This week’s Canstar rate update revealed mixed movements in the home loan market, with changes impacting both owner occupier and investor loan categories.

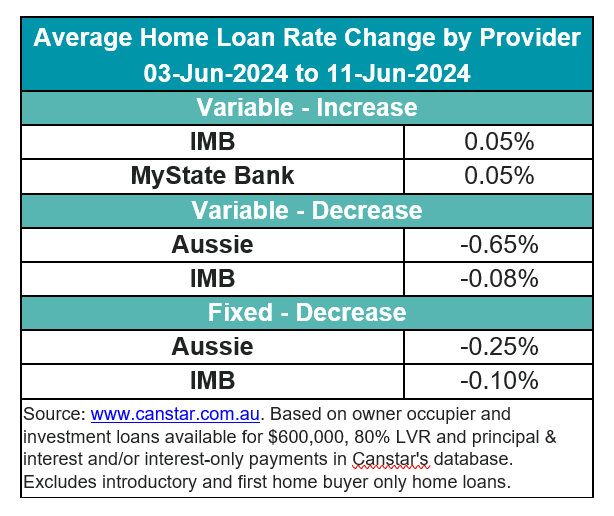

Two lenders have raised their variable rates for owner-occupiers and investors by an average of 0.05%, indicating a cautious approach in a fluctuating market. Conversely, the same number of lenders took a more aggressive stance by cutting five-owner occupier and investor variable rates by an average of 0.19%.

Additionally, two lenders also reduced their fixed rates by an average of 0.18%.

See last week’s rate adjustments in the table below.

To compare the latest changes with the previous week’s, click here.

The average variable interest rate for owner occupiers paying principal and interest stands at 6.87%. However, the lowest available variable rate is significantly lower at 5.74%, offered by Regional Australia Bank.

Canstar’s database currently lists 26 rates below 5.75%, maintaining consistency with the previous week’s figures. These rates are available at Australian Mutual Bank, Bank Australia, Horizon Bank, HSBC, LCU, People’s Choice, Police Credit Union, RACQ Bank, Regional Australia Bank, The Mac, and Unity Bank.

Steve Mickenbecker (pictured above), Canstar’s group executive of financial services and chief commentator, provided insights into the broader economic context influencing these rate changes.

“The past month or so has delivered a mixed bag of data releases, with low GDP growth, accelerating inflation, new lending taking off, record house prices, and lower spending on credit cards,” Mickenbecker said.

He said that with a booming property market and threatening recession, the Reserve Bank faces a challenging decision next week.

“The Reserve Bank will be feeling torn during next week’s cash rate decision between interest rate cuts, a cash rate hike, and waiting for less ambiguous signals while hoping the future doesn’t bring stagflation,” the Canstar executive said.

“The smart money is on keeping the cash rate on hold at least until the June quarter CPI release. The banks have taken this lead and have done very little rate-wise last week, with two banks inching rates up, while a couple cut. The consensus appears to be that it is too tight to call the next move, so wait and see.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.