The latest Canstar interest rate wrap revealed significant shifts in both fixed and variable home loan rates as the year winds down.

While most lenders opted for increases, one standout player bucked the trend with rate reductions.

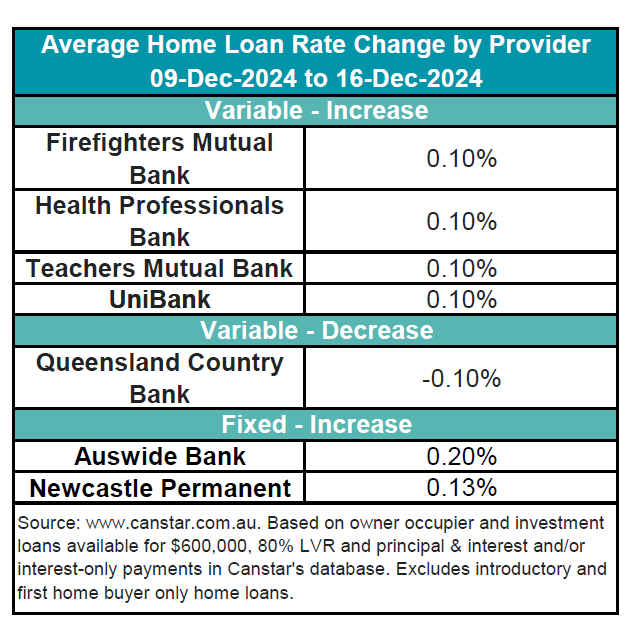

Over the past week, four lenders raised 16 variable interest rates for both owner-occupier and investor loans by an average of 0.10%.

On the fixed rate front, two lenders lifted 49 rates by an average of 0.13%. This signals a temporary pause in what had been a year marked by frequent fixed rate cuts.

Notably, Teachers Mutual Group, which includes Uni Bank, Health Professionals Bank, and Firefighters Mutual Bank, raised variable rates for new customers by 0.10 percentage points.

Newcastle Permanent also increased its fixed rates, with some hikes reaching as high as 0.20 percentage points, Canstar reported.

In a rare move this week, Queensland Country Bank lowered four of its owner-occupier and investor variable rates by an average of 0.10%.

See the latest rate action in the table below.

To compare with the previous week’s rate changes, click here.

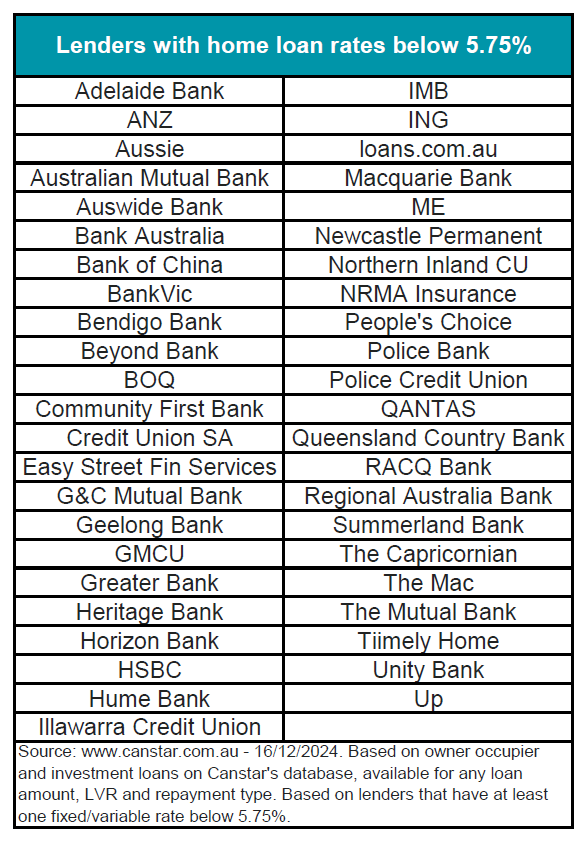

Currently, the average variable interest rate for owner-occupiers paying principal and interest sits at 5.84%, while the lowest variable rate available for any LVR is 5.69%, offered by Australian Mutual Bank as part of its three-year introductory offer.

On Canstar’s database, the number of rates below 5.75% has dropped to 178, compared to 192 the previous week. These rates are being offered in the banks listed in the table below.

Sally Tindall (pictured above), Canstar’s data insights director, commented on the rate changes over the past week.

“The second last full week before Christmas was dominated by fixed and variable rate hikes... while Newcastle Permanent hiked fixed rates by up to 0.2 percentage points,” Tindall said.

She highlighted the anomaly of Queensland Country Bank being the only lender to cut variable rates, with no reductions in fixed rates.

“It appears the fixed rate cutting cycle is on hold for now...,” Tindall said. “However, it could well pick up pace again in early 2025 if the cost of wholesale funding starts dropping further and we get more signs a cash rate cut is imminent.”

Canstar’s recent Consumer Pulse Report revealed optimism about cost-of-living pressures easing in 2025, thanks to anticipated support from RBA and the government. However, housing remains a major concern.

“Housing costs, including mortgage repayments and rents, are Australians’ top financial concern for 2025,” Tindall said. “While mortgages are weighing borrowers down, 44% of property owners expressed interest in purchasing an investment property in the next two years.”

Tindall said that increased investor activity could push housing prices higher, potentially sidelining first-home buyers. However, greater investment in new housing developments may alleviate some pressure and improve accessibility.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.