Greater Bank has lifted its fixed rate home loans up for owner-occupiers, leaving behind the market’s lowest rates on record in 2021.

Fixed rates continue to rise as anticipated, creating a different landscape to what people have become accustomed to. In fact, over half of all lenders have hiked at least one fixed rate in the past two months, according to RateCity’s database.

“Today’s hike from Greater Bank marks the end of an era for record-low fixed rates,” said Sally Tindall, research director at RateCity. “We are unlikely to see another fixed rate of 1.59% for years, if ever.”

Ultra-low fixed rates peaked in April 2021 with 180 rates under 2%, but this number has since fallen to 41 and is expected to fall close to zero within the next six months. As such, potential mortgage holders are encouraged to act fast and take advantage of what are still considered relatively low rates.

UBank, Qudos Bank and RACQ take Greater Bank’s spot with the new lowest fixed rate at 1.79%. HSBC and Australian Mutual Bank follow with fixed rates at 1.88% and 1.98%, respectively.

“Banks are still trimming variable rates, but the cuts have largely been to their basic loans and almost always reserved for new customers,” Tindall said. “While we expect more cuts to variable rates in the next few months, we could see some lenders hike later this year ahead of the RBA, if the cost of funding continues to escalate.”

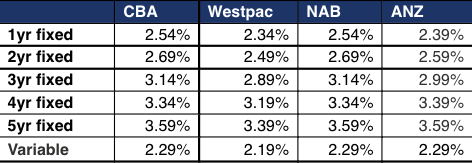

On the other hand, the big four have grown less competitive in the past two months, with Westpac holding the lowest fixed rates across all its terms in a pool of higher 2s and 3s.