The FBAA has stepped up its advocacy efforts and met with federal Finance Minister Katy Gallagher to discuss a host of issues important to mortgage brokers.

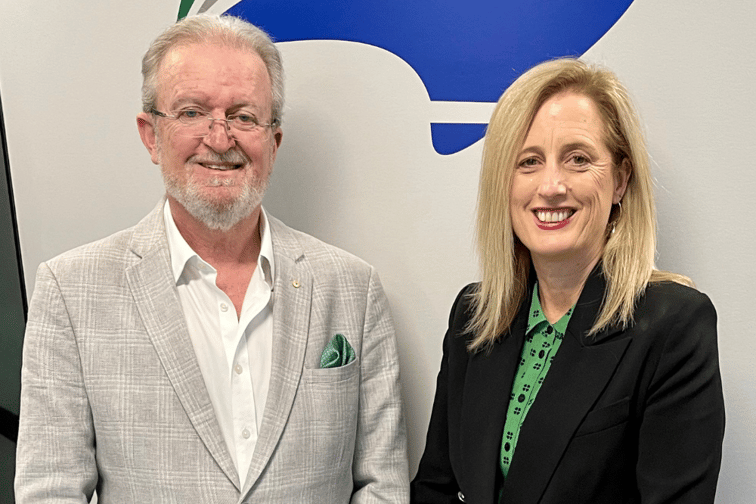

FBAA managing director Peter White AM (pictured above) revealed that the FBAA had presented a new round of submissions to the federal government.

This included clawbacks, net of offset commission payments, APRA buffer rates, bank practices to entice new borrowers, and the need to better define broker eligibility for best interests duty.

“The fight for fairness around clawbacks and other issues that adversely affect the industry will continue,” said White, who recently criticised the Commonwealth Bank’s decision to extend clawbacks to 24 months.

However, White also thanked the banks that have recently reduced clawbacks and those non-bank lenders that have eliminated them on some products such as Rate Money’s no fee, no clawback product line.

White credited the FBAA’s ongoing lobbying efforts for these decisions.

“We welcome each step that brings greater fairness for brokers, so I don’t want to ignore or downplay what some banks have done and the movement we are seeing,” White said. “However, there is a long way to go, and until we see real, tangible and widespread progress, we will continue our efforts.”

Part of the FBAA’s advocacy efforts has been to increase its visibility among the federal government.

White said over the past few weeks he had forwarded new submissions on various subjects to Treasurer Jim Chalmers and Assistant Treasurer and Financial Services Minister Stephen Jones.

Th FBAA’s national executive team last week also discussed the issues personally with Finance Minister Katy Gallagher (pictured above) when she called into the association’s national office.

“The meeting was an opportunity to discuss policy that impacts the industry and to help the minister gain a better understanding of the important work undertaken by finance and mortgage brokers,” White said. “We covered a wide range of issues including challenges with regulation in several areas, housing, and even issues that related to her role as minister for women.”

While White said he regularly spoke to senior ministers in his role, it was a “wonderful opportunity” for the team to hear from Gallagher and provide input on issues of importance to brokers across Australia.

“To have such a senior minister come and spend an hour-and-a-half with the group is testimony to the work done by the FBAA and the level of top-end engagement we have with government, as well as the respect they have for our association and the industry.”

While the FBAA has pushed for industry change before, White said the work was never done.

“I can’t guarantee the end result or how fast any progress will be made, but I can provide our members and the industry-at-large a commitment that I and the FBAA will not give up,” he said.

White said while clawbacks were of high importance, the FBAA wanted to see change on a number of other issues as well.

“Buffer rates need to be decreased, there must be changes around how BID is applied to bundled products in a home loan, and brokers are still being ripped off by bank practices around net of offset commissions.”

White urged brokers to continue with the excellent customer service the industry has become known for. “It makes our work a lot easier when decision makers in government know that we have Australian borrowers backing us.”

Do you think the FBAA are doing enough? Comment below.