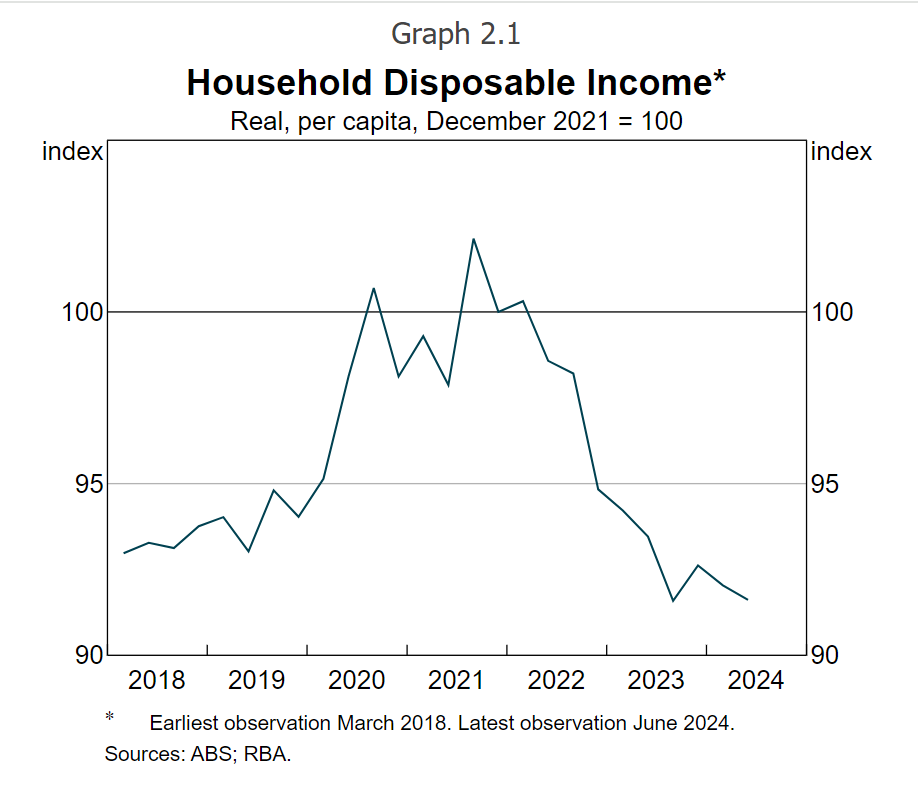

High inflation and rising interest rates continue to squeeze household budgets, leading to significant declines in real disposable incomes – measured after tax, interest, and adjusted for inflation – since early 2022, according to the Reserve Bank.

Many mortgage holders have seen their repayment amounts increase by 30-60% since the first cash rate hike in May 2022.

Despite some stabilisation in real incomes to pre-pandemic levels, ongoing cost-of-living pressures are heavily impacting households, with many seeking assistance from community organisations for the first time.

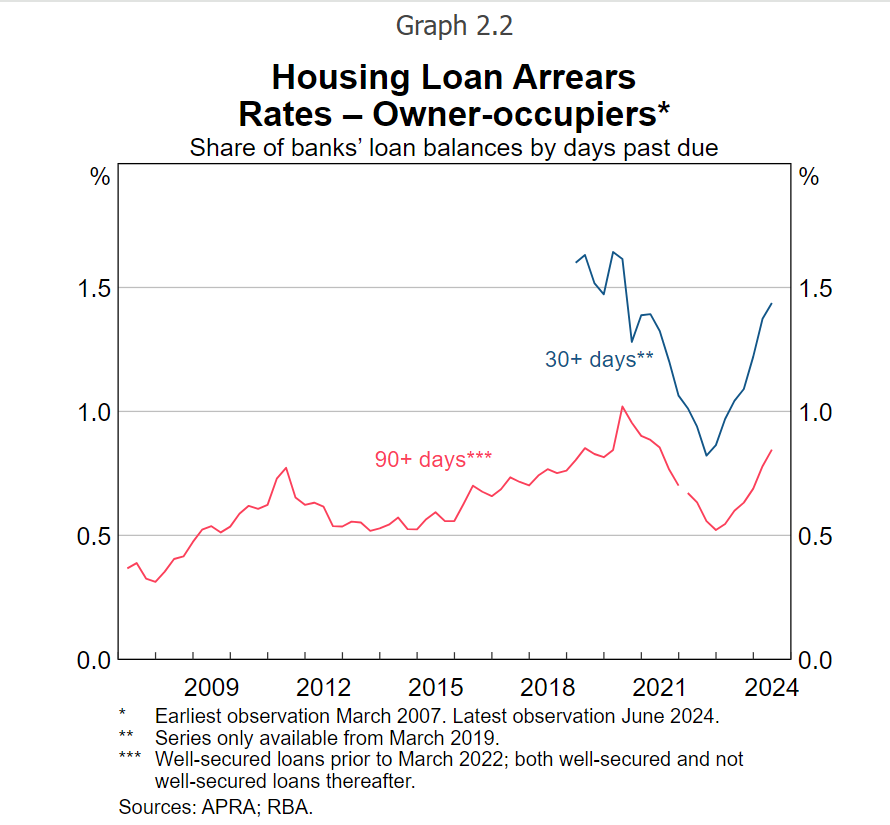

A growing number of homeowners are struggling to keep up with mortgage payments, with loan arrears steadily increasing from late 2022.

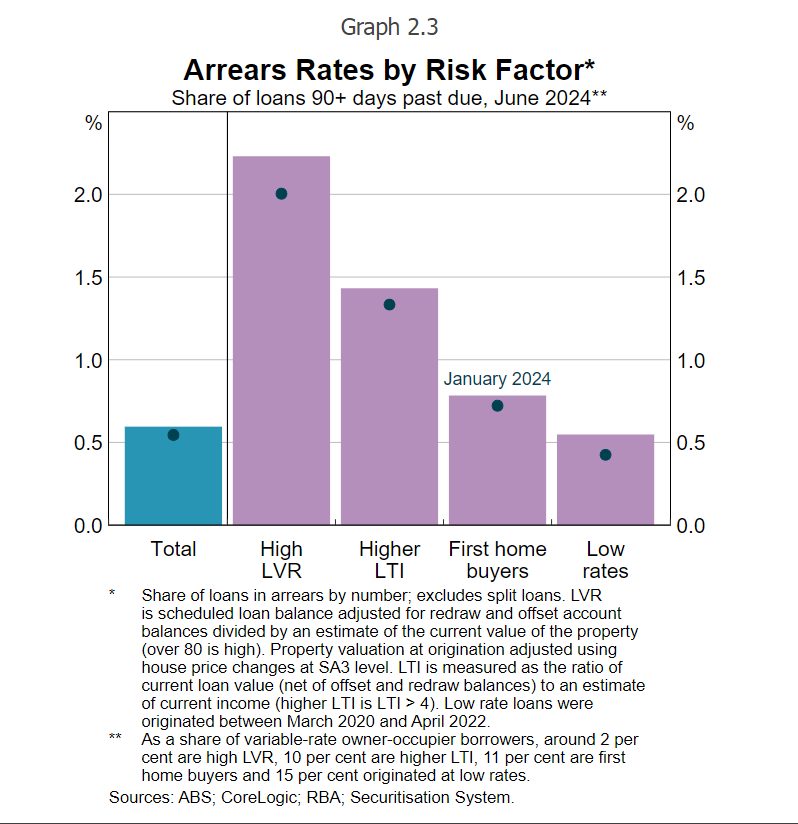

Highly leveraged borrowers, those with high loan-to-value or high loan-to-income ratios, are most vulnerable to falling behind due to economic stress and limited savings.

By contrast, first-time buyers and those with low-rate loans have seen smaller increases in arrears, even as they transition to higher rates.

Despite the rise in arrears, the overall risk to financial stability is limited. Less than 1% of housing loan balances are over 90 days in arrears.

Lenders have been proactive, setting up hardship arrangements early to help struggling borrowers adjust and continue servicing their loans.

Although the number of hardship notices has increased since 2022, only a small fraction of loan balances are affected, and most borrowers are able to resume payments.

Very few loans in arrears are in negative equity, where the loan exceeds the property’s resale value. Around 0.5% of arrears cases fall into this category, with overall risks of both default and negative equity remaining minimal.

Some borrowers in financial difficulty have opted to sell properties to avoid default, often repaying their loans in full, RBA said.

A small percentage of borrowers face severe budget pressures, with essential expenses and mortgage repayments exceeding their incomes.

Many in this group, particularly lower-income households, have had to make tough financial adjustments such as drawing on savings, selling assets, or working extra hours.

Despite these challenges, only a tiny fraction of these borrowers are in negative equity.

Most borrowers continue to manage their debt obligations despite ongoing financial pressure.

Although some are drawing down on their savings, many are maintaining their mortgage buffers, and high-income borrowers still hold significant prepayment reserves.

Projections suggest household budget pressures may ease in the latter half of 2024 due to tax cuts and declining inflation, potentially reducing the share of borrowers facing cash flow shortfalls by 2026, RBA said.

Economic conditions remain uncertain, with inflation, interest rates, and unemployment as key factors that could affect household financial stress levels.

However, even under adverse scenarios, the majority of borrowers are likely to remain resilient.

Strong equity positions and sound lending standards provide a buffer against economic downturns, and banks are well-positioned to absorb potential losses.

Looking ahead, household financial stability will depend on prudent borrowing and lending practices.

While periods of low interest rates have previously led to increased debt levels, maintaining discipline in credit markets will be crucial to avoiding a broader economic disruption that could erode household equity and financial security, RBA said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.