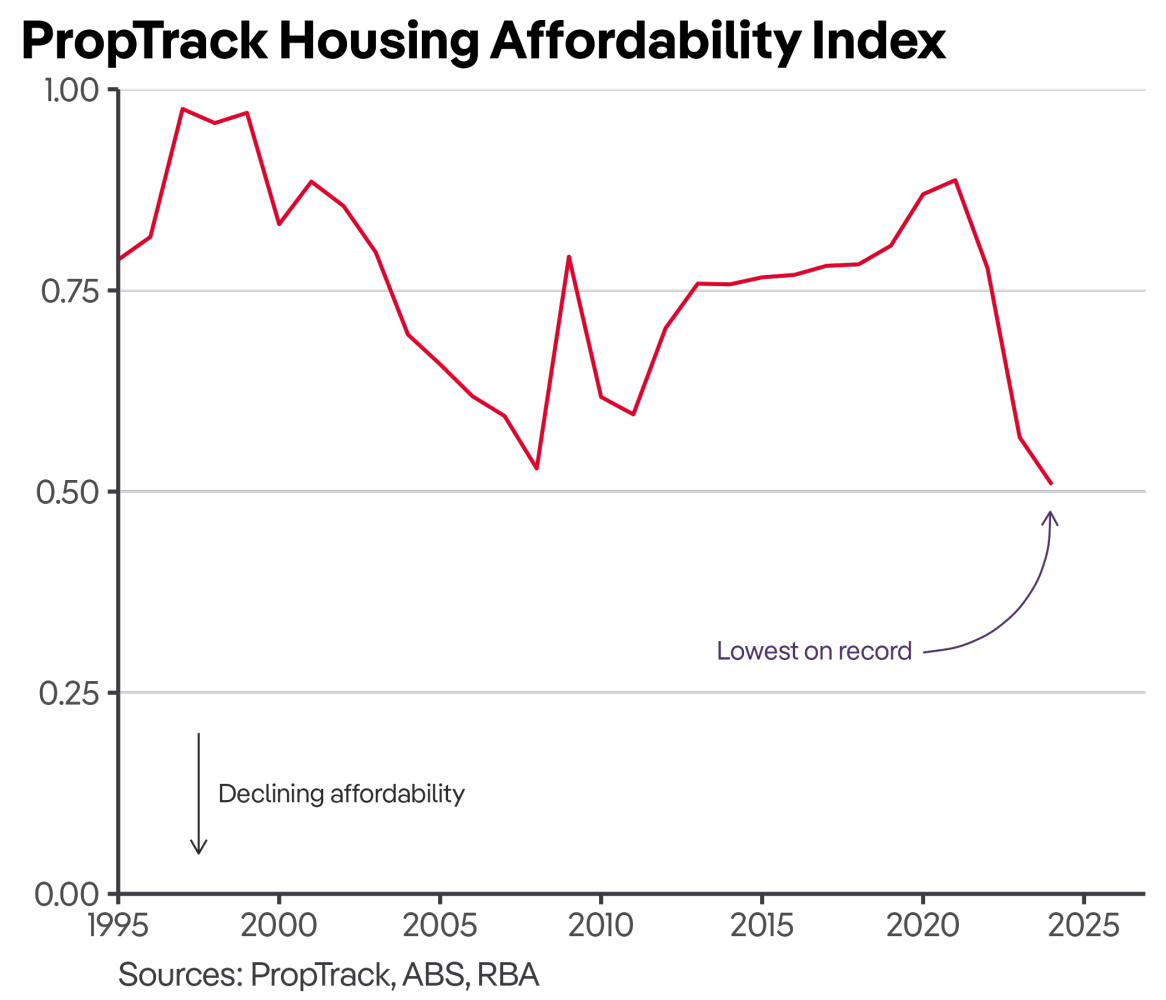

Housing affordability in Australia has reached its lowest level on record, according to the latest PropTrack housing affordability index.

A combination of high mortgage rates – at levels not seen since 2011 – and rapid home price increases has severely restricted the ability of households to purchase property.

Over the past year, the national median home price has surged by approximately $50,000, leaving households able to afford only the smallest share of homes since records began.

The decline in affordability has been stark.

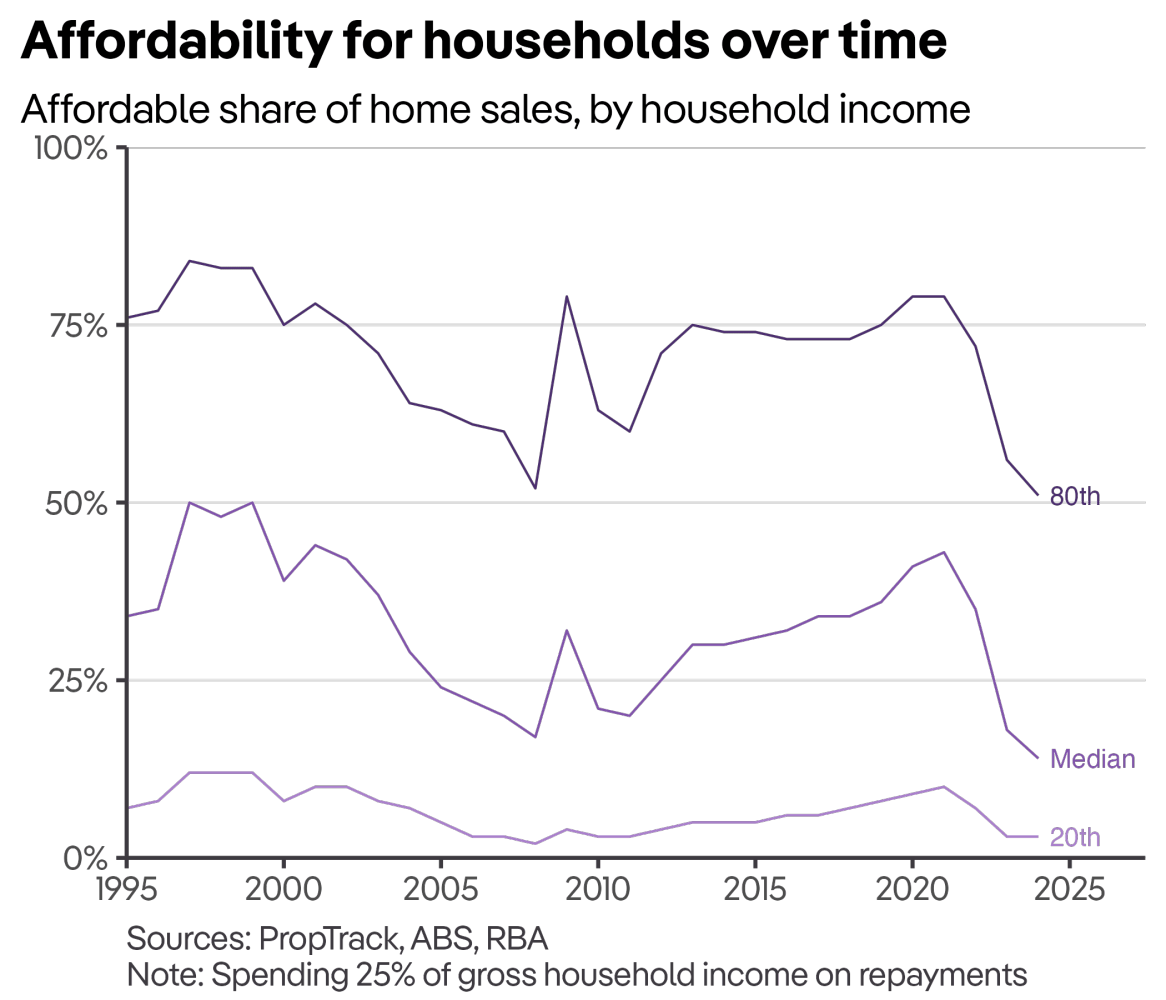

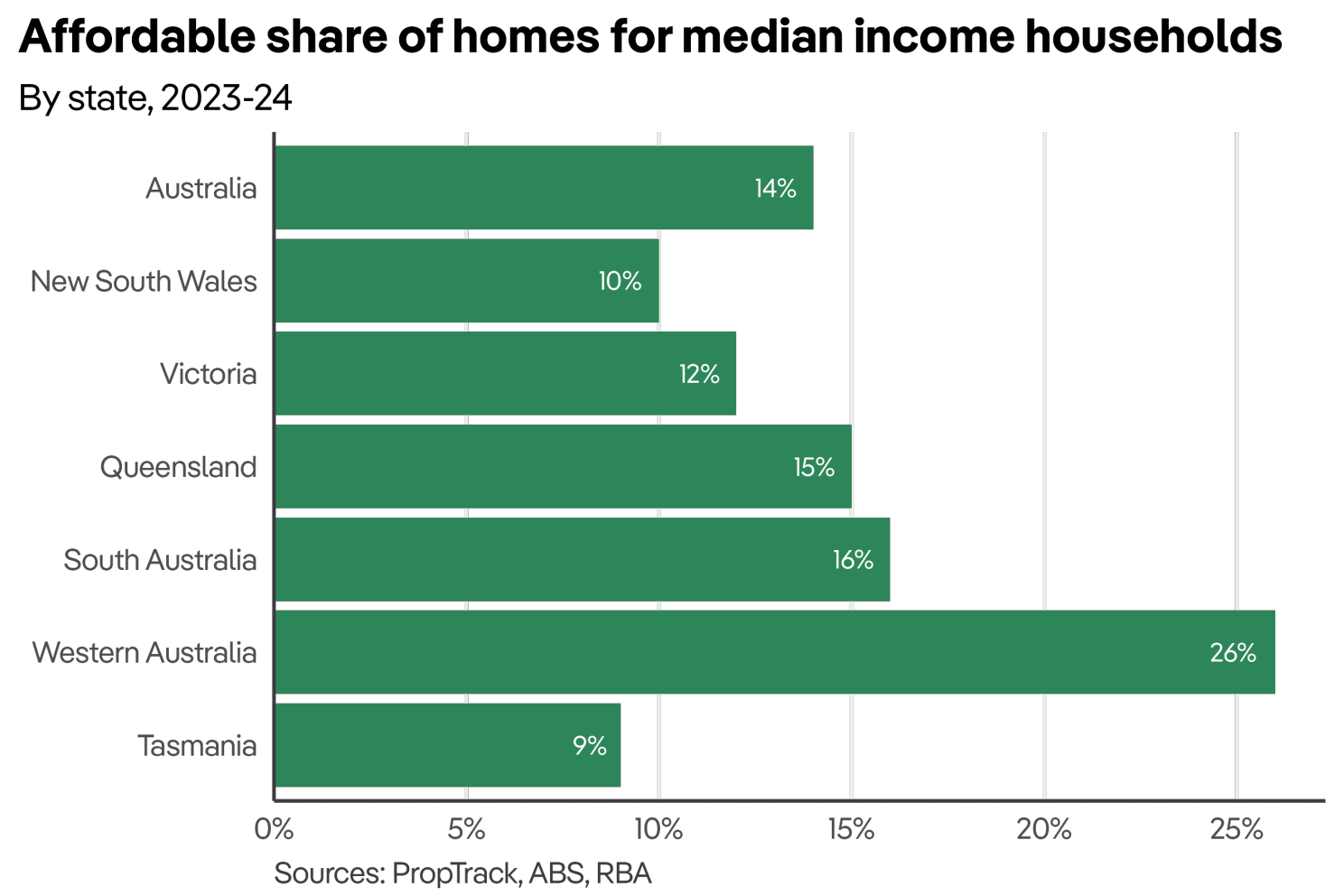

“A median income household – earning just over $112,000 a year – can afford to purchase just 14% of homes sold across the country,” said Paul Ryan (pictured above), PropTrack’s senior economist.

This represents a dramatic drop from 2020-21, when a median-income household could afford 43% of homes. Today, only high-income earners, with annual earnings of $213,000, can afford to purchase half of the homes on the market.

New South Wales, Tasmania, and Victoria are experiencing the most severe affordability challenges.

In Sydney, where the median home price is now $1.5 million, homeownership is largely out of reach for most.

Tasmania ranks as the second least affordable state, with less than 10% of homes within reach for a median-income household.

South Australia saw the largest year-over-year decline in affordability, while Western Australia remains the most affordable state, attracting many interstate movers.

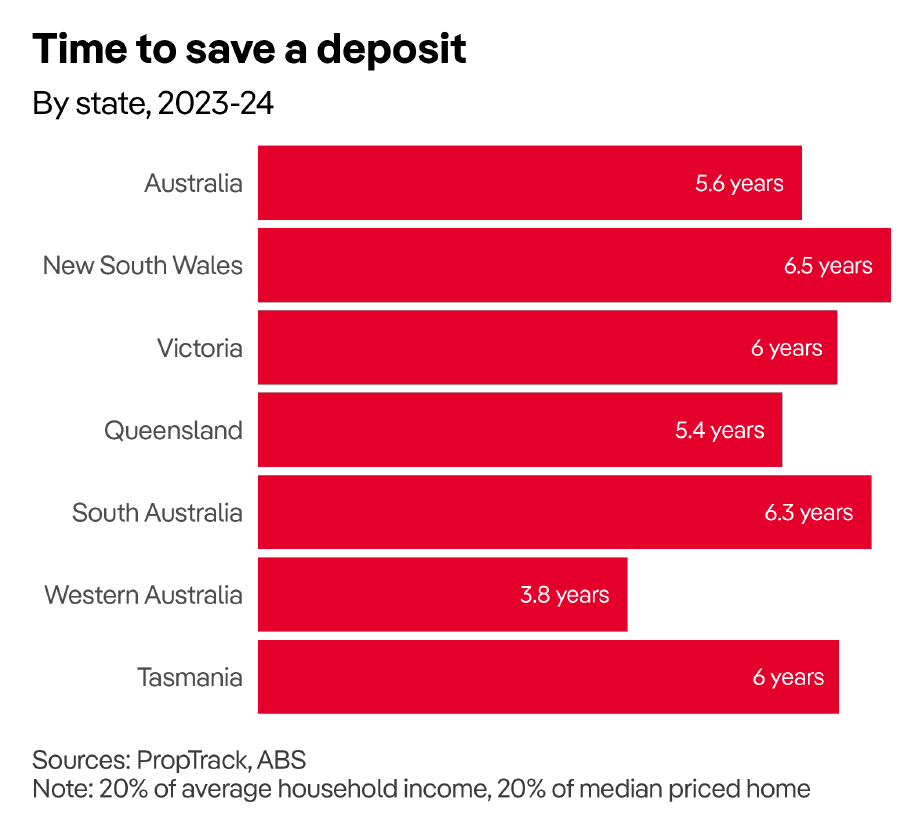

Beyond managing mortgage repayments, saving for a home deposit remains a significant challenge, particularly for first-home buyers.

An average household must save 20% of their income for over five and a half years to gather a 20% deposit on a median-priced home, making homeownership an elusive goal for many.

While a potential reduction in interest rates later this year could offer some relief, experts argue that substantial, long-term improvements in affordability require broader changes to the housing market.

“Lower interest rates will ease housing affordability somewhat, and this relief may come as soon as late this year,” Ryan said. “But meaningful, long-term improvement will require structural changes to the housing market to make more homes available.”

The National Cabinet’s goal of building 1.2 million well-located homes is seen as a positive step, but coordinated efforts will be essential to address the broader housing crisis and keep homeownership within reach for future generations.

Read the PropTrack economist update in full here. For full results, see the PropTrack Housing Affordability Report 2024.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter