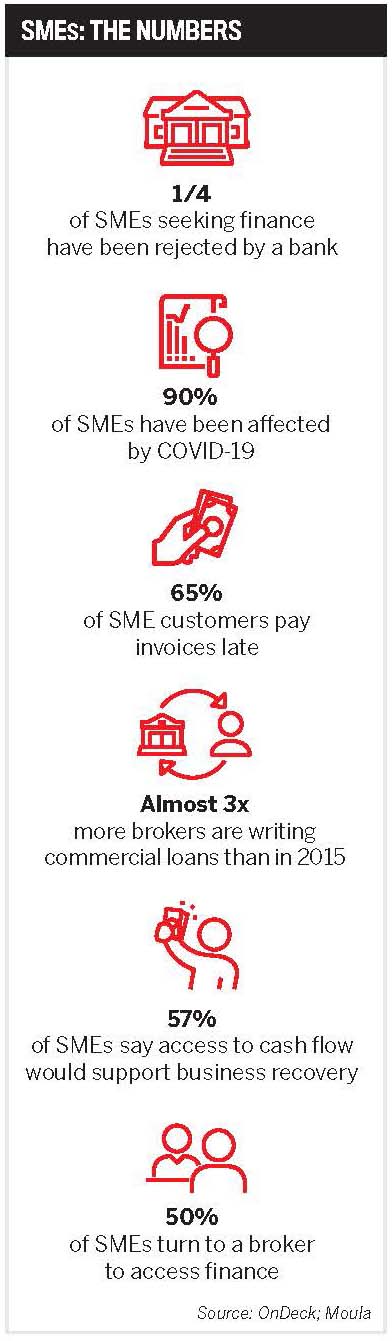

According to OnDeck surveys of SMEs that have applied for finance from any possible source, 24% have been rejected by a bank.

Small business owners often have an uneven cash flow and must deal with all the financial uncertainty and complexity that goes with running an SME. They need fast decisions and a more agile, digital approach. So, what do they do if the traditional banks won’t help them?

This is where fintech lenders such as OnDeck and Moula come in. They specialise in using technology to quickly assess each SME’s unique circumstances and then provide tailored financial solutions.

OnDeck CEO Cameron Poolman says that even for those SMEs that do get the green light for a business loan, the drawn-out process banks use means that a quarter will experience the negative impacts of a protracted funding process.

The company is entirely based in Australia, with BDMs serving SMEs and brokers nationwide, ensuring clients can speak to a real person.

Poolman says fintechs make intelligent use of data to assess the credit risk a business poses.

Cameron Poolman, CEO, OnDeck

Cameron Poolman, CEO, OnDeck

“By using real-time data from bank statements, credit bureaus and credit scores, fintechs take a forward-facing view of the business, rather than the rear-vision view that the banks rely on,” Poolman says.

“And that makes good sense as no business is likely to face exactly the same market conditions in the future as it has in the past.”

He says the traditional, paperwork-heavy approach of mainstream banks is outdated in a digital world.

“Not only can data provide valuable insights into an SME’s creditworthiness; it also allows for a vastly quicker and more efficient loan application and approval process. We can have funds to a small business in as little as one working day.”

Moula head of sales Tas Tzimos says a few years ago waiting six to eight weeks for a loan outcome “was the norm across the board”.

“But by challenging mainstream lending and turning deals around within hours or days, we’ve managed to shift customer and broker expectations,” he says.

“By using real-time data from bank statements, credit bureaus and credit scores, fintechs take a forward-facing view of the business, rather than the rear-vision view the banks rely on” Cameron Poolman, CEO, OnDeck

“Our fastest loan processing time from start to finish is 14 minutes. For the more complex, larger deals, we can sometimes take a few days, but it’s still much, much faster than the service levels offered by banks.”

“Our fastest loan processing time from start to finish is 14 minutes. For the more complex, larger deals, we can sometimes take a few days, but it’s still much, much faster than the service levels offered by banks.”

Tzimos says traditional lenders are still taking a long time to catch up with fintechs.

“Through COVID we know those service levels have been dropping even lower. Awareness of lending solutions has changed, and now both brokers and SMEs know they have better options to access credit and seize opportunity.”

The Melbourne-based lender was founded in 2013 to give business owners across the country access to finance that they need to grow.

Moula also relies on digital tools to help it stand out from other lenders.

“We have a proprietary platform which we’ve developed in-house and tailored to the Australian SME market,” Tzimos says.

“Our decisioning engine uses artificial intelligence and is always improving, which means we can give our brokers fast outcomes and confidence in credit decisioning.

“The platform is at the core of Moula’s business model, and having our own tech means we can keep refining and improving the process to maintain our competitive edge.”

Poolman says OnDeck’s core goal has always been to deliver rapid funding to small businesses. This has been achieved by using both innovative technology and insights gained during the fintech’s 12-year lending history.

OnDeck’s loan application process features a one-page form and requires a maximum of six months of bank statements.

“From here, our proprietary credit-scoring methodology – OnDeck Score® – uses thousands of data points to identify the financial health of potential borrowers based on cash flow, credit history and various business attributes,” Poolman says.

“This allows us to quickly provide appropriate finance offers to customers that are within their repayment capacity.”

OnDeck also successfully pushed for the adoption of the SMART Box loan comparison tool in Australia, which uses plain English to explain pricing metrics for small business loans.

“The transparency offered by SMART Box is revolutionising the ability of SMEs to determine the ROI on assets funded through finance and make informed decisions,” Poolman says.

Despite its tech-driven methods, he says OnDeck is “focused on people, our products and trust”.

“We may operate in the online space using the best of technology, but that’s backed by a highly skilled team of people who connect with our brokers and small business customers to deliver a personal touch.

“We’re about clear and fair finance with no surprises, so you won’t see any hidden fees or charges in our small print. Plus, we don’t offer cheaper rates to direct customers, so brokers can be confident that they’re offering the most competitive deal to their SME clients.”

Being upfront with clients is a key focus at Moula.

“What sets us apart is our transparency,” Tzimos says. “Our core offering for brokers is speed and ease, but for us it’s not just about getting fast outcomes. We’re a values-driven business, which means we’re very much committed to responsible lending and transparency.

“We don’t have any hidden fees. We also back good business to enable growth, which means we have no penalty or scheduled interest if a borrower wants to repay early.”

After creating a world-class platform for unsecured business lending, Moula realised there was a need to help SMEs get paid faster when they sold to other businesses. A survey of SMEs revealed that 65% of their customers paid invoices late. In response, the fintech developed and launched Moula Pay, a finance solution for business-to-business transactions, a year ago.

When a business offers Moula Pay on their invoices, they get paid upfront. Their customers get 12 months to pay, with the first three months interest and repayment free.

“As the late payments problem has worsened in recent months, the product has grown far beyond expectation. As with our business loan product, we also offer a commission for brokers who refer their customers to become merchants,” Tzimos says.

“Our decisioning engine uses artificial intelligence and is always improving, which means we can give our brokers fast outcomes and confidence in credit decisioning” Tas Tzimos, head of sales, Moula

Both Moula and OnDeck have adapted quickly to the challenges of COVID-19.

Tas Tzimos, head of sales, Moula

Tas Tzimos, head of sales, Moula

Tzimos says that with banks and traditional lenders experiencing a drop in service levels during the pandemic, speed has become an even more important factor in Moula’s offering.

“Many businesses are seeking finance to seize an opportunity which won’t be there any more in six to eight weeks. We offer credit decisions within 24 hours, and usually it’s much faster than that,” he says.

“SMEs have been adapting their business models and pivoting quickly in a time of uncertainty, and we’ve been there to fund that opportunity in real time.”

OnDeck is supporting clients and brokers through its online COVID Recovery Hub, which keeps SMEs and brokers up to date with government support and provides case studies of SMEs and how they have adapted to the crisis. Poolman says its surveys confirm that close to 90% of Australia’s SMEs have been affected by COVID-19, though not always negatively.

“Importantly, many have used the pandemic as an opportunity to explore new markets, closely examine costs and perhaps make better use of technology in their business operations.”

OnDeck experienced a 50% jump in loan applications between September and October, which translates to valuable opportunities for brokers.

Both companies are confident about the future of fintechs and the growth of the SME market.

Tzimos says commercial lending is a fast-growing opportunity for brokers and a way to diversify. This is backed up by recent research showing that the number of mortgage brokers also writing commercial loans nearly tripled between 2015 and 2020.

During the six months to March 2020, the total value of commercial loans settled by mortgage brokers reached its highest level ever at nearly $9.7bn, up by close to 8% compared to the previous six months.

“SME growth is closely connected to the ability to access business finance, and we see brokers as playing a pivotal role in helping SMEs grow,” Tzimos says.

Poolman says research shows that 57% of SMEs believe access to cash flow would support business recovery, and this is underpinning growth in commercial finance.

OnDeck’s research also reveals that 50% of SMEs turn to a broker to access finance, and the lender is keen to help brokers capitalise on this valuable market.

“Right now, business owners cannot afford to take their eye off the ball, and handing over the finance process to a broker allows SME owners to focus on guiding their enterprise through the recovery process,” Poolman says.