The impact of COVID-19 has resulted in varying degrees of softening of the property market across Australia. In some areas, this softening is more pronounced than in others – and the commercial property market has borne the harshest brunt of the lockdown laws that swept the country in April and May.

Considering the current environment, a softening of the market is to be expected, says Peter Vala, general manager, partnerships and distribution, at Thinktank – yet at the same time, it’s not the case that all commercial properties are responding in the same way.

“At Thinktank we cover all of the main commercial property segments, namely industrial, retail and office space. Understanding how these markets are being impacted is critical,” Vala explains.

“Our analysis illustrates the following trends: office has moved from good/fair to stable but will be impacted further by the reinstatement of COVID-19 restrictions in some areas and how businesses respond to stay-at-home [orders]. Industrial is proving remarkably resilient so far, with all capital cities continuing to maintain a stable position. Not surprisingly, retail has been worst hit, with the segment now rated as deteriorating and likely to continue in this direction for the foreseeable future.”

Brokers need to be aware of these trends so they can respond appropriately to their existing clients and be ready to take advantage of opportunities when the market recovers, Vala adds.

“The current market is presenting some significant challenges, but it will also present significant opportunities when more normal levels of economic activity and business confidence return,” he says.

“The current market is presenting some significant challenges, but it will also present significant opportunities when more normal levels of economic activity and business confidence return,” he says.

Commercial property expert Scott O’Neill, director of Rethink Investing, agrees with Vala that certain sectors of the market were hit harder than others.

Any businesses that were forced to close, for instance, such as gyms, restaurants and other non-essential businesses, suffered the most throughout March and April due to COVID – and many are still struggling to get back on their feet.

“These businesses often entered agreements with landlords for reduced rents for the months they were affected. We have seen that, as restrictions eased throughout May and June, most affected businesses are now back paying full rent,” O’Neill says.

“Other businesses were never affected, such as those based in industrial properties; the majority of logistics, trade and storage-related businesses were able to operate even in the worst parts of the closure.”

“Diversification has never been more important, and adding commercial lending to your offering means that you have more ways to help a wider range of customers” John Mohnacheff, group sales manager, Liberty

“Diversification has never been more important, and adding commercial lending to your offering means that you have more ways to help a wider range of customers” John Mohnacheff, group sales manager, Liberty

As a market snapshot, O’Neill says he has helped a range of clients purchase over $820m in properties; in that mix, a significant 95% of commercial properties “had no financial impact due to COVID”.

“This is mostly because we target essential-service-type properties and industrial assets. If you stick to these types of properties, your odds of success will be greater in these strange times,” he says.

Interestingly, leading up to the pandemic, the commercial property market was experiencing steady growth and was increasingly catching the interest of savvy property investors.

John Mohnacheff, group sales manager at Liberty, says part of the reason why commercial property saw such an increase in popularity is that it offers so many different opportunities to invest – from office space and shopfronts to warehouses and factories.

“By implementing safety precautions and following the relevant social distancing guidelines, many factories and warehouses have been able to continue their usual operations. And although many retailers have seen a significant reduction in foot traffic, online shopping has seen a spike, which has enabled many businesses to continue trading,” he says.

“In the current climate, where the stock markets are in flux and reacting to world events, opportunities may emerge for astute commercial property investors, especially those investors that take a longer-term view of their investments.”

Just where do these opportunities lie, then? And how long will the pandemic and its associated health and economic influences continue to impact the commercial property and finance markets?

“Coronavirus is forcing some businesses to change the way they operate permanently. For example, some are shifting so they don’t rely so much on overseas manufacturing. Marketing spending may change, with less money spent on things like conferences and more funds going to online marketing. Retail shopfronts may find that operating 100% online could be a better financial option, and flexible work agreements will continue to grow,” O’Neill says.

“A trusted broker who can help preserve and/or enhance cash flow reserves will be worth their weight in gold. And they’ll be sought after when pent-up demand emerges” Peter Vala, general manager, partnerships and distribution, Thinktank

“A trusted broker who can help preserve and/or enhance cash flow reserves will be worth their weight in gold. And they’ll be sought after when pent-up demand emerges” Peter Vala, general manager, partnerships and distribution, Thinktank

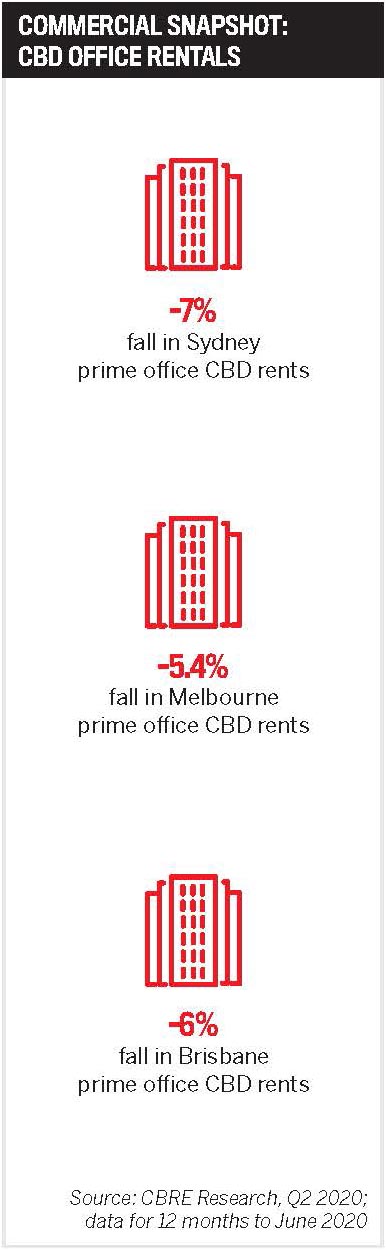

“Commercial investors must think about how these types of changes may affect commercial assets. Some business in retail and office markets may find they need less space as their businesses are not in growth phases, so this might cause rents to decline in these at-risk segments of the market. But I see strength in the industrial markets as local manufacturing grows and there is a greater need for storage as online sales boom. Many boutique medical and office commercial purchases are also performing strongly.”

With exceptionally competitive mortgage interest rates on offer, along with a broad range of high-yielding properties with long leases, O’Neill believes commercial assets will gain in popularity again as investors turn away from residential markets that have a weaker outlook for growth.

“More people will flock to commercial for the cash flow that residential properties just can’t offer. This is contributing to capital growth, which has been evident in many markets throughout 2020,” he says.

Thinktank’s Vala confirms that freeing up cash flow is where brokers can provide great value to their clients at a time like this and unlock the best opportunities.

“One way to help clients improve their cash flow is to restructure finances to the lowest monthly loan repayments possible, whilst still retaining the ability to amortise the loan at an accelerated rate if surplus cash is available. Another way is to explore releasing some equity, or establish a line of credit/working capital facilities in case the business is rocked by further lockdowns or shocks to trade,” Vala explains.

“A trusted broker who can help preserve and/or enhance cash flow reserves will be worth their weight in gold. And they’ll be sought after when pent-up demand emerges as it always does after a lull in lending activity.”

In the second half of 2020, it’s “never been more important” for a broker to have an in-depth understanding of their clients’ needs and circumstances, and to respond quickly and flexibly, Vala says.

“At Thinktank, our loans do not have annual reviews or revaluation requirements, making it easier for clients to navigate the challenges of COVID-19. But this is not the case with many lenders, so the onus is on the broker to ensure that their client can meet those review requirements and make the process as smooth as possible. This is vitally important and will be one of the critical issues brokers will need to face,” Vala says.

“More people will flock to commercial for the cash flow that residential properties just can’t offer. This is contributing to capital growth, which has been evident in many markets throughout 2020” Scott O’Neill, director, Rethink Investing

“More people will flock to commercial for the cash flow that residential properties just can’t offer. This is contributing to capital growth, which has been evident in many markets throughout 2020” Scott O’Neill, director, Rethink Investing

One of the strategies to consider is holding interim financial statements from July 2019 to end March 2020 to show the performance of a business prior to any impact of COVID-19, he advises.

“Also, take care if using BAS statements to verify income as they may be reflective of a quieter last quarter and not be a true indicator of that client’s current and future trading and cash flow position. If brokers need assistance, Thinktank offers a range of alternative income verification solutions beyond just BAS,” Vala says.

While this is a difficult time for the commercial finance and the broader property industry and finance market, Liberty’s John Mohnacheff remains optimistic that there are more opportunities now than ever for brokers to demonstrate their value to borrowers.

“With many changes and increased uncertainty, it is so important for commercial property investors to have the guidance and support of a trusted broker. This presents an ideal opportunity for brokers to help customers through challenging times and build strong, lasting professional relationships,” he says.

“Communication is key – and it’s important to let customers know about all the many ways you can support them with their lending needs. From here, the possibilities truly are endless. The need for commercial lending is extensive, from office premises and furniture fit-outs to tools, trucks, training equipment – you name it. There are endless reasons why a business owner may require business or commercial finance, and even more opportunities for brokers to help. Diversification has never been more important, and adding commercial lending to your offering means that you have more ways to help a wider range of customers.”

With no crystal ball to make predictions for the future, and the pandemic still an issue that’s evolving by the day, this is the time to reinforce commercial property investors’ need to take a longer-term view of their investments.

“The market will continue to evolve, and although there is currently some uncertainty about the future, the commercial property market is anticipated to recover well post-COVID-19. We listen to what’s important to business owners and then construct innovative offerings to suit their needs. Helping business owners achieve their financial goals is our highest priority, and we’re committed to finding new solutions to help brokers take their businesses to the next level,” Mohnacheff says.

“Mortgage brokers have more than 50% market share of the residential lending market, but when it comes to commercial, their market share is less than 5%. The opportunity is enormous, and you will be doing your community a great service by helping meet the needs of that market.”