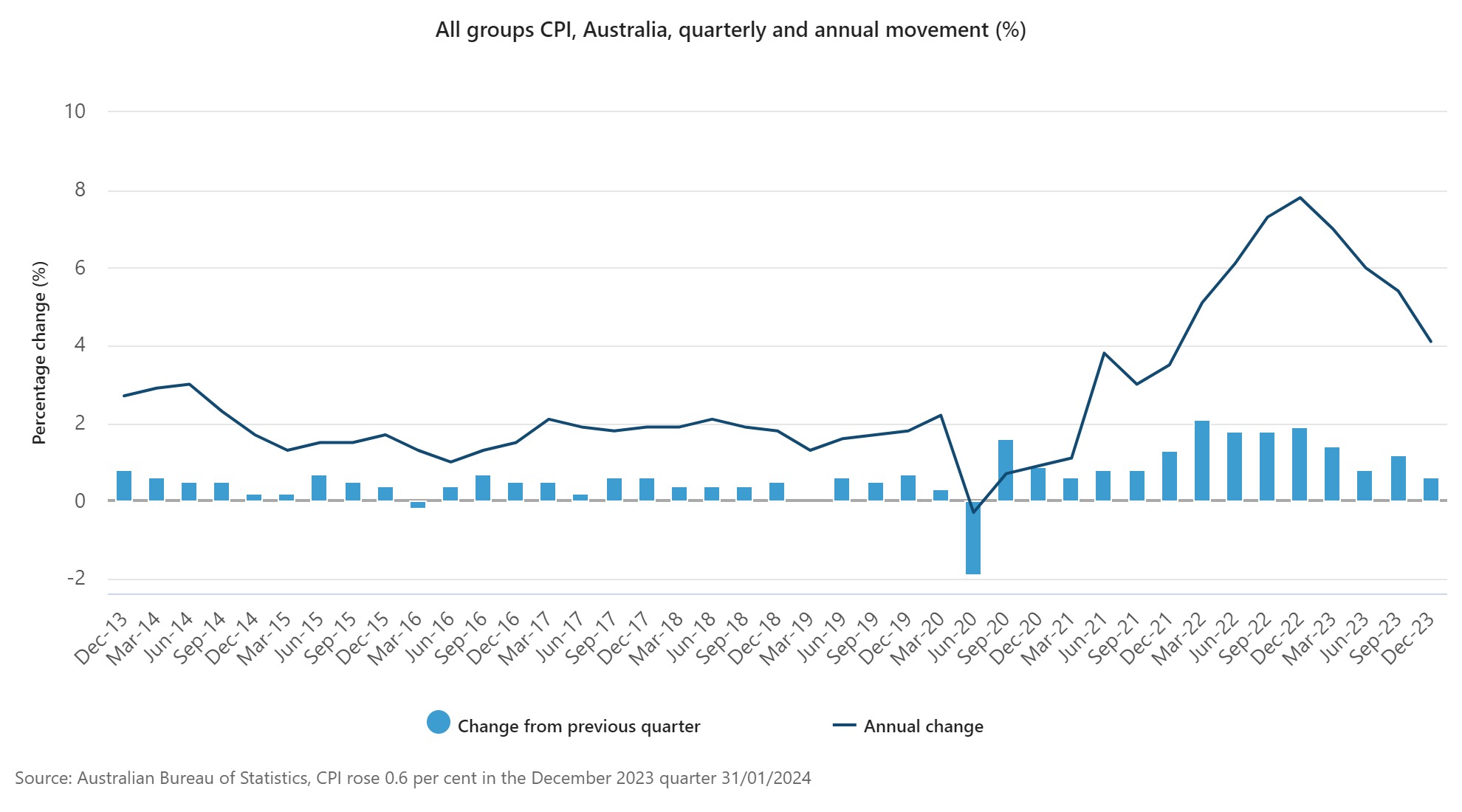

Inflation has continued to track down towards the Reserve Bank’s (RBA) target band, with the Consumer Price Index (CPI) rising only 0.6% in the December 2023 quarter and 4.1% annually, according to the latest data from the Australian Bureau of Statistics (ABS).

Michelle Marquardt (pictured above), ABS head of prices statistics, said the CPI rose 0.6% in the December quarter, lower than the 1.2% rise in the September 2023 quarter.

This was the smallest quarterly rise since the March 2021 quarter.

“While prices continued to rise for most goods and services, annual CPI inflation has fallen from a peak of 7.8% in December 2022, to 4.1% in December 2023.”

With inflation consistently dropping each month, the RBA’s next cash rate decision on the first Tuesday of February becomes increasingly crucial.

While a cut might reignite inflation – especially with the Stage 3 tax cuts scheduled for July – a seemingly impossible rate rise could tip the Australian economy into a recession.

The most significant contributors to the December quarter rise were housing (+1.0%), alcohol and tobacco (+2.8%), insurance and financial services (+1.7%), and food and non-alcoholic beverages (+0.5%). Housing was driven by new dwellings purchased by owner occupiers (+1.5%), rents (+0.9%), and utilities (+0.6%).

“Higher labour and material costs contributed to price rises this quarter for construction of new dwellings. The 1.5% increase is slightly higher than the 1.3% rise in September 2023 quarter,” Marquardt said.

Rental prices rose 0.9% for the quarter, following a 2.2% rise in the September quarter. The rate of quarterly growth was moderated by changes to Commonwealth Rent Assistance.

Excluding the changes to rent assistance, rental prices would have increased by 2.2% in the December 2023 quarter.

Tobacco rose 7.0%, following the introduction of the 5% annual tobacco excise indexation and biannual Average Weekly Ordinary Time Earnings increase, which were both applied on September 1, 2023.

Insurance had a strong quarterly movement of 3.8%, following the 2.8% rise in September 2023 quarter.

“The increase in Insurance was due to higher premiums across motor vehicle, house and home contents insurance. Over the past twelve months insurance rose 16.2%, making it the largest annual rise since March 2001,” Marquardt said.

Food and non-alcoholic beverage prices rose this quarter, although the rise was the smallest since September 2021.

The rise was driven by Meals out and takeaway foods (+0.9%), Food products not elsewhere classified (+1.9%), and Bread and cereal products (+1.9%).

Partially offsetting the quarterly rise were price falls for Meat and seafood (-1.2%), and Fruit and vegetables (-1.2%).

"Meat and seafood prices fell this quarter due to increased supply leading to price drops for Lamb and goat of 12.1%, and Beef and veal of 1.5%,” Marquardt said.

Annually, the CPI rose 4.1%, with housing (+6.1%), food and non-alcoholic beverages (+4.5%), and alcohol and tobacco (+6.6%) contributing the most.

Underlying inflation measures reduce the impact of irregular or temporary price changes in the CPI.

Annual trimmed mean inflation was 4.2%, down from 5.1% in the September quarter.

This is the fourth quarter in a row of lower annual trimmed mean inflation, down from the peak of 6.8% in the December 2022 quarter.

The ABS also released the monthly CPI indicator for December, which rose 3.4% in the 12 months to December, compared to a rise of 4.3% in the 12 months to November.

The most significant contributors to the rise were housing (+5.2%), food and non-alcoholic beverages (+4.0%), alcohol and tobacco (+6.8%), and insurance and financial services (+8.2%).