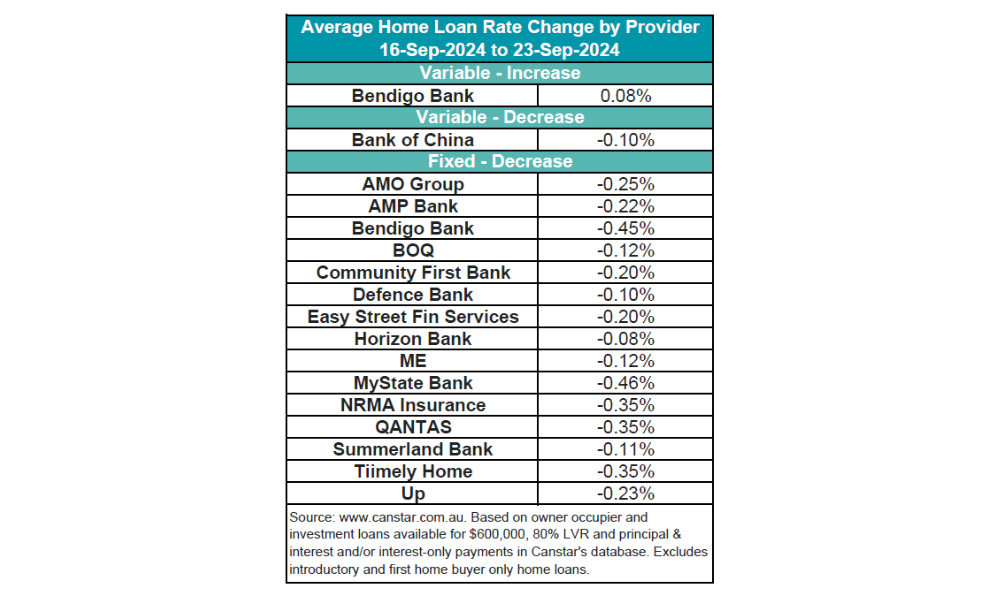

Canstar reported 16 lenders cut 165 fixed rates, averaging a 0.19% reduction, while Bendigo Bank was the only lender to hike one variable rate by 0.08%, Canstar reported.

See the latest rate changes in the table below.

To compare with the previous week’s results, click here.

The lowest variable rate remains at 5.75%, offered by Abal Banking.

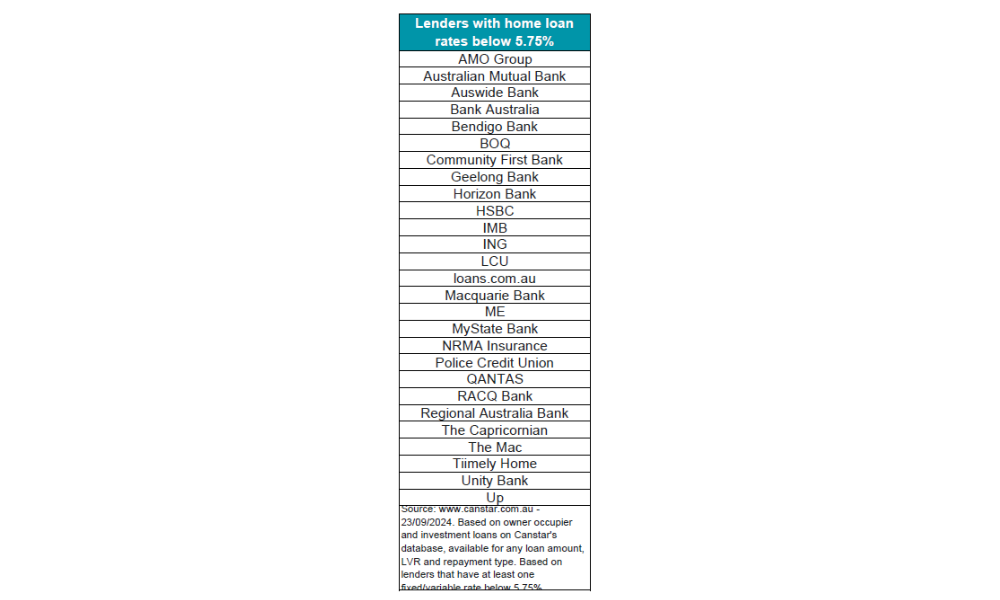

Canstar’s database now lists 64 rates below 5.75%, an increase of 16 from the previous week, reflecting ongoing competitive shifts in the market. These low rates are on offer in the list of banks below.

Canstar Data Insights director Sally Tindall (pictured above) noted the significant drop in fixed rates, driven by lower wholesale funding costs.

“There was another deluge of fixed rate cuts this week with 16 lenders cutting 165 rates,” Tindall said.

Despite this, she advises caution in fixing rates now, given the potential for future cash rate cuts.

“Does that make it a good time to fix? Unlikely, when you factor in the likelihood of cash rate cuts next year,” the Canstar leader said.

Tindall highlighted that the Reserve Bank (RBA) is expected to keep the cash rate on hold, despite speculation about future cuts influenced by the US Federal Reserve’s recent rate changes.

“Australia might be following in the same trajectory as the US, however, we’re on a different timeline,” Tindall said.

While inflation is moving in the right direction, the RBA is likely to remain cautious, especially given temporary measures like electricity bill relief, which could impact headline inflation in the next ABS data release.

Looking ahead, Tindall predicts that any cash rate cuts might not occur until 2025, even as Australia continues to navigate its inflation challenges.

“RBA has said it will be looking past temporary drops in inflation and won’t base its monetary policy decisions on short-term measures,” she said, underscoring the uncertainty surrounding future rate adjustments.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.