Brokers can get a slice of the action as a new survey shows seven in 10 Australians are using the equity in their homes to do renovations or invest in another property.

The latest NAB Housing Market Insights Report revealed many Australians were also taking the opportunity to get ahead on their loan repayments.

The survey involved 500 Australians and took place from April 26 to May 01, 2022.

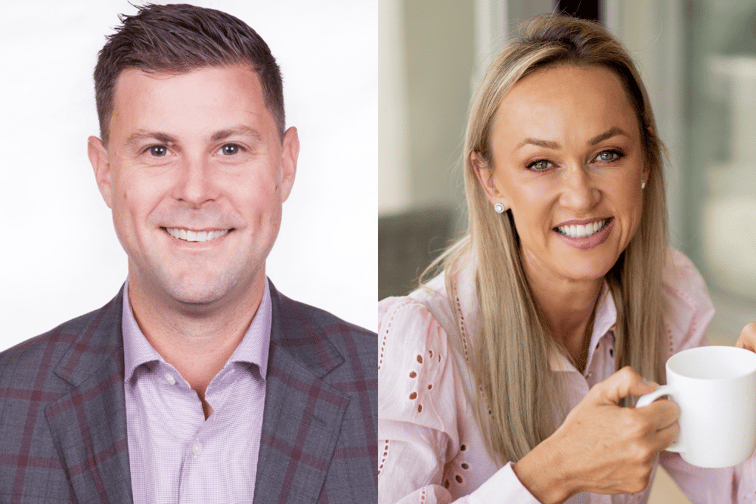

Nathan Aird (pictured above left), director of Central Coast NSW brokerage Universal Mortgage Experts, said property values had increased rapidly across the country.

“We are busier now more than ever before with people refinancing and tapping into their equity to renovate or value-add to their home,” Aird said.

“People are more inclined to go into more debt and spend money on their own home as they were unable to travel, turning their own home into a holiday destination.”

NAB’s report found about three in 10 Australians whose home needed a facelift had put renovations on the agenda and were unlocking the useable equity and borrowing more to make the changes.

“With equity growing and people capitalising on disposable income, this is a win for the local economy as people can hire local trades to carry out home renovation projects,” he said.

NAB’s report also found that buying an investment property (16%) was another way Australians were using their home equity to get ahead.

Adele Andrews (pictured above right), director of Melbourne brokerage Australian Property Home Loans, said there was still heat in property markets across the country with lots of opportunity to purchase an investment property.

“It makes sense for people to take advantage of the equity built up in their own homes if they want to build their property portfolio,” Andrews said.

“There is lots of demand from tenants, so now is a great time to arrange a valuation of your owner-occupied home. The equity is the difference between the valuation price of your property minus the debt owed.”

Read more: Brokers beware: tax time is here

NAB executive home ownership Andy Kerr said with many NAB customers ahead on their loans, it was interesting to see them using their equity to get further ahead.

“Customers are wanting more security and certainty, so it is not surprising in this environment of rate increases that we are seeing Aussies paying down their mortgages even further,” Kerr said.

“We’re fielding more enquiries today about how to use equity than we’ve ever seen. And as hybrid working continues to evolve, many Aussies are taking the opportunity to build a new study or finally get that dream kitchen.”