Non-bank lender Aquamore has been funding businesses with short-term property-backed loans since 2016. Head of third party distribution Matthew Porch says a new $120m warehouse facility will boost Aquamore’s growth and ability to help brokers and their clients access finance.

Porch, (pictured) is excited by the opportunities $120m in warehouse funding will provide the Sydney-based company.

He says the institutional bank providing the funding believes in the Aquamore team and product.

“They plan to continue funding the business as we grow the loan book. We expect to have exhausted the first tranche by the middle of next year, given the unprecedented demand we are seeing for our product,” says Porch.

“This facility puts us in a key position to continue assisting our brokers with solutions their clients appreciate. In a way we were kind of compelled to seek an institutional funding partner after the success we saw with our smaller fund.

“Brokers appreciate our transparency, simple pricing structure and flexibility with policy, which allows us to structure deals in a way our competitors may not. This warehouse facility isn’t simply access to capital; it’s a shared vision with a financial institution who has the same long-term goals as us.”

Porch says Aquamore has access to further funding.

“It’s simply a case of us being in a position to deploy it all to the market. We are confident this is the first tranche of many, which will bode well for our brokers as our cost of funding begins to fall as we scale our business.”

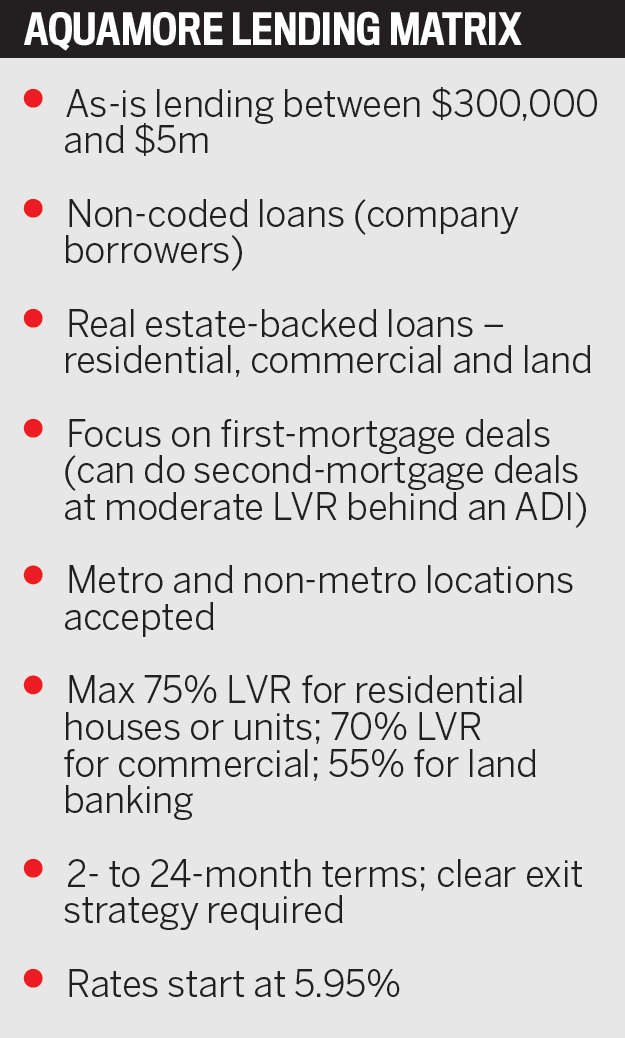

“Our core is very simple: $300,000 to $5m loan sizes, short-term in nature with our average term of 12 months backed by Australian real estate collateral,” Porch says.

“Many private lenders don’t like the smaller and short-term deals, whereas we do and like to facilitate this kind of business.”

Brokers and their clients can access finance for residential, commercial and land projects, with loan terms of two months to two years.

Porch says Aquamore clients take up loans for a variety of purposes.

“The most popular at the moment appear to be loans for commercial property purchases. We assess these transactions on the strength of the lease, and an appropriate interest coverage ratio gives us the majority of the basis for the interest rate applicable,” he says.

“Our offering is a simple fully drawn advance product which is perfect for these kinds of scenarios. We have also had a few construction-type scenarios where the client pledges an unencumbered asset unrelated to the underlying project to leverage up against, an approach we are comfortable with.”

Aquamore is focused on growing its loan book sustainably, says Porch, by “filling it with loans to good borrowers”.

“We understand the major lenders have greatly reduced their appetite for commercial loans in the SME space, and the ones that haven’t aren’t always in a position to assist in a timely manner.”

Porch says Aquamore’s points of difference include the way it studies potential loan deals, and its capacity-to-service calculations.

“We have a focus on providing a solution that is right for the client by analysing their profile accordingly and not simply looking solely at the asset that backs them.”

The lender also prefers interest to be serviced monthly.

“This is proving popular amongst our brokers as it frees up headroom in the client’s overall limit, and it also allows us to price competitively as we have correctly priced our risk.

“Our capacity-to-service calculations are easy to conduct and understand, which is in contrast to many major lenders.”

Porch says Aquamore will consider pre-payment or capitalisation of interest in the right circumstances, but this is not the default position.

“Our product is called a secured business loan and is structured as a fully drawn advance.”

Aquamore loan advantages

Aquamore loan advantagesSo, why should brokers choose Aquamore over other lenders?

“We analyse scenarios on a case-by-case basis in respect to the purpose of funding, interest rates and loan terms,” Porch says.

“We understand that every borrower is different, and we can accommodate this accordingly.

“We are not hemmed in by a restrictive credit policy, and we are not simply an asset-based lender.”

Porch says this is advantageous because many private lenders will only consider blue-chip properties in prime locations.

“We’re happy to consider collateral that is non-metro or regional, as our scope goes beyond simply the security on offer.”

There is also some flexibility when it comes to loan terms.

“The length of our traditional facility is short, but we are happy to roll these come expiry if the client’s account conduct has been good, and we have the breadth and depth of capital to give the clients comfort that we won’t be chasing them out the door come the expiry of their term.”

Aquamore’s pricing structure is also very transparent, Porch says. Commitment fees or engagement costs are not normally charged, while valuations and legal requirements are at cost, quoted up front by the provider.

“In the instance where we pre-pay interest for the term, should the client refinance early – after minimum loan term obligations – we will refund them the unutilised interest.”

Aquamore also accepts accountant declarations and self-declared income for servicing, and its expression of interest in a deal is made known early in proceedings.

“If we aren’t going to write the deal, it’s a quick no, allowing other solutions to be found.”

Speed of loan turnaround is another attraction for brokers.

“We can provide terms the same day, and we can issue letters of offer within 24 hours, subject to receipt of the requested information.

We also have an easy apply online portal which we encourage brokers to take advantage of.”

Porch encourages brokers who work solely in the residential home loan space to diversify.

“Diversification has been a hot topic over the past 18 months, with everyone being forced to adapt to new ways of working, and looking at fields they may not have done previously.”

He says branching out into commercial loans is a great way for brokers to diversify and improve their income streams.

“Furthermore, private lending offers the opportunity to build strong relationships with clients.”

Aquamore’s short-term funding lines are a solutions-based approach, Porch says.

“More often than not, the broker will be involved in the back-end exit refinance, which allows them to boost their income by collecting a commission on both parts of the transaction.”

Aquamore’s loan facility can be considered a bridge, he says.

“A client uses our funding to get settled, and tidies themselves up within 12 to 24 months to then present themselves to a major lender for a long-term set-and-forget facility.”

From loan enquiry to settlement takes an average of three weeks. “Even writing one of these a month can significantly boost a broker’s income position. “For example, a short-term bridge deal of three months is in our appetite. The broker will retain full control of the relationship and after the three months will be front of mind for that client’s whole-of-wallet requirements.”

Porch says there is undoubtedly pent-up demand for finance, especially in the hospitality sector.

“If you looked at the queues outside the pubs on Monday 11 October in Sydney, that tells you all you need to know.”

But he predicts that business confidence will take a while to get back to pre-pandemic levels, with a lot of apprehension around what happens next.

“Given the state governments have such a focus on case numbers, the inevitable spike in numbers may lead to restrictions coming back into play, although I’m very hopeful this will not be the case.”

Porch says Zoom and Microsoft Teams have been lifesavers for many commercial businesses, but he still prefers the face-to-face approach.

“Now there’s a sense of normality coming back, I hope this leads to a busier commercial finance marketplace.

“We look forward to playing our part in the recovery of the SME market after a tumultuous couple of years.”

Porch encourages brokers to reach out to Aquamore with any scenarios they want to discuss.

“We can provide a quick expression of interest and an out-of-the-box solution for almost any transaction. We’re happy to run over our policy with any interested referrers at any time.”