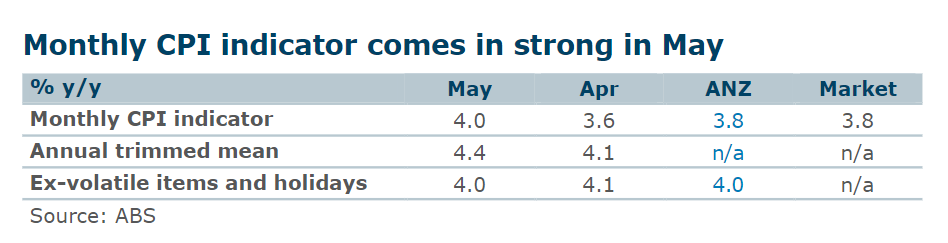

The monthly Consumer Price Index (CPI) in Australia showed a sharp increase to 4% year-over-year in May, hitting a six-month high and surpassing both market and ANZ’s own forecasts.

“This was above our and market expectations,” said Catherine Birch (pictured above), ANZ’s senior economist.

Further dissecting the inflation figures, the annual trimmed mean inflation also jumped to 4.4% year-over-year in May from 4.1%. However, inflation that excludes volatile items and holiday travel showed a slight decrease, shedding 0.1 percentage points to settle at 4%.

Birch pointed out that the stall in non-tradable disinflation and a potential uptick in services inflation could be factors.

“Figures suggest non-tradables disinflation has stalled and services inflation may have picked up,” she said, advising caution in interpreting these monthly data due to partial coverage of price changes across different expenditure classes.

The latest CPI figures could trigger concerns at the Reserve Bank (RBA), raising the possibility that the second-quarter CPI might exceed RBA’s predictions of 3.8% year-over-year for both headline and trimmed mean inflation.

The result “may make the RBA a little nervous,” Birch said, outlining the scenario where increased inflation alongside positive revisions in economic activity and labour market data could prompt an interest rate adjustment, although she said that “a rate hike is not our base case.”

Drawing parallels with global economic trends, Birch said, “It is possible that Australia is experiencing a temporary stalling in the disinflation process, similar to what the US went through early this year.”

She added that the US seemed to resume its disinflation trajectory by April and May.

Despite a 0.1% month-on-month drop in prices during May, which Birch described as “not unusual,” the annual inflation rate was pushed higher due to smaller-than-expected reductions in categories like clothing and footwear and fuel.

Other elements contributing to the stronger inflation print included unexpected increases in the prices of fruits, vegetables, and international holidays, along with slightly higher rent and alcohol & tobacco prices. Meanwhile, weaker-than-expected electricity and gas prices provided some offset.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.