More than 640,000 Australian households are experiencing housing stress, with this figure tipped to rise to nearly 1 million by 2041, according to a new report by comparison service Savvy.

A recent report by SGS Economics and Planning found that 42% of all low-income households were paying more than 30% of their income on housing, with the figure rising to 47% for households in NSW and 58% for Australia’s private rental market.

Someone is said to be under severe rental stress if they are spending 38% to 60% of their income on rent, putting low-income households at risk.

The Savvy report said singles receiving JobSeeker, pensioners, and part-time working parents have an RAI (Rental Affordability Index) score that ranges from unaffordable to extremely unaffordable, meaning 30% to 60% or more of their gross income is used for rent.

Hospitality workers are likewise struggling, with rental affordability moderately unaffordable to severely unaffordable.

For student sharehouses, rental affordability has declined over the past year and now ranges from moderately unaffordable to unaffordable. Despite a slight increase in the annual income of these households, they still need up to 40% of their income for rent, making it increasingly tough to balance study and work.

Minimum-wage couples, with an average gross annual income of $84,510, range from unaffordable to acceptable, which means they are paying 20% to 38% share of their income on rent.

Brisbane saw the sharpest decline in rental affordability, with its RAI score falling 11% by the end of last year. Adelaide and Perth, meanwhile, saw a 6% dip. This was particularly the case for pensioner couples, which found Brisbane and Perth the second least affordable cities, behind Sydney and ACT.

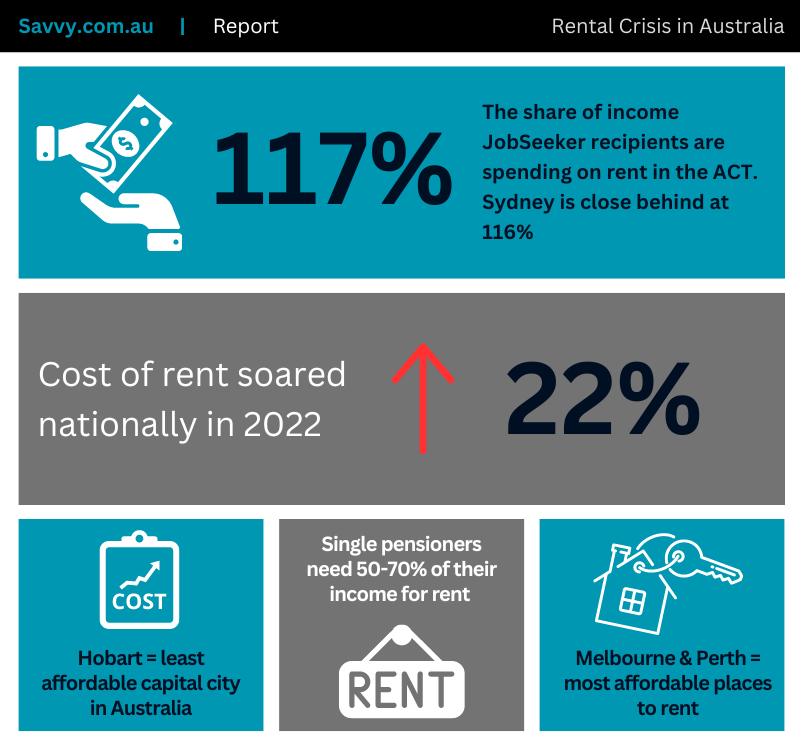

Single pensioners are battling extremely unaffordable to severely unaffordable rents, taking up 50% to 70% of their income. This does not include costs associated with ageing, such as healthcare and accessing nearby shops, services, and transport.

Regional South Australia is the only place with acceptable rents for pensioners, but increasing rates made it difficult for all other low-income earners in the area.

Hobart continues to be the least affordable for the average rental household, sinking below the critical threshold, while Sydney remains critically unaffordable.

Melbourne is Australia’s most affordable capital, with households forking out an average of 21% of their income on rent. This is followed by Perth, despite the sharp rental increases and decline in affordability over the years.

Greater Queensland is moderately affordable for the first time, posting the largest decline in RAI score across the country.

Facing the worst rental affordability are job seekers, who allocate 60% or more of their income to rent. In some areas, such as Perth, Sydney, and ACT, they are forking out more than 100%, making rentals severely unaffordable, Savvy reported.

Also in the same boat are single part-time working parents on benefits, although healthcare and childcare costs have further compounded their financial stress. ACT is the most unaffordable area, with renters paying 69% of their income. Victoria and Tasmania are the most affordable at 40% to 41%.

For dual-income parents, rents are affordable or better in all regions. This is due to the annual household income rising by nearly $4,500. Households in Sydney and ACT pay the highest rent share, at 15%, while South Australia the lowest, at 8%.

Single-income couples with children, meanwhile, face moderately unaffordable rents and can only get affordable rentals in South Australia.

Use the comment section below to tell us how you felt about this story.