After saving its 930,000 customers an estimated $70m since September, the last of the big four banks has confirmed it is to increase rates this month.

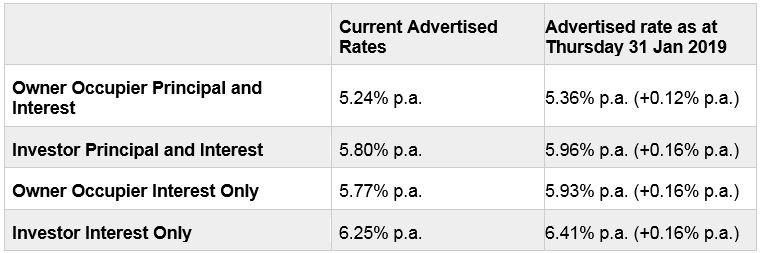

Owner occupiers with P&I home loans will see rates increase by 0.12%, while investors and interest only borrowers will face a rise of 0.16%. Both rates are effective from 31 January.

NAB’s chief customer officer for consumer banking, Mike Baird said, “We have been deliberate in our approach to limit the impact on owner occupier borrowers by keeping their rates as low as possible to encourage both new and existing customers to pay down their loan sooner.

“We are focused on rewarding our loyal customers including engaging with our home loan customers with our check in program,” he added.

Westpac became the first of the big four to increase rates back in August. All its variable rates increased by 14 basis points as of 19 September, for both new and existing customers.

It was followed by ANZ, which increased rates on home and residential investment loans by 0.16%pa, effective from 27 September. The following week CBA hiked its rates by 15 basis points effective from 4 October.

Shortly after these announcements, NAB made a public pledge to support its mortgage customers by keeping rates on hold.

Baird added, “Our decision to hold our Standard Variable Rate since September last year, the only major Australian bank to do so, has led to around $70 million remaining in the households of more than 930,000 NAB customers.

“We wanted to reward our existing customers for their loyalty and held off as long as we could despite being subject to the same increasing wholesale funding costs and market pressures as other major lenders,” he added.