Amid wide expectation of a November cash rate increase and a growing concern among mortgage holders that they’ll buckle from another rate hike, several lenders made rate adjustments between Oct. 30 to Nov. 6, according to Canstar’s weekly interest rates wrap-up.

Over the past week, five lenders raised 18 owner-occupier and investor variable rates by an average 0.08%, while seven slashed 15 of theirs by an average of 0.08%. Six lenders also lifted 115 of their fixed rates for owner occupiers and investors by an average 0.26%

See the table below for the variable and fixed rate changes.

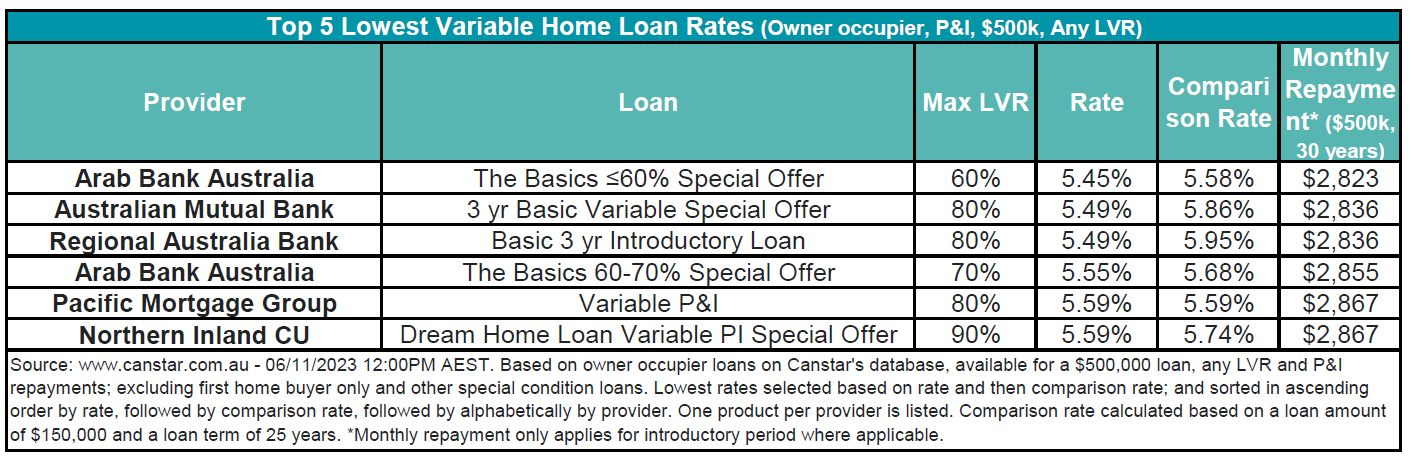

Following this week’s rate moves, the average variable interest rate for owner-occupiers making principal and interest payments stands at 6.68% with an 80% LVR. The lowest variable rate available for any LVR is 5.45%, offered by Arab Bank.

On Canstar’s database, there are currently eight rates below 5.5%, a decrease from the nine rates available the previous week.

Listed in the table below are the five lowest variable home loan rates in Canstar’s database.

With the Reserve Bank set to release its cash rate decision today, Effie Zahos (pictured above), Canstar’s editor-at-large, said all four banks now forecast a November rate increase – which could spell trouble for many homeowners.

“A Canstar survey of 893 Australian mortgage holders in October found that just 31% of borrowers felt confident they could continue to make loan repayments if interest rates rise again,” Zahos said. “This leaves 69% of mortgage holders who are likely to buckle from a rate hike.”

“Another 0.25-percentage-point increase in the cash rate rise could add $99 to repayments for a borrower who bought a home just before rates began to increase and borrowed an average loan amount at the time of $611,154. This would see monthly repayments rise from $2,570 in April 2022 to $4,137, a total increase of $1,567 or 61% since the current rate rise cycle began.

“Those who bought a home in New South Wales could see their repayments jump to $5,321, which is a massive $2,016 more than they were in April.”

She said homeowners facing potential financial stress have three main options to mitigate the impact of a further rate hike in November in the short term.

One is to switch to a low one-year fixed rate.

“Someone with a $600,000 mortgage at the average variable rate of 6.68% could potentially save as much as $457 by switching to the cheapest one-year fixed rate on Canstar’s database at 5.5%, available to borrowers with a 60% loan to value ratio or less,” Zahos said. “Borrowers who have a loan to value ratio of 80% could still score a great one-year fixed rate of 5.7% which could reduce their repayments by $382 per month.”

Another possibility is to revert from principal-and-interest repayments to interest-only payments.

“On a $600,000 mortgage at the average variable rate of 6.68%, reverting to interest-only payments could cut repayments by $249 per month, but borrowers should consider that delaying repayments on the principal loan amount will end up costing more in the long run,” Zahos said.

Finally, borrowers may opt to extend their loan term by five years.

“Canstar analysis shows a homeowner with a $600,000 mortgage who extends a 25-year loan to a 30-year loan could cut their repayments by $255 per month,” Zahos said. “It’s important to weigh up the benefits of extending the loan term given this strategy will see the borrower repaying their debt for longer and paying more interest in the long term.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.