By

Interest rates are rising, but it’s the banks rather than the RBA that have moved first. Tom Uhlich of Boss Money looks at what’s driving the change – and at the implications for the property market.

We haven’t seen it in years. The RBA has not raised interest rates for more than 130 months. But we all knew it had to come at some point. It seems that time has come.

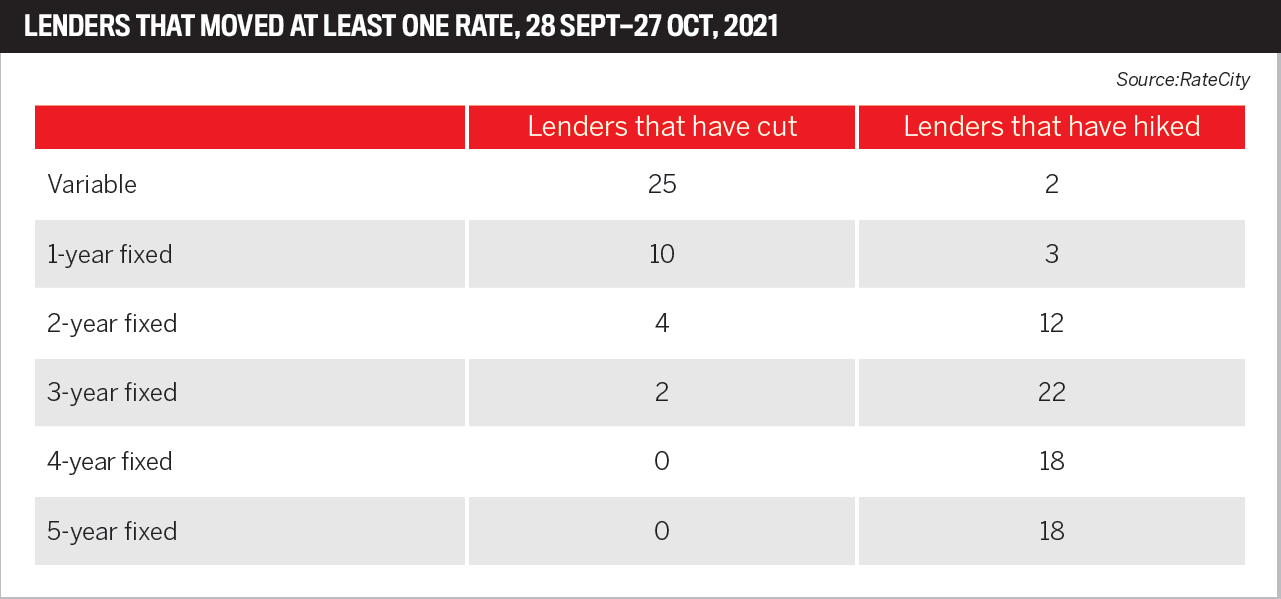

We have seen the biggest movement in interest rates for a long time, but it’s not due to the RBA. Banks are taking action and increasing their interest rates.

Managing director and founder of Finsure, John Kolenda, explained.

There’s an inverse relationship between interest rates and inflation; if one rises the other has to fall. The RBA has flagged no interest rate rises until 2024. The only reason for an earlier rise would be to seize rising inflation and drop it back to where it needs to be.

Kolenda believes there is pressure on inflation. We have seen this in the increasing cost of goods and services throughout the COVID pandemic.

This could mean the RBA is forced to review interest rates earlier than planned.

Other indicators of inflation are bond prices and the price of money. The RBA has used bonds and funding terms to support the economy throughout COVID, with a lot of success. As it reduces the support, this can lead to inflationary pressure.

Banks borrow from overseas and could be paying a higher rate. This, and rebounding economies, also builds inflationary pressure.

As the cost of money and borrowing rises, banks will increase rates to compensate.

Inflationary pressure is high in the US and New Zealand as these economies rebound from COVID. The same is expected in Australia soon.

Cashed-up customers are coming out of lockdown ready to spend. Confidence is increasing, as is the cost of goods and services. Pressure to increase wages is expected as businesses struggle to find staff. All of these pressures will lead to increasing inflation and the banks needing to raise interest rates to claw back costs. Westpac and CBA moved first; it’s expected that other banks will follow shortly.

Cashed-up buyers coming out of lockdown want to buy new homes. It’s not just the weather that’s heating up; the real estate market is too. While it’s a great boost if your nest egg is in your home and you are looking to cash out and downsize, it’s not all good news. Skyrocketing prices put pressure on affordability and the cost of living; together with inflation, it’s a recipe for disaster.

To reduce the impacts of skyrocketing house prices and inflation risks, APRA has recently made some changes to mortgage lending, because it’s concerned about people borrowing more than they can service when interest rates are likely to go up. APRA has increased the interest rate buffer that banks must apply to loans at application stage from 2.5% to 3%. This means borrowing capacity is reduced.

This buffer rate rise does not affect an existing mortgage, and the interest rate won’t change. What will change is how the bank, during the application process, views a borrower’s ability to service a loan.

It also won’t affect the customer if they are not borrowing at their maximum capacity. The biggest impact will be on investors who are more likely to be borrowing closer to their limit than owner-occupiers.

Given only a small percentage of customers borrow at capacity (CBA reports 8%), sellers can still expect high property demand.

At Boss Money, we have found that clients who borrow close to their margins need to reduce their purchase price expectations, but this is, once again, a small number of clients.

Contact Boss Money on 0476 111 000 or [email protected].

Tom Uhlich

Director and senior mortgage broker, Boss Money