Investor home loans in Australia are on the rise, as first-time buyers target lesser-known towns for affordable property investments, according to Ruggable Australia.

With capital cities becoming less accessible, many are opting for smaller towns, renovating properties to increase value.

Ruggable Australia’s analysis showed that towns like Point Nepean lead the way, spending 20 times the national average on home renovations.

“Point Nepean’s residents have significantly surpassed the average, increasing it by 1901.51%, nearly 20 times higher,” the report said.

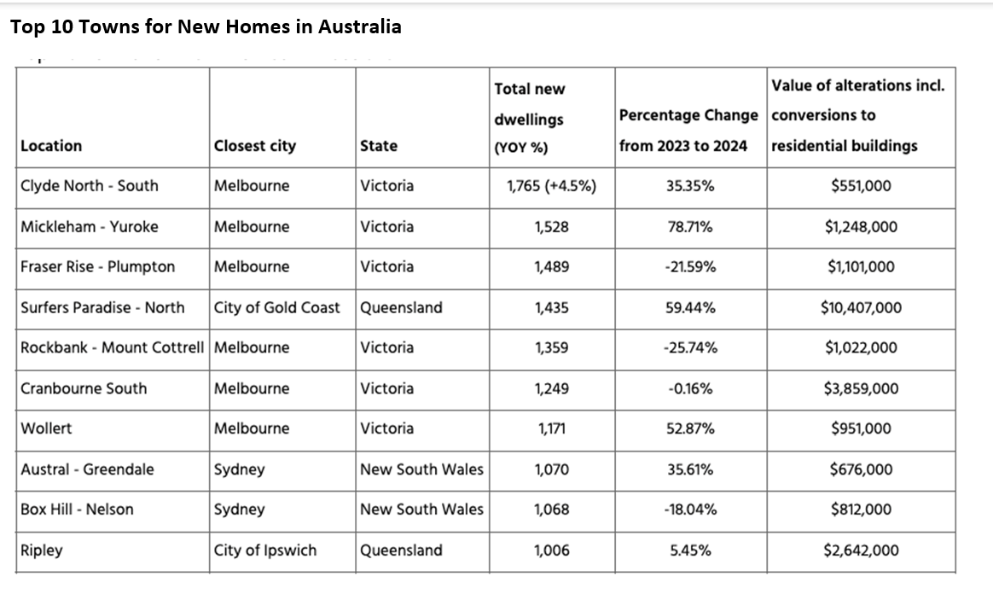

Ruggable’s data also revealed that Clyde North (South) in Melbourne ranks first in new residential developments, with 1,765 new houses built over the past year.

Mickleham-Yuroke follows closely, experiencing a 78.71% year-over-year increase in new dwellings.

This highlighted the growing popularity of Melbourne’s suburbs for new housing developments, as buyers seek more value for their money.

Victoria is leading the way in home alterations and additions, with an average investment of $3.59 million, followed by New South Wales at $3.57m.

This trend is driven by investors seeking to flip houses and maximise returns outside of expensive capital cities, Ruggable Australia reported.

The rise in investor home loans, paired with a boom in renovations and new dwelling approvals in smaller towns, underscores a shift in Australia’s housing market.

As buyers move away from capital cities, these regional areas are becoming hotspots for property investment and development.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.