This week, Canstar’s rate wrap-up revealed ongoing adjustments in home loan rates as lenders compete for borrowers.

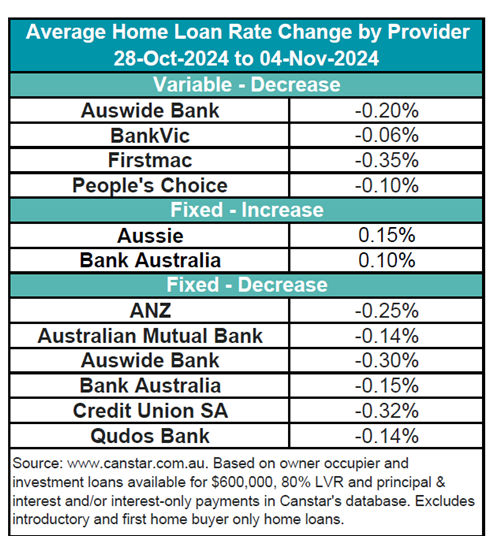

Four lenders have cut 17 variable rates for owner-occupier and investor loans by an average of 0.22%, while two lenders raised 32 fixed rates by 0.12% on average.

Additionally, six lenders reduced 76 fixed rates by an average of 0.24%, offering new opportunities for borrowers looking for relief amid high rates.

According to Canstar, the average variable rate for owner-occupiers paying principal and interest is currently 6.83%, with the lowest variable rate sitting at 5.75%, offered by Abal Banking.

In total, Canstar’s database lists 218 rates below this threshold, providing options for those considering refinancing.

Sally Tindall (pictured above), Canstar data insights director, observed a busy month of rate adjustments.

“A total of 30 lenders cut at least one fixed rate in October, while just seven raised rates,” Tindall said, noting that this activity underscores the competitive nature of the current lending environment.

On variable rates, she added, “Seventeen lenders made cuts in October, and only two increased them, showing that competition among banks is still alive.”

Despite a decline in refinancing from its 2023 peak, nearly 30,000 home loans are being refinanced each month in 2024, according to the ABS lending indicators. This trend reflects borrowers’ continued search for better rates.

“Since the cash rate hikes began in May 2022, nearly one million home loans have been refinanced,” Tindall said, adding that high interest rates have kept many homeowners “stuck in mortgage prison” while others benefit from competitive rate options.

With 34 lenders offering at least one variable rate below 6% for owner-occupiers, Tindall advised borrowers to shop around.

“Customers don’t necessarily have to bring a giant wad of equity to qualify for these rates,” she said, suggesting that loyal customers who haven’t explored other options may be missing out on potential savings.

The current market landscape presents valuable opportunities for proactive borrowers to secure better rates, as competition among lenders shows no signs of slowing.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.