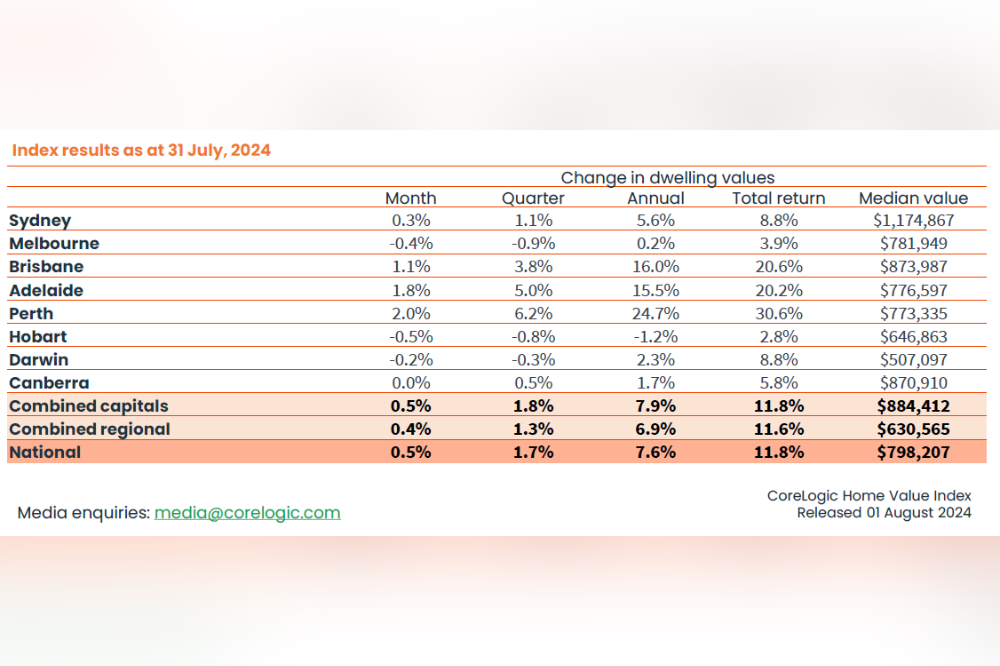

Despite a 0.5% increase in national home values in July, three capital cities – Melbourne, Hobart, and Darwin – saw declines over the past three months, CoreLogic reported.

Melbourne led the decline with a -0.9% fall, followed by Hobart at -0.8% and Darwin at -0.3%.

“While the headline growth rate remains positive, it is clear momentum is leaving the cycle,” said Tim Lawless (pictured above), CoreLogic’s research director.

National home values rose for the 18th consecutive month in July, matching the 0.5% increase recorded in June.

After a -7.5% decline between May 2022 and January 2023, the national HVI has gained 13.5%, consistently reaching new record highs since November last year.

The rolling quarterly pace of growth in Sydney has slowed significantly to 1.1%, compared to a 5% gain a year ago. This has impacted national home values, which rose 1.7% in the past three months, down from a 3.2% increase last year.

Conversely, Perth and Adelaide have seen substantial growth, with Perth recording a 6.2% quarterly growth rate and Adelaide accelerating to 5%, the fastest pace since May 2022.

Brisbane’s quarterly growth was 3.8%, down from 4.7% last year.

Lawless emphasised that supply and affordability are key factors in the diverse outcomes in housing growth trends.

“The number of homes for sale in Brisbane, Adelaide, and Perth is more than 30% below average for this time of the year, while weaker markets like Melbourne and Hobart are recording advertised supply well above average levels,” he said.

Demand is skewing towards lower price points, with lower quartile values leading growth in every capital city except Darwin and Canberra.

Regional housing values lag behind capitals, with a 1.3% rise compared to 1.8% in capitals.

Regional Western Australia (4.7%), South Australia (3.2%), and Queensland (2.8%) led the growth, while regional Victoria saw a -1.4% decline.

Units are now rising faster than houses in most capitals, except Darwin and the ACT, where affordability pressures are less intense.

The disparity in market performance highlighted the complex dynamics at play, influenced by local supply and affordability factors.

The continued rise in unit values reflects a shift towards more affordable housing options as borrowing capacity and housing affordability remain challenging, CoreLogic reported.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.