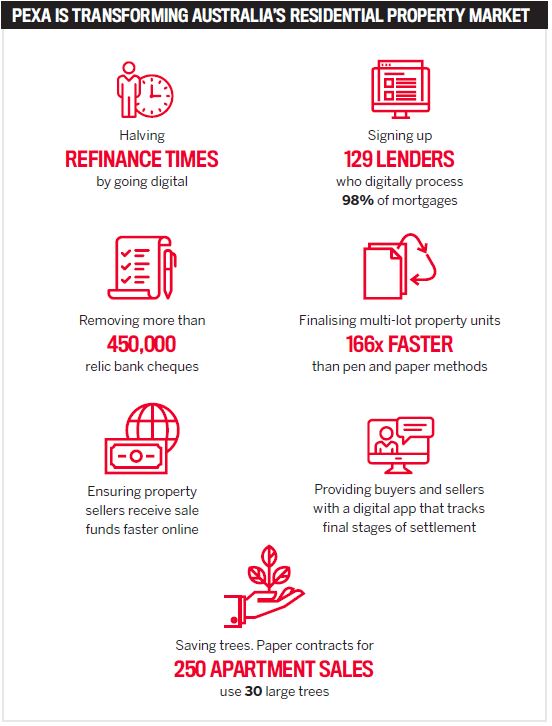

So far Price and the PEXA team have been incredibly successful in getting nearly 5,000 conveyancers and lawyers as well as 129 lenders to shelve their familiar paper processes. More than 550,000 digital transactions worth almost $70bn have been transacted through PEXA’s online platform since 2013. But Price’s work is not done yet.

“Embrace the change and be part of it. Make sure that the industry we get at the end of this is the one you want to be part of” Marcus Price, PEXA

“I think people underestimate the impact of the change at this stage. It’s going to be quite significant and it’s going to take a little while; it’s one of those things that’s going to creep up on you,” he says.

There’s a “quiet revolution” going on in the end-to-end digitisation of the mortgage and lending processes, and Price sees brokers as being part of it.

While brokers aren’t registered to be included in the PEXA workspace, they can reap some immediate benefits from seeing their clients through a better, faster and cheaper settlement process.

Price says settlement times for refinances, which as of 1 August must now be lodged electronically in Victoria and NSW, have dropped by about half through PEXA, and that could be reduced even further. That ease and speed of refinancing will be a boon for brokers and their clients when interest rates inevitably rise and people are stressed financially.

Price also expects conveyancing fees to reduce over time, although the market sets its own rates. PEXA has a flat fee for service structure, which members are charged on successful transactions.

“We can offer complete transparency of the settlement process, which is one of the big frustrations for mortgage brokers. They can get the business, but of course they can’t really offer their client the certainty of when settlement is going to happen,” he says.

That will change, likely in the next six to 12 months, with the development of applications by banks and other parties that will link into the PEXA workspace, providing brokers and their clients with a way to view and track the progress of settlement, similar to how one can track an online shopping parcel in real time from warehouse to doorstep. PEXA already has an app that does this, called SettleMe, which is available to lawyers, conveyancers and their clients.

Giving brokers this sort of access will offer them more certainty and clarity in regard to settlement, and it will cut out some of the phone tag between banks and brokers, he says.

Once brokers see how convenient it is, Price believes they’ll start advocating for their clients to settle their property through a PEXA practitioner because of how much more reliable and less error-prone it is.

“What [brokers] should do is start insisting on being part of that ecosystem of innovation, because they have a real role to play, in particular, in the customer experience part of it, which is really what the brokers are all about,” he says. “They really should demand, and will get, tools to give to their customers and tools to make that customer experience much better and more efficient.”

One of those brokers eager to be part of the ecosystem is Marshall Condon, CEO of Melbourne-based brokerage Neue Black.

“That process of manually going to settlement with cheques and you’re 10 cents out is archaic at best. In the age that we’re in and with what we can do with technology, it makes sense that we bring it all online. But for us, we would love to be able to get access to PEXA so we can still keep involved with that process and make sure that the actual process is followed,” Condon says.

As it stands right now, brokers have to call lenders and lawyers, and they have to call one another, just to find out what’s going on. “If we could be involved in the process and view the file moving forward, it’s a better outcome for everyone,” he says.

A broker’s job isn’t done once they have the loan documents back, Condon says. “Our job is done when the loan settles, and that last part is a critical part … if you don’t get that right, your whole experience of the whole loan goes down the drain.

“We want to make sure it’s the best experience it possibly can be,” he adds.

Some banks have already started responding. Brett Walker, Suncorp home lending manager, said the non-major’s next priority is improving its tracking transparency to give brokers a real-time view of the status of their clients’ applications.

“We’ve got a sophisticated status tracking and workflow system internally; however, we know this is not fully transparent to brokers due to some technical limitations on messaging,” Walker says, adding that this will be improved throughout FY18.

Suncorp wants to enhance this sort of self-service capability so brokers and customers can get a “snapshot view”, which will improve transparency, he says.

Adopting change

Adopting change

It doesn’t matter what kind of technological change society is facing – steam trains, electricity, internal combustion engines or plastics – inevitably, humans will adopt the most efficient tool available, and that’s no different now with digital disruption. It’s more efficient to exchange information digitally, which is why the industry is phasing out paper.

While brokers and banks have been supportive and eager to join this revolution, there are still some conveyancing practitioners who are afraid to let go of what they know, Price says. That, or they are such small operators they don’t feel they have the resources or time to change on their own.

Price is not pushy about getting people to adopt PEXA. He has empathy for those who have been doing settlements the paper way for 30 years – using a system that’s been around for a century and a half – and he understands how hard it is to relinquish that control. That’s why he says it’s about balancing how much change people can absorb, providing them with the necessary tools and education, and having the infrastructure in place to support them through the conversion.

“It’s a huge leap of faith and I never underestimate what it takes,” he says.

Price says he’s proud of the industry for making this shift, and he values the trust it has in PEXA. While Price has made a point of helping practitioners through this transition, he doesn’t actually have to convince anyone to adopt PEXA, because state governments will be making it mandatory.

In Western Australia, all property transactions will be lodged electronically from 1 May 2018, followed by Victoria in October and NSW in June 2019.

The industry has to move in one direction together in order for the system to work, or one person working in paper could hold back the rest. Eventually there has to be a sunset clause on the old technology, he says. “You do need to shut the door on paper.”

“E-conveyancing was not a technology problem; it was a people and business problem” Marcus Price, PEXA

All in it together

“We are not doing this to the industry; we are doing this for the industry. This is not our network; it’s the industry’s network. You don’t join PEXA to become a customer of PEXA; you join PEXA because you want to communicate with someone else,” Price says.

PEXA is similar to Facebook in that way, he says. It’s a collaborative network business that only works if everyone believes in it and everyone is part of it. So far, he’s seen “unprecedented collaboration”, firstly between the state governments and banks who initially joined forces to seed PEXA’s growth, and now online, between practitioners helping each other through transactions and banks providing useful hints and responding to commentary, replacing the old us versus them mentality.

In the future, Price sees PEXA’s “ecosystem” widening, further cementing itself as a cornerstone of the property industry’s infrastructure, with applications providing brokers, real estate agents, and possibly even removalists and utility companies, with better access to the settlement process.

“You can’t assume the world is going to stay the way it is. There’s going to be a lot of change the next couple of years,” Price says. “Embrace the change and be part of it. Make sure that the industry we get at the end of this is the one you want to be part of.”

.JPG)

Adopting change

Adopting change