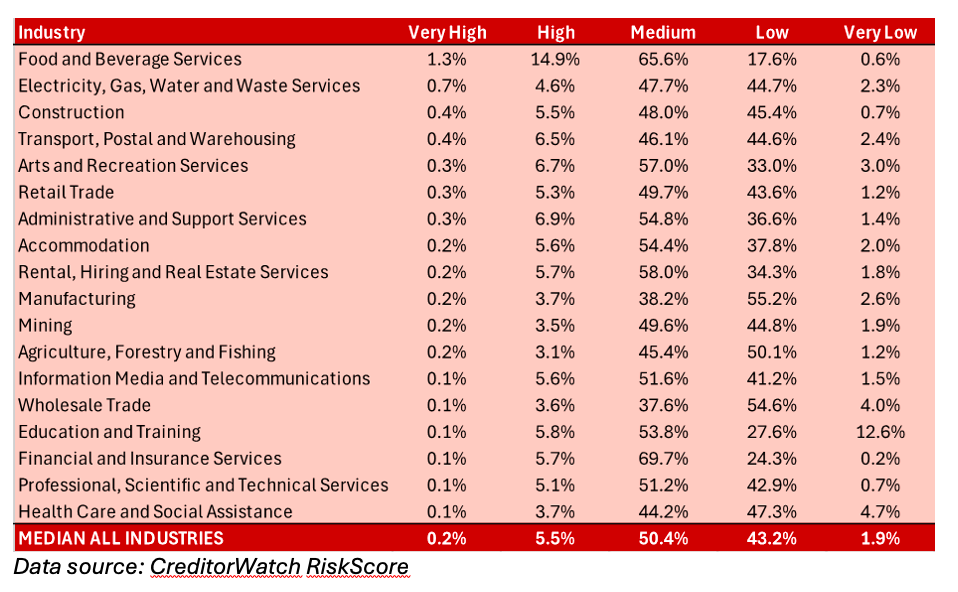

CreditorWatch’s latest industry risk ratings revealed that 16.2% of businesses in the food and beverage services sector are classified as “high” or “very high” risk.

The figure significantly outpaces the next highest sectors: Administrative and support services at 7.2% and arts and recreation services at 7.0%.

According to CreditorWatch, the hospitality sector is grappling with several challenges, including higher interest rates, rising input and energy costs, decreased foot traffic in CBDs, and diminished consumer demand amid cost-of-living pressures.

Notably, only 18.2% of food and beverage businesses are rated low or very low risk, with a mere 0.6% classified as very low risk.

CreditorWatch chief economist Ivan Colhoun noted the contrast in risk levels across sectors.

“On the lower risk ratings side, unsurprisingly, there is a predominance of government or effectively government-funded business categories,” Colhoun said.

He anticipates potential shifts in the Education and Training sector due to recent federal policy changes.

CreditorWatch CEO Patrick Coghlan (pictured above) stressed the ongoing difficulties for discretionary sectors.

“These industries that are heavily reliant on discretionary spending will, unfortunately, continue to find it tough until consumers feel a reduction in cost-of-living pressures.

“Discretionary spending is one of the few ways that consumers can actively cut costs.”

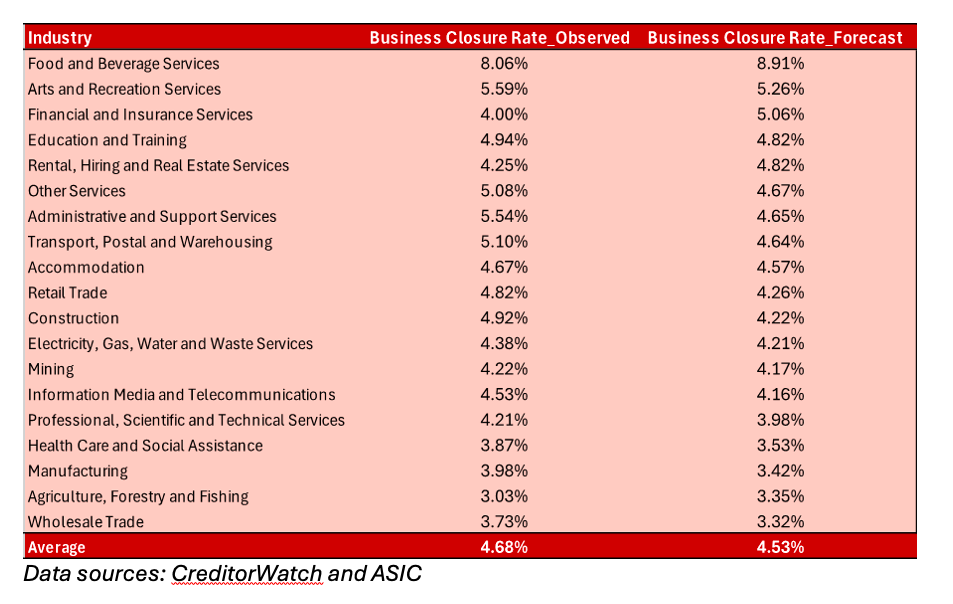

The CreditorWatch report predicted that the food and beverage services and arts and recreation services sectors will face the highest business closure rates over the next year.

CreditorWatch defines the closure rate as encompassing voluntary and involuntary administrations, ASIC strike-offs, and closures of solvent businesses.

The models indicated increased failures in sectors sensitive to interest rates, including food and beverage services and financial and insurance services. Despite not currently exhibiting significant risk increases, these sectors may experience pressure as high interest rates persist.

Recent data from ASIC showed that 1,225 companies entered insolvency in September, marking a record high.

However, as the number of registered companies has doubled since 2008, the overall insolvency proportion is not as alarming as it might seem.

Colhoun explained that while insolvencies are rising, the current rate is not yet alarmingly high.

“The rate of insolvencies is not yet especially high and the enforcement actions of the ATO are currently obscuring the underlying trend,” he said.

Colhoun expects further increases in insolvency rates but remains optimistic about upcoming interest rate cuts and recent tax changes.

Overall, the restrictive monetary policy and lingering effects of COVID-19 are increasing the risk of business failures, particularly in consumer discretionary sectors, CreditorWatch reported.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.