New findings from ASIC’s Moneysmart have unveiled significant financial stress disparities between Gen Z women and men in Australia, with young women exhibiting higher levels of stress and concern over their financial situations.

According to the research, Gen Z women are more likely to feel stressed by the cost of living and overwhelmed by their finances compared to their male counterparts.

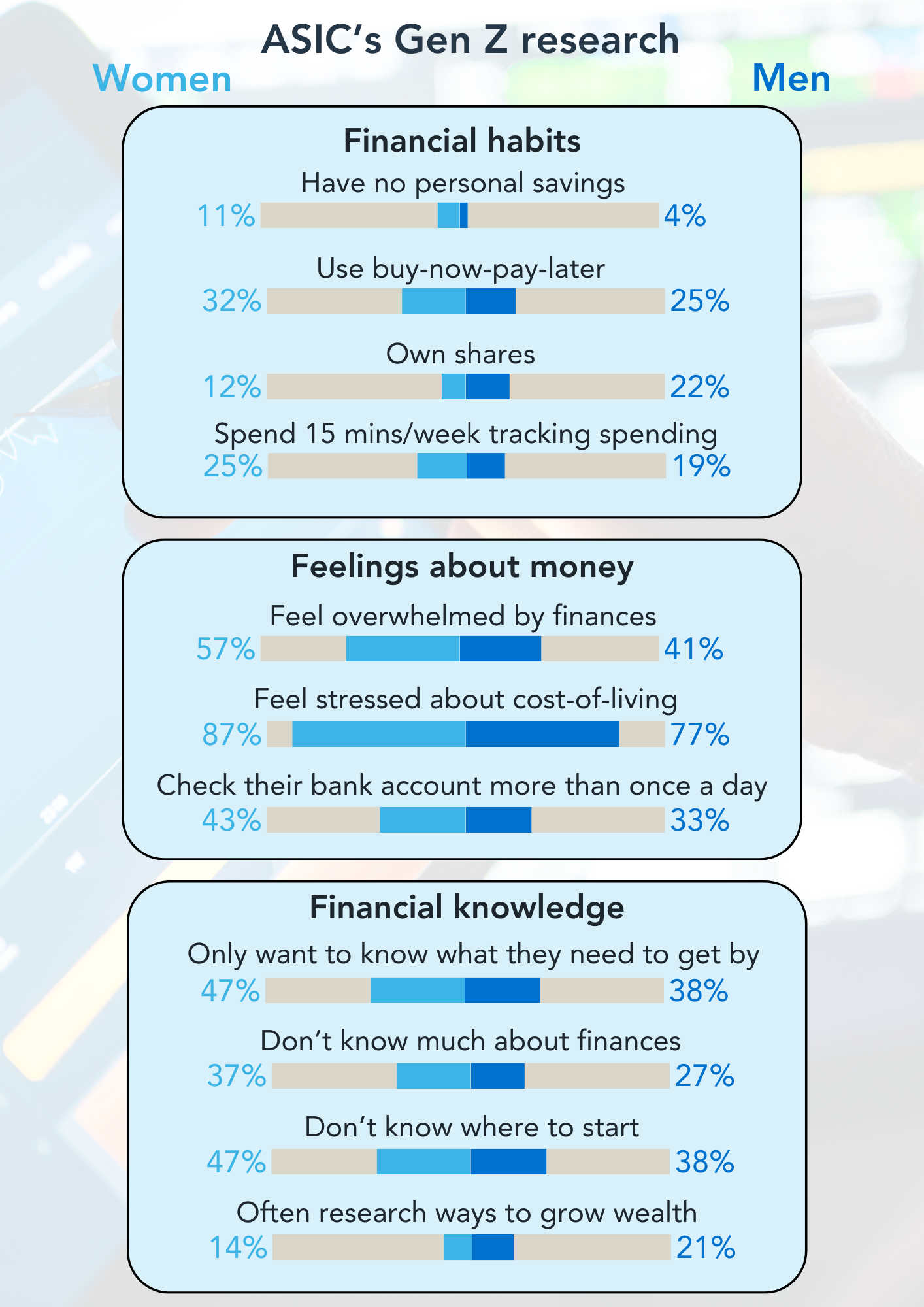

The study revealed the following key disparities:

Amanda Zeller (pictured above), ASIC’s acting senior executive leader of corporate finance, said that these findings align with international research indicating a gender gap in financial confidence and knowledge, as documented by organisations like OECD.

“This is an issue further exacerbated by harmful stereotypes about young women and money, perpetuating a cycle of financial anxiety and insecurity among women,” Zeller said. “It’s an issue we need to tackle, because the emerging picture is bleak: The financial decisions young women make today will compound across their lifetimes.”

The concept of “girl math,” a popular social media trend, illustrates an unconventional approach to rationalising spending among young women, such as justifying the cost of a $300 bag by planning to use it daily. Although sometimes based on economic principles like cost-per-wear, this mindset does not typically lead to financial security.

Zeller stressed the need to empower young women to overcome the pitfalls of “girl math” and take control of their finances.

“Countless studies have shown financially literate people are better at budgeting and saving, managing mortgages and debt, planning for retirement, and growing their wealth,” she said. “These behaviours aren’t inherent – they can be learnt at any age. That’s why we need to change the equation on girl math in 2024.”

Moneysmart offers various resources and tools to support women in making informed financial decisions, such as budgeting and saving tips, investment strategies, and superannuation advice.

To break through the glass ceiling of “girl math,” Moneysmart advised women to track their spending, automate their savings, and utilise apps or accounts that round up transactions to the nearest dollar for savings.

“Instead of stereotyping, let’s encourage women to make every dollar count,” Zeller said.

For further guidance and resources, visit the Moneysmart website.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.